A court ruling deals a blow to efforts by HUD to restrict nonprofit housing funds from operating on a national scale; most banks get another year to implement CECL; CEO William Demchak plans to enter more markets and more from this week’s most-read stories.

Federal court blocks HUD guidance on down payment assistance

(Full story

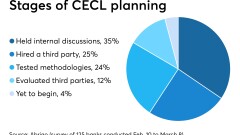

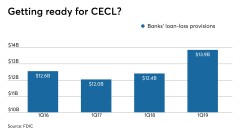

FASB extends CECL deadline for most lenders

(Full story

PNC aggressively adding branches to become coast-to-coast bank

(Full story

Ally ends credit card experiment, pivots to point-of-sale loans

(Full story

First Horizon may ask Alexa to help take on bigger banks

(Full story

Once a doubter, TD is now bullish on crypto, blockchain

(Full story

Emboldened by CECL delay, industry seeks repeal

(Full story

PayPal-backed blockchain aims to help banks verify digital IDs

(Full story

Elizabeth Warren makes play to put banking in 2020 spotlight

(Full story

Wells Fargo sued for denying loan to Dreamer

(Full story