-

Only North Dakota has its own state-owned bank, but policymakers in other states say more public banks are necessary to fully meet society's needs. Among those who proponents say would benefit the most: small-business owners and legal marijuana suppliers and distributors.

March 25 -

The e-commerce giant is muscling its way into a number of businesses that banks have long dominated.

March 18 -

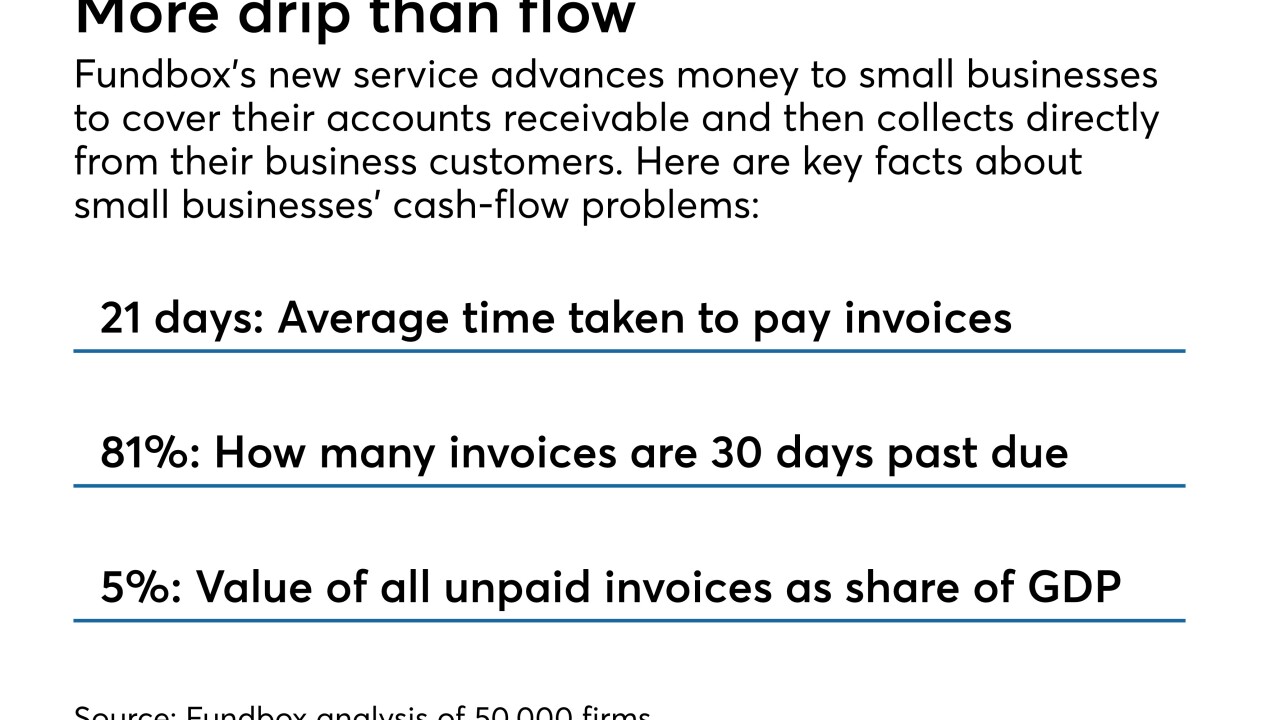

Fundbox is testing a payments and credit network for small businesses and their business clients that may offer an alternative to traditional lenders, credit card issuers and supplier financing.

March 14 -

The online lender is hiring Kenneth Brause, a CIT Group executive, to succeed CFO Howard Katzenberg.

March 13 -

Amazon.com is planning to offer a credit card to U.S. small-business customers, furthering its push to supply companies with everything from reams of paper to factory parts, according to people with knowledge of the matter.

March 12 -

Franklin Synergy and MidFirst both plan to deploy the online lending platform, which according to its creator can render loan decisions in just under three minutes.

March 12 -

Deposit prices are starting to rise, deposit growth is slowing, commercial loan growth remains tepid (with some exceptions) and concerns are mounting about the economic toll of U.S. trade policy, bank executives said just a few weeks ahead of the end of the quarter.

March 6 -

The Charlotte, N.C., company will open 500 new branches and hire 5,400 employees as it continues to expand in midsize cities across the country.

February 26 -

On Sep. 30, 2017. Dollars in thousands.

February 26 -

Since stepping down as CEO of Webster Bank last month, James Smith has spent much of his time co-chairing a panel tasked with solving his home state’s fiscal and economic woes. Banks, and perhaps even fintechs, could be a part of its comeback story, he says.

February 26