Wells was tipped off to government probe by OCC, watchdog says

(Full story

Bankers aren't waiting for Amazon 'to come eat our lunch'

(Full story

Why HSBC is getting back into mortgages

(Full story

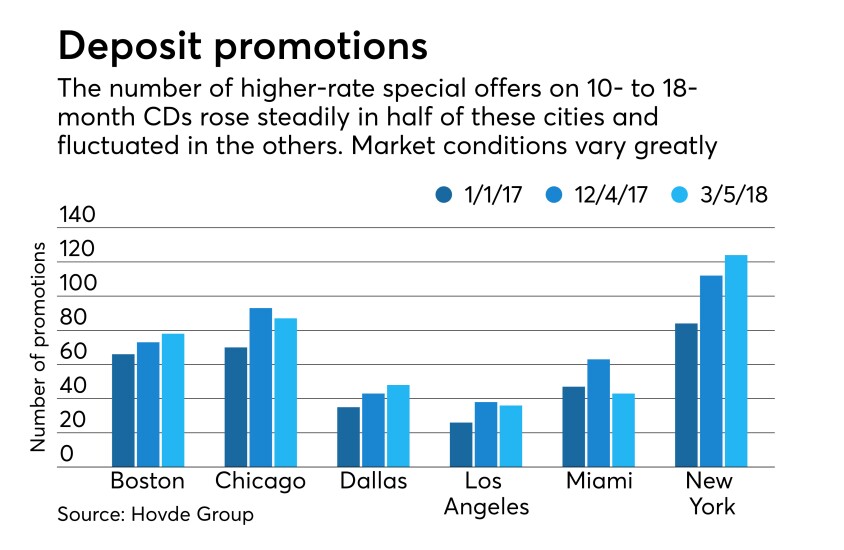

Megabanks gird for battle over deposit pricing

(Full story

5 questions as Dodd-Frank reform moves closer to becoming law

(Full story

Bank regulators vow more flexibility in vetting fintech partnerships

(Full story

AI as new tool in banks' crime-fighting bag?

(Full story

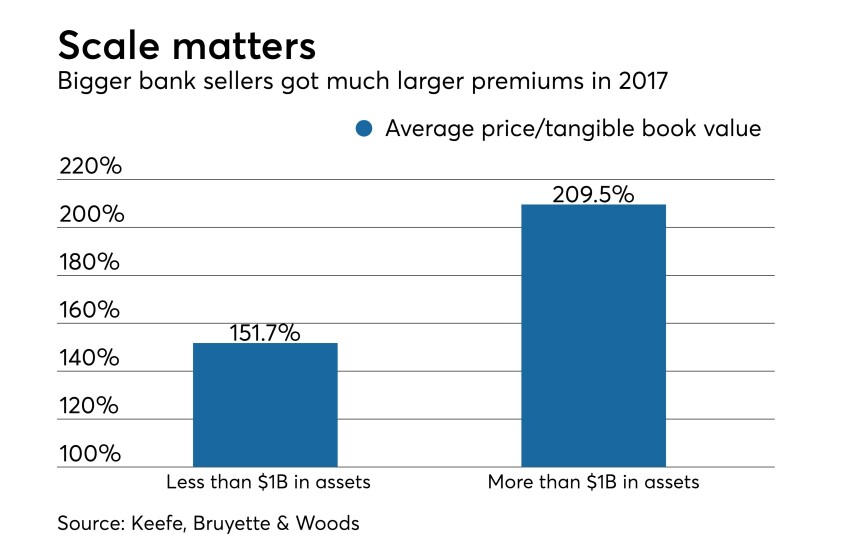

What's driving surge in sales of larger community banks

(Full story

Will HMDA data carve-out for small banks make discrimination easier?

(Full story

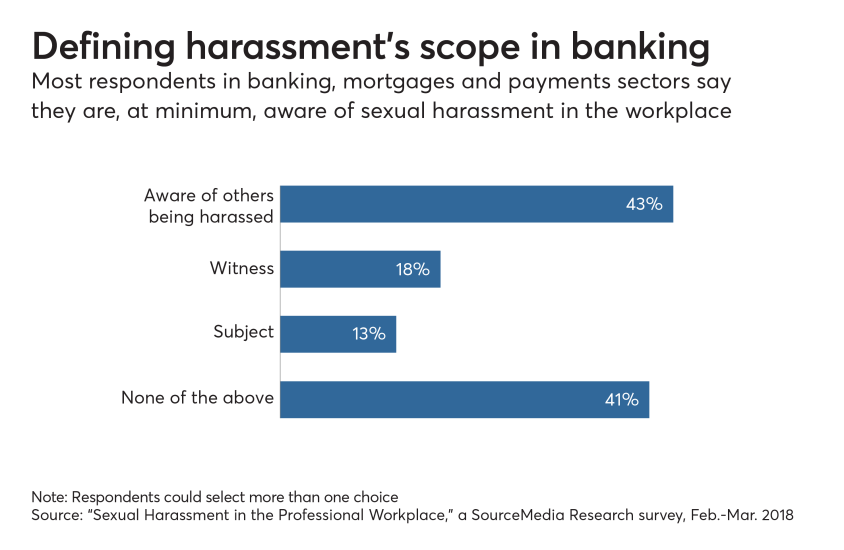

Banks wrestle with sense of futility on sexual harassment

(Full story