On activist investor Lawrence Seidman's calls for a North Carolina bank to sell itself:

Related Article:

On the motivations of former prosecutors and enforcement officials weighing in on the Justice Department's failure to bring charges against bankers after the financial crisis:

Related Article:

On the level of control that lenders have over loan performance after money has changed hands (<a href="https://twitter.com/AlexH_Johnson/status/636635141381615616" target="_blank">via Twitter</a>):

Related Artcile:

On the debate over whether the young marketplace lending industry poses a systemic risk to U.S. economy:

Related Article:

In response to analysts who say that a Fed rate hike wouldn't have done much to boost banks' margins:

Related Article:

On the usefulness of annual percentage rates as a tool for understanding the cost of a short-term loan:

Related Article:

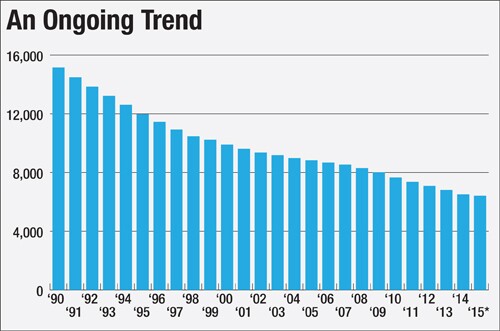

On the degree to which Dodd-Frank accelerated the long-running decline in the number of community banks (via <a href="http://www.arkansasbusiness.com/article/106652/correlation-causation-gwen-moritz-editors-note?page=all" target="_blank"><em>Arkansas Business</em></a>):

Related Article: