-

The New York-based fintech's high-tech initiative is the centerpiece of an initiative aimed at capitalizing on an expected surge in small business lending activity.

February 20 -

A federal magistrate judge is recommending that the Consumer Financial Protection Bureau's small business lending data collection rule be upheld, rejecting a challenge by merchant cash advance lenders.

February 19 -

A federal appeals court in Texas has delayed the implementation of the Consumer Financial Protection Bureau's small-business data reporting rule slated to go into effect in July. How the Trump administration proceeds from here could be instructive on its approach to other CFPB rules.

February 10 -

A bill offered by Rep. Roger Williams, R-Texas, would repeal Dodd-Frank Section 1071 and eliminate any data-collection requirements for the Consumer Financial Protection Bureau.

February 4 -

The case against Yellowstone Capital, which state officials alleged deceived small-business borrowers, has brought attention to the industry.

January 23 -

On her way out the door, SBA Administrator Isabel Casillas Guzman issues licenses to four more nondepository lenders.

December 24 -

The Columbus, Ohio-based regional launched Lift Local Business in October 2020 with a $25 million ceiling. Four years and $133 million later, the program is still going strong.

November 22 -

The average size of a Small Business Administration 7(a) loan has fallen to just over $400,000, a level last reached in 2017, according to agency statistics.

October 29 -

President Joe Biden called on Congress to return to Washington to make sure Small Business Administration loans don't run out after Hurricanes Milton and Helene devastated large swaths of the Southeast.

October 10 -

Federal Deposit Insurance Corp. Chair Martin Gruenberg said an FDIC study proves relationship-driven lending practices remain crucial to small-business lending and economic stability, despite technological advancements in the banking industry.

October 2 -

Democratic Gov. Gavin Newsom signed measures designed to bolster consumer protection rules. The bills target several issues that have also been percolating at the federal level.

September 26 -

Executives from JPMorgan Chase, TD, U.S. Bank, M&T and other banks will gather to discuss how they serve small-business clients, what those customers want now and what they expect in 2025 and beyond.

September 12 -

A survey of 135 financial services companies conducted by LexisNexis Risk Solutions, a subsidiary of LexisNexis, found that a vast majority reported increased levels of fraud in 2023.

September 5 -

Cannabis is becoming a big business in the U.S., but companies in the field still struggle to find financing. A broadly accepted way of assessing their creditworthiness would be a huge help.

September 2

-

A federal judge excoriated banks for inflating data in a challenge to the Consumer Financial Protection Bureau's data collection on small-business loans.

August 26 -

A representative of America's Credit Unions takes issue with a recent article suggesting that credit union commercial lending is excessively risky.

August 21

-

The same creativity and flexibility that community development financial institutions bring to business lending ought to be applied to financing affordable housing.

August 7

-

The core services provider partnered with Lendio to devise a cloud-native tool that will automate small business loan decisioning and onboarding for banks.

July 16 -

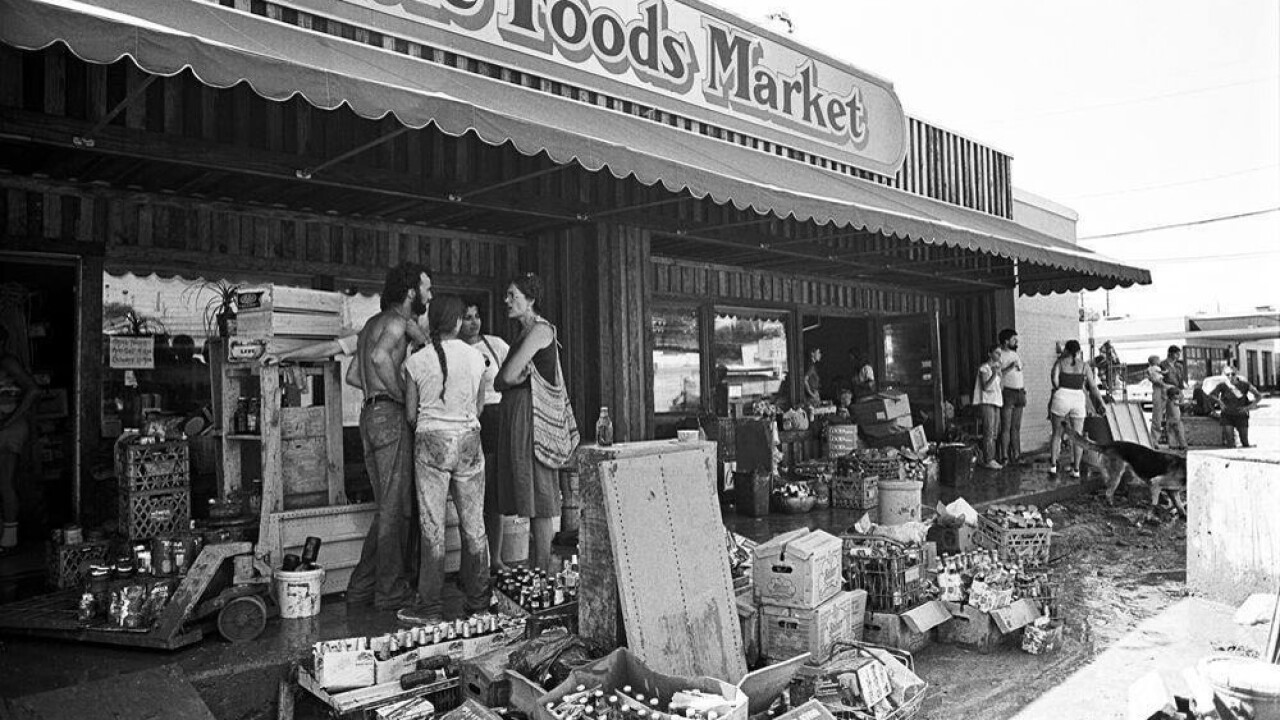

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

Funding Circle US fought to win a coveted license to make SBA 7(a) loans only to see its London-based parent company agree to a sale before it could make its first government-guaranteed loan

June 25