-

Few small businesses in Puerto Rico applied for credit to finance recovery from hurricane damage. The reasons are instructive for financial institutions’ response to disaster recovery, the New York Fed says.

September 27 -

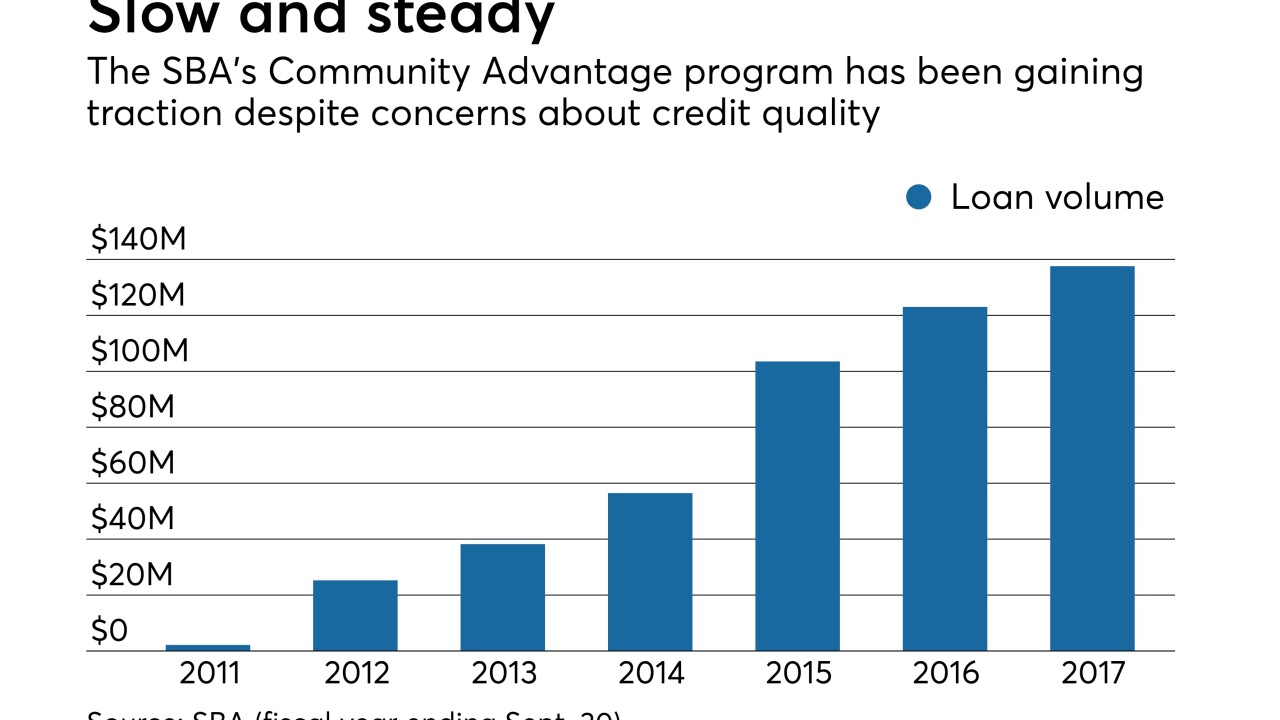

Some lenders fear a moratorium on new participants, and other restraints, could be the beginning of the end for the agency's Community Advantage program.

September 26 -

The bank seeks to answer the threat posed by disruptors with quick online loans and a card that rewards small businesses for more kinds of spending.

September 25 -

The legislation would help small-business owners better evaluate financing options by requiring updated disclosures.

September 25 Lending Club

Lending Club -

JPMorgan's chief cautioned against expanded regulation for big companies, arguing that businesses contribute to the economy.

September 24 -

BMO Harris Bank has made significant strides in recent years attracting retail and small-business customers, and now it's up to Ernie Johannson to keep the momentum going.

September 23 -

The agency wants more information as it conducts fair-lending exams, but conflicting statutes make writing a data collection rule difficult.

September 21 -

Community bankers reject the conclusions of a Government Accountability Office report that say regulatory burdens only had a “modest effect” on the declining number of banks since 2010.

September 19 -

The legislation, which creates new disclosure standards for financing costs, could hamstring commercial lenders that offer revolving credit facilities.

September 19 Commercial Finance Association

Commercial Finance Association -

Using software from Eastern Bank spinoff Numerated, Bremer Bank says it will be able to approve automated loans to farmers within a minute.

September 13