-

Federal Deposit Insurance Corp. Chair Martin Gruenberg said an FDIC study proves relationship-driven lending practices remain crucial to small-business lending and economic stability, despite technological advancements in the banking industry.

October 2 -

Democratic Gov. Gavin Newsom signed measures designed to bolster consumer protection rules. The bills target several issues that have also been percolating at the federal level.

September 26 -

Executives from JPMorgan Chase, TD, U.S. Bank, M&T and other banks will gather to discuss how they serve small-business clients, what those customers want now and what they expect in 2025 and beyond.

September 12 -

A survey of 135 financial services companies conducted by LexisNexis Risk Solutions, a subsidiary of LexisNexis, found that a vast majority reported increased levels of fraud in 2023.

September 5 -

Cannabis is becoming a big business in the U.S., but companies in the field still struggle to find financing. A broadly accepted way of assessing their creditworthiness would be a huge help.

September 2

-

A federal judge excoriated banks for inflating data in a challenge to the Consumer Financial Protection Bureau's data collection on small-business loans.

August 26 -

A representative of America's Credit Unions takes issue with a recent article suggesting that credit union commercial lending is excessively risky.

August 21

-

The same creativity and flexibility that community development financial institutions bring to business lending ought to be applied to financing affordable housing.

August 7

-

The core services provider partnered with Lendio to devise a cloud-native tool that will automate small business loan decisioning and onboarding for banks.

July 16 -

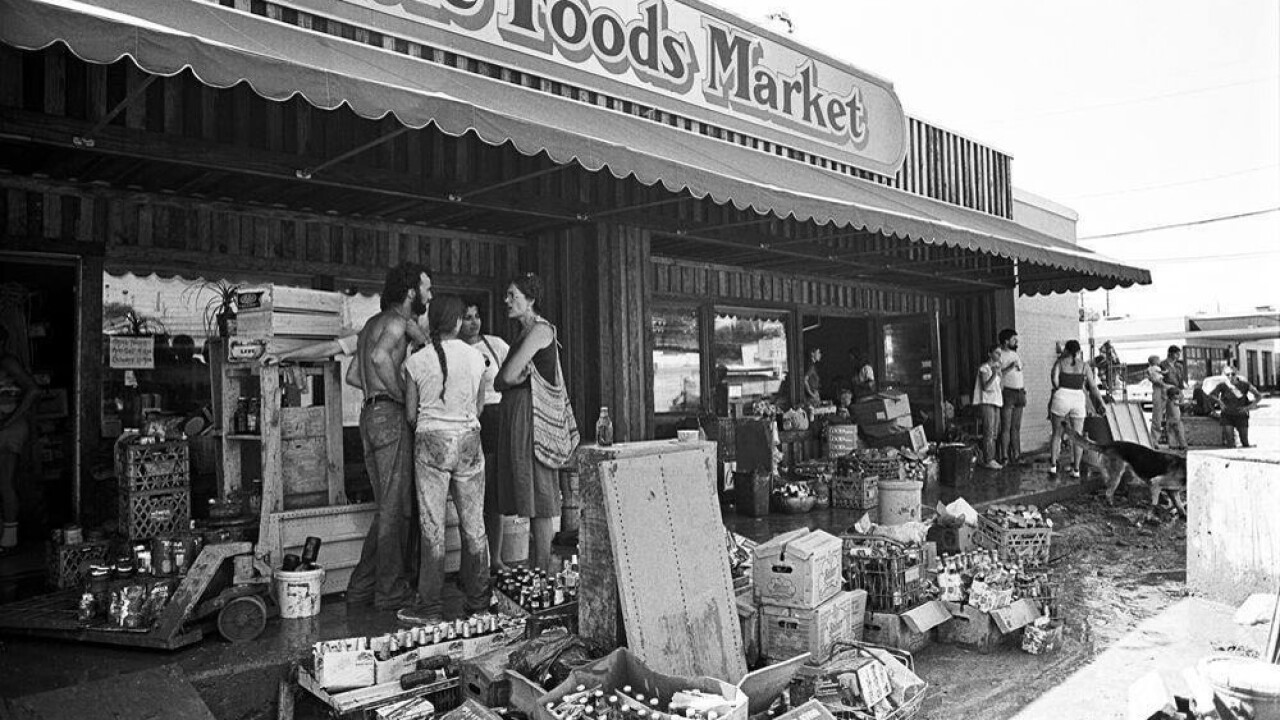

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3