-

A court ruling deals a blow to efforts by HUD to restrict nonprofit housing funds from operating on a national scale; most banks get another year to implement CECL; PNC chief William Demchak plans to enter more markets and more from this week’s most-read stories.

July 19 -

Readers react to House lawmakers attempting to overhaul the credit bureaus, express sarcasm to the Senate Banking Committee eyeing cannabis banking, criticize Sen. Elizabeth Warren's plans to overhaul Wall Street and more.

July 18 -

The company will work on Libra, but won’t issue digital currency without proper authority; the bank’s profit dropped 8% on reduced revenue.

July 18 -

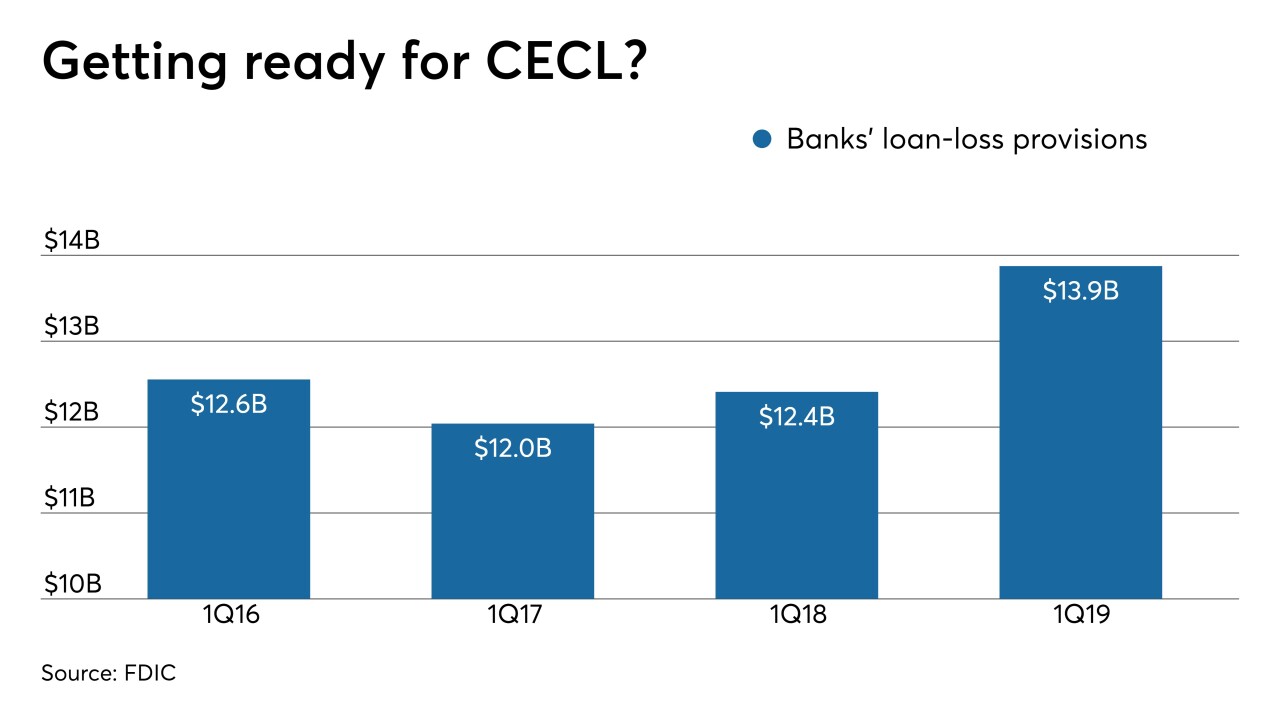

After FASB's decision to give most credit unions and banks extra time to prepare, lobbying groups are pushing for more.

July 18 -

After FASB's decision to give most banks extra time to prepare, lobbying groups are pushing for more.

July 17 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

Credit unions could have an answer about when a new credit loss standard will take effect, while the National Credit Union Administration will hold its monthly board meeting this week.

July 15 -

Beginning next year, banks will have to dramatically change the way they account for future credit losses, but experts disagree on the new rule's long-term impact.

July 11 -

Questioning whether core-banking technology is nearing a 'big shake-up'; Capital One keeps closing branches, even as rivals open them; FASB chair defends CECL, saying 'the benefits justify the cost'; and more from this week's most-read stories.

July 5 -

Readers react to Congress vetting Facebook's Libra, heavily debate whether to delay CECL, opine on attempts to roll back overdraft laws and more.

July 4