(Image: Thinkstock)

On a Bank of America refi pitch that would raise the customer's interest rate and add 10 years to the loan term:

Related Article:

(Image: Bloomberg News)

On a Bank of America refi pitch that would raise the customer's interest rate and add 10 years to the loan term:

Related Article:

(Image: Thinkstock)

On a regulator's claim that FFIEC's social media guidance is just that, and not a requirement:

Pictured: Elizabeth Khalil, a senior policy analyst of supervisory policy at the FDIC

Related Article:

On a regulator's claim that FFIEC's social media guidance is just that, and not a requirement:

Related Article:

(Image: Thinkstock)

On FFIEC's social media guidance:

Related Article:

(Image: Thinkstock)

On the suggestion that banks regulators do FDA-style product vetting:

Related Article:

(Image: Thinkstock)

On the widespread use of the terms 'underserved' and 'underbanked':

Related Article:

(Image: Thinkstock)

On the Consumer Financial Protection Bureau finding that overdraft programs hurt consumers:

Related Article:

(Image: Bloomberg News)

On the idea that the CFPB is all-powerful:

Related Article:

(Image: Thinkstock)

ON PNC eliminating its free checking program:

Related Article:

On MasterCard executive Theodore Iacobuzio's belief that mobile banking is going mainstream:

Related Article:

(Image: Thinkstock)

On an assertion that an increase in enforcement actions is a step in the wrong direction:

Related Article:

(Image: Thinkstock)

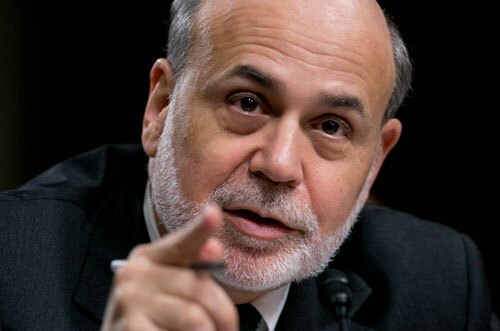

On a call to heed Fed Chairman Ben Bernanke's warnings about interest rate risk:

Related Article:

(Image: Bloomberg News)