(Image: iStock)

Hit: Richard Davis

(Image: Bloomberg News)

Miss: Jamie Dimon

(Image: Bloomberg News)

Hits: Beth Mooney and Kelly King

(Image: Bloomberg News)

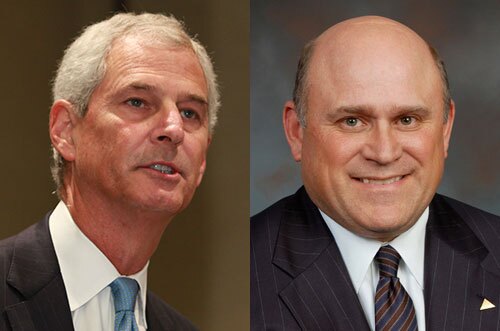

Misses: Grayson Hall and Kevin Kabat

Hit: Richard Fairbank

Misses: Kenneth Chenault and David Nelms

(Image: Bloomberg News)

Hit: Bruce Van Saun

Miss: Brian Moynihan

(Image: Bloomberg News)

Hit: Philip Flynn

Misses: Bankers in the Oil Business

(Image: iStock)