This isn't a bailout, this is return of stolen funds

(Full story

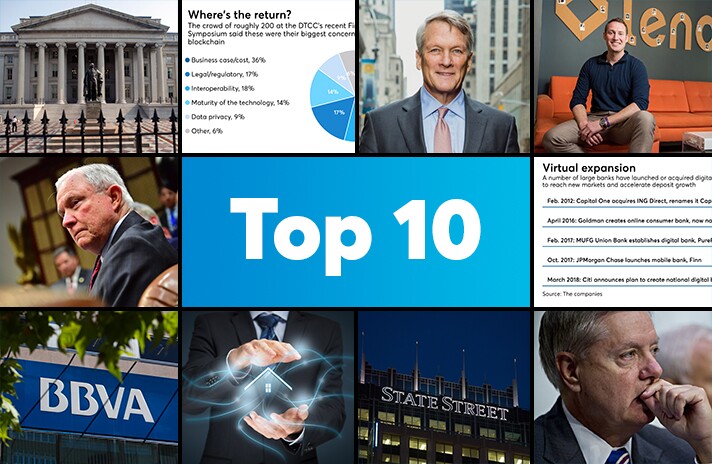

The reasons U.S. blockchain adoption has stalled

(Full story

MUFG's big U.S. expansion is just getting started

(Full story

A mortgage in 30 minutes? Fintech says it's coming

(Full story

DOJ pot crackdown has yet to hit banks

(Full story

Latest weapon in battle for deposits: A digital-only bank

(Full story

BBVA-backed fintech launches global bank account

(Full story

Here's how blockchain could help the mortgage industry

(Full story

Regionals may lose 'systemic' label, but they're not out of the woods

(Full story

Graham unveils Senate measure to repeal CFPB payday rule

(Full story