On how people are using emojis in digital chats with friends, family, and even bank systems:

Related:

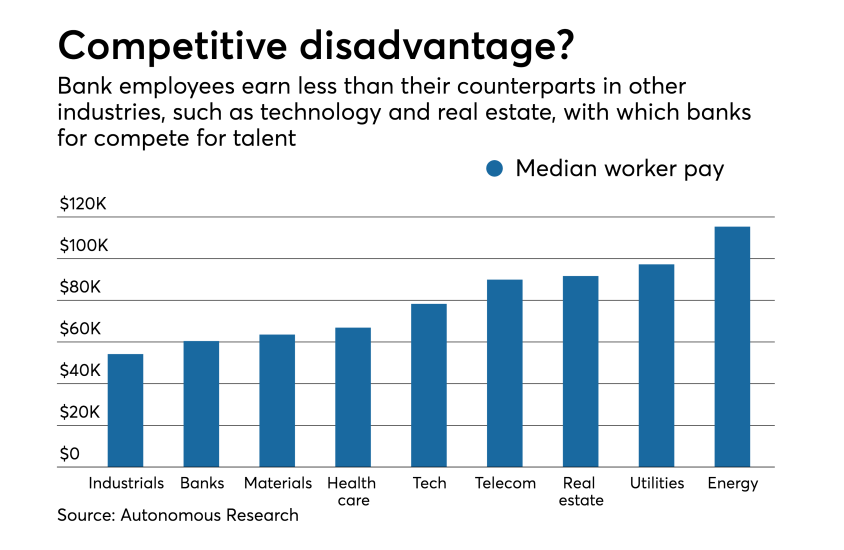

On companies disclosing the median pay of their employees:

Related:

On eliminating tax lien data from credit reporting:

Related:

On why Credit Karma bought a chatbot:

Related:

Weighing in on the debate on what a financial services chatbot is good for:

Related:

On a Treasury report’s recommendations to reform the Community Reinvestment Act:

Related:

On Mick Mulvaney, acting head of the CFPB, calling for reforms that would effectively neuter the bureau:

Related:

On the dangers if Congress approved Mulvaney’s most recent proposal to restructure the agency:

Related:

On the reputational challenges facing the credit bureaus:

Related: