-

Regulated by multiple agencies, marketplace lenders reduce the financial system's leverage, provide greater financial transparency and ultimately deliver a better product to consumers and investors.

August 19 -

Social Finance, an alternative lender that has made its name in student loans, has branched out into unsecured personal loans.

February 17 -

Whether the startup's pricey valuation makes sense depends on whether you view it primarily as a tech firm or a financial company. And the answer to that question has big implications for the broader financial services world.

December 10 -

SoFi, a San Francisco startup, aims to shake up the market by offering favorable rates to borrowers with the highest earnings potential.

February 19

By hauling in an equity investment that's reportedly around $1 billion, Social Finance has vaulted itself into the top echelon of the burgeoning U.S. marketplace lending sector.

The eye-popping sum illustrates the unflagging enthusiasm among tech investors for the industry, also known as peer-to-peer lending. It also suggests that SoFi's strategy of differentiating itself by targeting well-to-do borrowers is paying off.

The equity investment is believed to be the largest ever in a U.S. marketplace lender. Through the first quarter of this year, SoFi had raised $365 million in venture capital, which was already

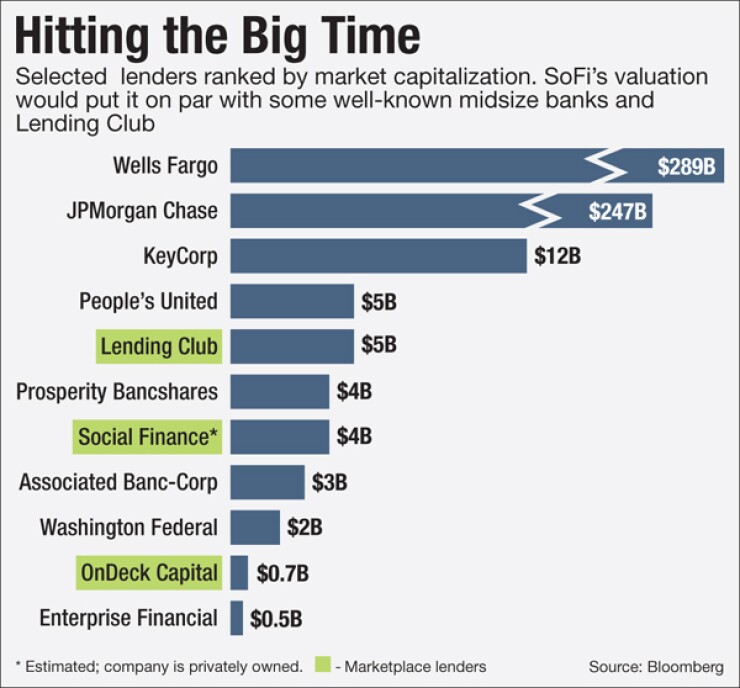

Following a $235 million funding round in February, SoFi was valued at $1.3 billion. The company's latest fundraising round brings its valuation to around $4 billion,

That is not far from the $4.6 billion market capitalization of industry leader Lending Club, which has been trading publicly since December. And it is well above the $1.87 billion valuation that privately owned Prosper Marketplace, long considered one of the sector's top contenders, achieved with a $165 million fundraising round in April.

The investments in SoFi were led by SoftBank, a Japanese telecommunications firm that was an early-stage funder of the Chinese ecommerce giant Alibaba, according to the Journal. SoFi declined to comment on its latest fundraising, and SoftBank did not respond to a request for comment from American Banker.

[Coming this November:

The whopping equity investment has raised questions about whether SoFi will follow through on its

It is easy to see why SoFi would prefer to stay private, as long as it has enough firepower to keep fueling rapid loan growth.

Since Lending Club's IPO, the company's stock price has fallen by about 18%. And since Jan. 1, Lending Club shares have fallen by more than 50%.

Some of this decline is likely driven by early institutional investors seeking to cash out. But it also points to a gap between the perceptions of Wall Street, which views marketplace lenders largely as financial firms, and Silicon Valley, which values them more like

Shares in OnDeck Capital, the only other publicly traded U.S. marketplace lender, are currently trading at less than half their IPO price from December 2014.

San Francisco-based SoFi has not revealed much about its financial performance, though company executives

One financial industry analyst said privately Thursday that it is hard to assess SoFi's reported $4 billion valuation without a better understanding of the firm's performance. "That's the problem when you don't live on the West Coast," this analyst joked.

While Lending Club and SoFi are both consumer-focused marketplace lenders, the two companies are pursuing distinct strategies.

Lending Club, which generates much of its loan volume by refinancing credit card debt, is seeking to build a mass-market brand. The comparatively high average interest rates on its loans, around 14%, reflect the company's focus on middle-class consumers.

SoFi, by contrast, markets its loans to a higher-earning cohort "early stage professionals," to use the firm's lingo.

SoFi launched in 2011 with a student loan refinance product for graduates of selective colleges. The company targeted borrowers who already earned large salaries, or seemed likely to do so eventually, and therefore

In a recently issued package of bonds backed by SoFi loans, the average borrower had an income of around $144,000. Ninety-eight percent of the borrowers had a FICO score of 700 or higher.

SoFi has been smart to focus on young, tech-savvy professionals, said Jahan Sharifi, a lawyer at Richards Kibbe & Orbe who works with marketplace lenders.

"At a time when there was at least some feeling like Lending Club and Prosper had such a huge lead on the rest of the market, [SoFi has] managed to generate a huge amount of volume and, it appears, a terrific customer base," he said.

SoFi goes to unusual lengths to prevent defaults and encourage customer loyalty, even offering free career planning and job search assistance to borrowers.

Today the firm is working on cross-selling personal loans and mortgages to its student loan customers. And those customers are generally in higher tax brackets.

SoFi's website quotes mortgage rates based on the assumption of a $1 million home loan.

And the company charges from 5.5% to 9.99% for fixed-rate personal loans, a range that

could only make sense for low-risk borrowers.

"For a prime or super-prime borrower, there hasn't been a great product out there," SoFi Chief Executive Mike Cagney

The focus on higher-earning consumers has led SoFi to fund its loans differently than Lending Club does.

Because the interest rates on SoFi's loans are relatively low, they're not as attractive to the hedge funds and other institutional investors who snap up a lot of Lending Club's loans.

Instead, SoFi has turned to the securitization markets, where pension funds and insurance companies are looking to buy debt that has a grade from a rating agency and earns more than Treasury notes.