On what's next for the Senate regulatory relief package:

Related:

On a credit score provision being added to the Senate banking bill:

Related:

On an argument that the housing market needs an explicit government backstop:

Related:

On HSBC getting back into U.S. mortgage lending after rocky times during the financial crisis:

Related:

On an argument that bankers should be careful when they wish for relaxed regulation:

Related:

On calls for regulators to become tech savvier in order to stop algorithm-based discrimination:

Related:

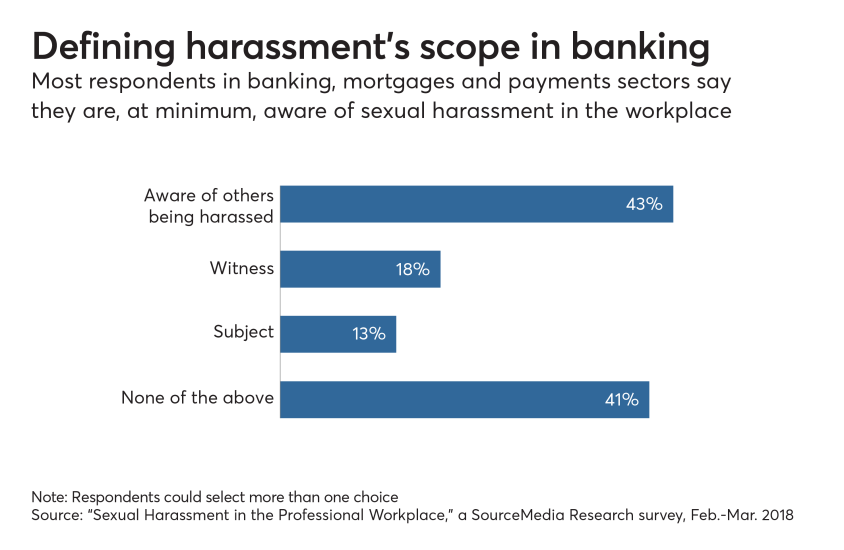

On how there is a lingering feeling among many that harassment is not only present, but it may actually be inevitable, based on responses to a new survey conducted across the banking industry:

Related:

On Wells Fargo CEO Tim Sloan's paycheck:

Related:

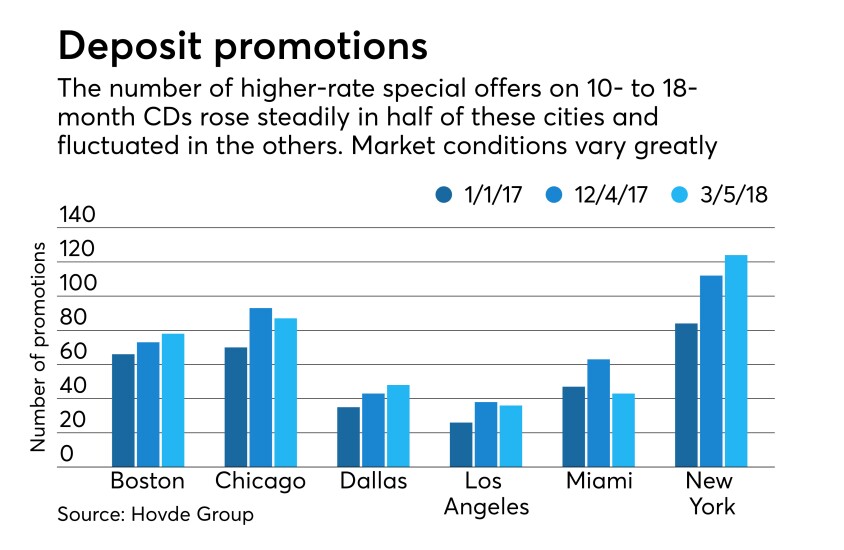

On banks offering different interest rates based on a customer’s region:

Related:

On the questions facing whoever the White House names as permanent CFPB director:

Related: