-

The average size of a Small Business Administration 7(a) loan has fallen to just over $400,000, a level last reached in 2017, according to agency statistics.

October 29 -

President Joe Biden called on Congress to return to Washington to make sure Small Business Administration loans don't run out after Hurricanes Milton and Helene devastated large swaths of the Southeast.

October 10 -

Federal Deposit Insurance Corp. Chair Martin Gruenberg said an FDIC study proves relationship-driven lending practices remain crucial to small-business lending and economic stability, despite technological advancements in the banking industry.

October 2 -

Democratic Gov. Gavin Newsom signed measures designed to bolster consumer protection rules. The bills target several issues that have also been percolating at the federal level.

September 26 -

Executives from JPMorgan Chase, TD, U.S. Bank, M&T and other banks will gather to discuss how they serve small-business clients, what those customers want now and what they expect in 2025 and beyond.

September 12 -

A survey of 135 financial services companies conducted by LexisNexis Risk Solutions, a subsidiary of LexisNexis, found that a vast majority reported increased levels of fraud in 2023.

September 5 -

Cannabis is becoming a big business in the U.S., but companies in the field still struggle to find financing. A broadly accepted way of assessing their creditworthiness would be a huge help.

September 2

-

A federal judge excoriated banks for inflating data in a challenge to the Consumer Financial Protection Bureau's data collection on small-business loans.

August 26 -

A representative of America's Credit Unions takes issue with a recent article suggesting that credit union commercial lending is excessively risky.

August 21

-

The same creativity and flexibility that community development financial institutions bring to business lending ought to be applied to financing affordable housing.

August 7

-

The core services provider partnered with Lendio to devise a cloud-native tool that will automate small business loan decisioning and onboarding for banks.

July 16 -

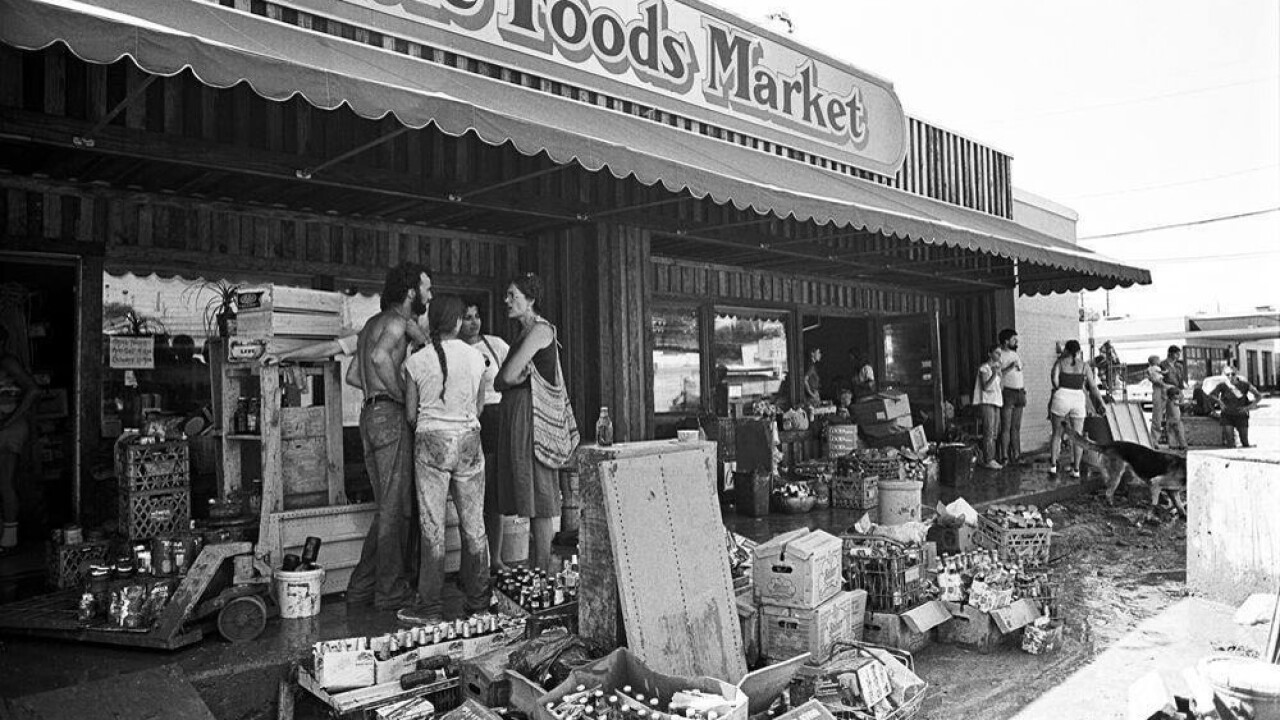

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

Funding Circle US fought to win a coveted license to make SBA 7(a) loans only to see its London-based parent company agree to a sale before it could make its first government-guaranteed loan

June 25 -

The Consumer Financial Protection Bureau extended the deadline for lenders with the highest volume of small-business loans to July 18, 2025, and will not assess penalties for reporting errors for a year.

June 25 -

The Canadian institution will offer cross-border banking services, financing, wealth management and more with its new TD Innovation Partners platform.

June 18 -

Rather than fueling uncertainty, the Consumer Financial Protection Bureau should be devising strategies that facilitate clearer policies that bring more certainty to lending markets.

June 6

-

While the $800 billion in PPP loans has largely self-liquidated through the forgiveness process, SBA continues to service the longer-duration EIDL portfolio and will likely be doing so for years to come after opting to hold on to the loans.

May 22 -

The small business lender's bankrupt shell has agreed to pay up to $120 million in connection with allegations that its verification processes for Paycheck Protection Program loan applications were faulty. The government argued that Kabbage reaped larger fees by enabling fraudulently inflated loans.

May 14 -

Bank stocks are up this year as interest rates have leveled off and there are hopes that pressure on lenders' profits could moderate.

May 8 -

Banks maintain lists of consulting firms that they trust to help troubled commercial borrowers to fix their businesses. These specialists say they're getting more calls, especially in areas such as multifamily and CRE, from business owners who need help.

May 2