-

Banks participating in the Main Street Lending Program were able to register for and offer credit to businesses last month, but the Federal Reserve said Monday it was set to make the effort fully operational.

July 6 -

The Senate had passed the bill Tuesday, shortly before the Small Business Administration was to stop accepting new loan applications.

July 2 -

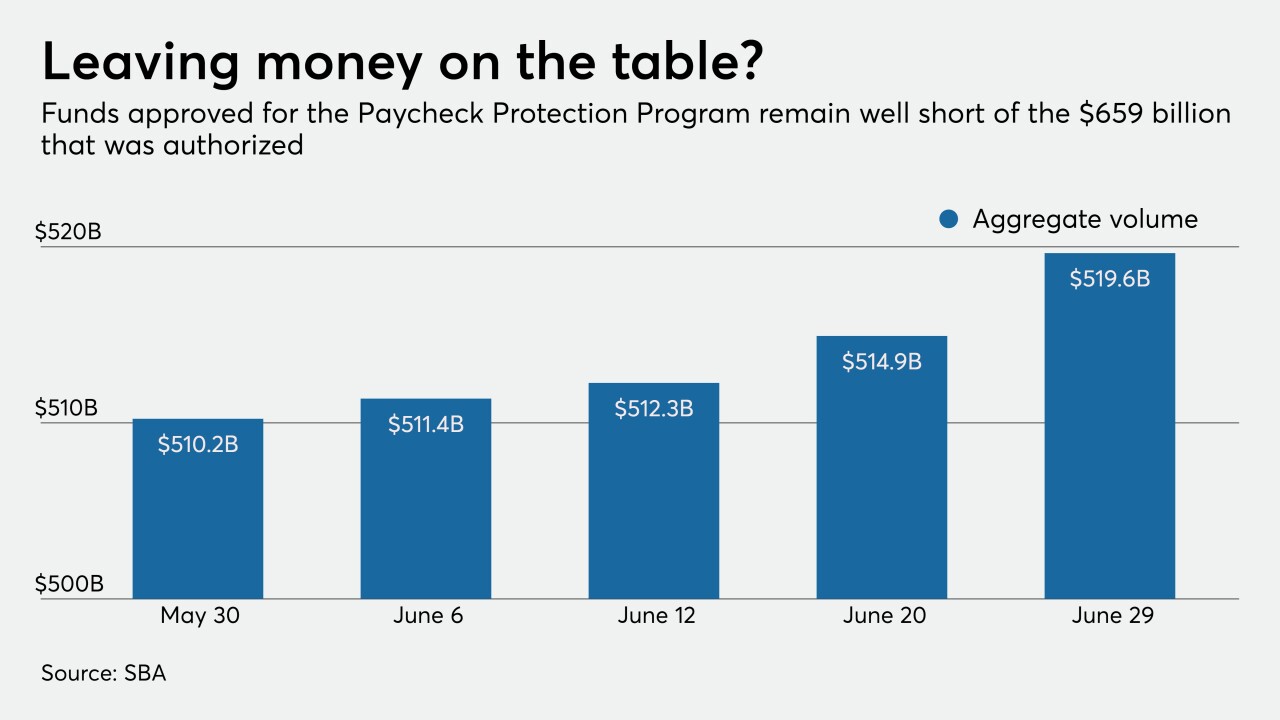

The Main Street Lending Program is off to a slow start, while the PPP is extended five weeks to distribute the remaining $130 billion in loans; the European regulator is softening its stance to allow more deals.

July 2 -

With stimulus money running out and forbearances set to expire, consumer spending is bound to shrink. That's bad news for business owners and their landlords, the Pittsburgh bank's CEO says.

July 1 -

The Paycheck Protection Program propped up many banks' balance sheets in the first half of the year, but what will drive loan demand in the second half?

July 1 -

The extension to Aug. 8 was offered by Sen. Ben Cardin, a Maryland Democrat, and cleared the chamber by unanimous consent. The House has yet to take up the bill but could pass it as soon as Tuesday night.

June 30 -

Lenders are selling their Paycheck Protection Program loans or hiring outside companies to navigate the process in an effort to reduce risk and avoid overloading their employees.

June 30 -

Banks are beginning to emphasize soft skills to help employees make “human” connections with customers in an environment of reduced face-to-face contact.

June 23 -

The Paycheck Protection Program put a premium on speed in processing and funding loans.

June 23 -

A global health crisis. Economic free fall. A reckoning over racism and inequality. We will not be the same after this — and neither will banking.

June 23