-

Subprime borrowers whose credit scores have risen since they bought their cars are increasingly looking for a better deal. Credit unions and small banks are seizing the opportunity, often with the help of fintechs.

August 25 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

July 2 -

KMD Partners, which makes high-interest rate loans through its CreditNinja brand, has agreed to acquire the $11.7 million-asset Liberty Bank. The purchase is likely to draw scrutiny, but the companies argue that it will help borrowers with lower credit scores qualify for less expensive loans.

June 15 -

After more than 100 years of mostly in-person operations, the subprime installment lender is seeking to adapt to changing consumer preferences — launching an online loan platform just before the pandemic and recently striking a deal to acquire a financial wellness app.

May 10 -

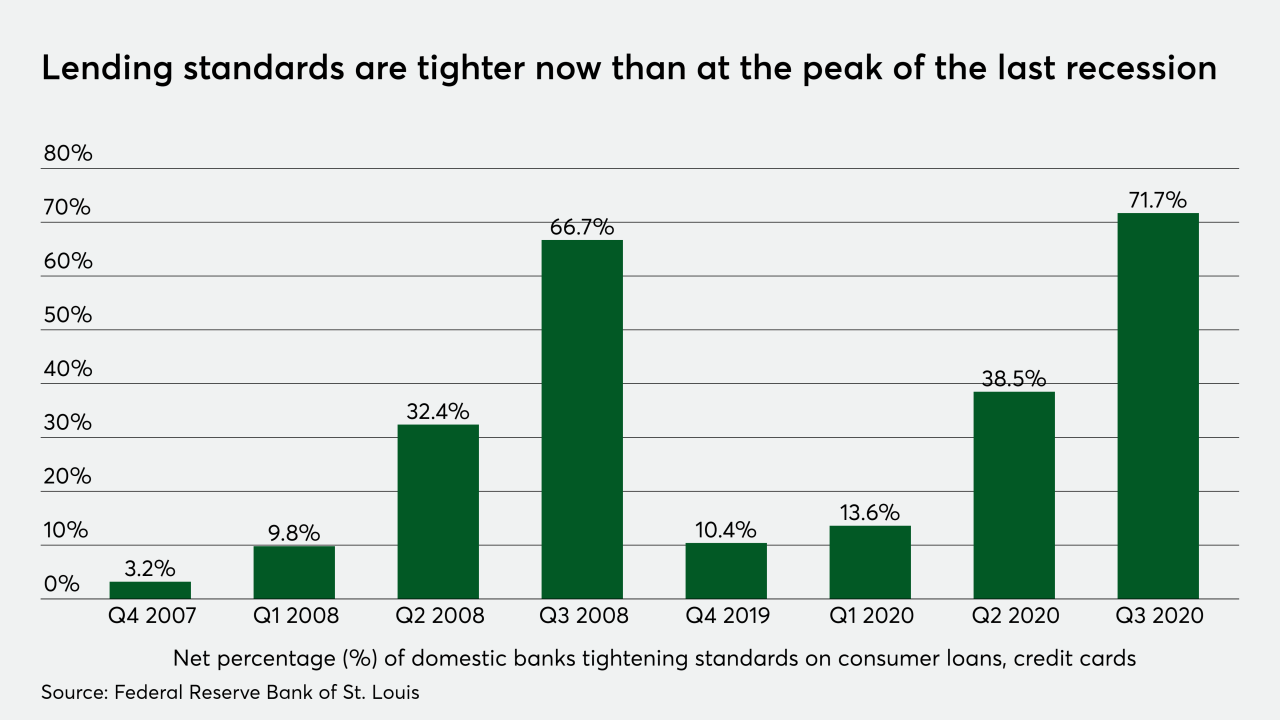

Looming defaults and the potential for heavier regulatory scrutiny have prompted banks to pull back from the sector. Is that a good thing?

April 28 -

The San Francisco company has faced financing challenges as its customers, largely lower-income Latinos, have struggled to keep up with monthly payments.

January 11 -

The company, which provides credit cards to millennials, is expanding its target audience beyond thin-file consumers and those without credit histories. It will now also target those with blemished, nonprime credit histories.

October 7 -

Millennial credit card provider Petal is expanding its target audience beyond thin-file consumers and those without credit histories. It will now also target those with blemished, non-prime credit histories.

October 7 -

A borrower advocacy group is asking federal banking regulators to investigate PayPal and Synchrony Financial, which partner on a product that is used to offer high-cost education financing.

August 24 -

Covered Care is promising to offer affordable loans to borrowers with credit scores below 700.

August 13 -

A subprime-related settlement between the government and Deutsche Bank provided meaningful benefits to some U.S. consumers in need, according to a new report. But the author acknowledged that those gains could prove illusory for some consumers given the coronavirus crisis.

July 10 -

The companies said the "meaningful impacts" of the coronavirus pandemic led them to terminate the $2.7 billion deal.

June 24 -

The lender will pay $65 million in restitution and forgive nearly $500 million in auto debt to settle charges that it steered subprime borrowers into risky loans.

May 19 -

Credit Acceptance Corp., the lender to car buyers with subprime credit scores, warned it's seeing a sharp drop-off in payments as people shift their financial priorities to get through the coronavirus pandemic.

April 21 -

Ally Financial's recently announced $2.65 billion cash-and-stock deal for CardWorks, which offers unsecured credit cards among other products, places a high price tag on a traditionally risky product.

February 21 -

Investors are reacting skeptically to the auto lender's deal to acquire CardWorks for $2.65 billion.

February 19 -

The city's decision to drop a lawsuit alleging predatory ending by Wells Fargo, JPMorgan Chase, Bank of America and Citigroup highlights the challenges municipalities face in taking on deep-pocketed financial institutions.

February 3 -

The New York bank said Wednesday that its first-ever credit card has brought in nearly $2 billion of loans in less than six months.

January 15 -

Without admitting wrongdoing, the bank has agreed to contribute $10 million to city programs promoting homeownership for low- and moderate-income residents.

December 16 -

The Bank is poised to pick two people to handle Simon Potter’s former job; Securities backed by subprime U.S. car loans are “going gangbusters.”

November 26