-

Banks would have drowned if lawmakers hadn't delayed the new accounting standard during the coronavirus pandemic.

April 24 -

Banks had an opportunity to delay compliance with the new accounting standard, but many opted to move forward to get ahead of credit issues that could arise from the coronavirus outbreak.

April 22 -

The Los Angeles regional bank recorded the $1.5 billion noncash charge after its stock price ended March below its tangible book value.

April 21 -

Lawmakers delayed the new accounting standard as part of the stimulus package, but they shouldn't let bankers persuade them to eliminate it outright.

April 16

-

Measures that delay the Current Expected Credit Losses standard and reduce a community bank capital ratio are temporary, but the industry now sees an opening to argue that they should be permanent.

April 7 -

The regulator must speed up its capital reform efforts while taking immediate steps to reduce the examination burden.

April 7 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

Parties talking about a temporary lift of Wells' asset cap; GDP would have to drop an “unlikely” 35% in Q2 before JPMorgan would be forced to stop payouts.

April 7 -

Congress and financial regulators have implemented a number of measures to help the industry survive the financial impact of the pandemic, and a fourth phase of stimulus could be coming.

April 6 -

Emergency loan program plagued by chaos on eve of launch; why Moven, one of the first challenger banks, is calling it quits; Fed faces conundrum on whether to remove Wells Fargo's asset cap; and more from this week's most-read stories.

April 3 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

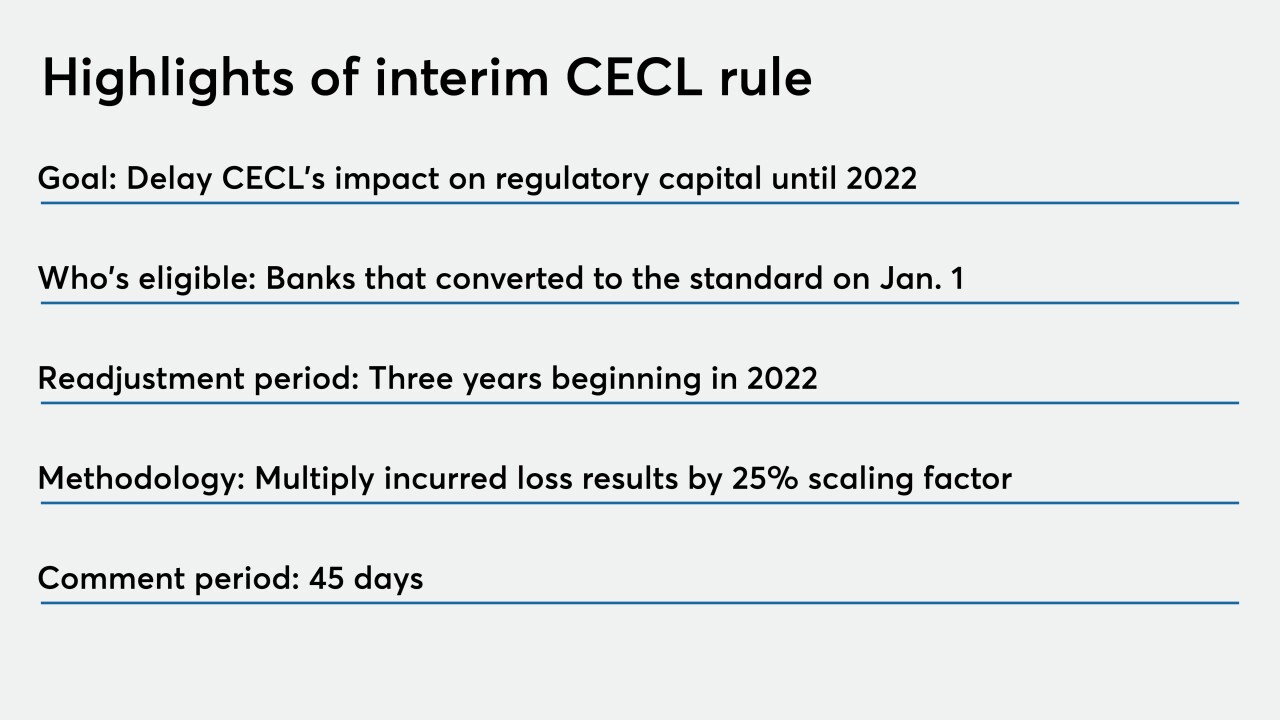

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

March 27 -

NAFCU and CUNA wrote to the regulator asking for a variety of measures to help credit unions weather the pandemic, including not implementing the CECL standard until at least 2024.

March 26 -

Details of the $2 trillion deal were still fluid Wednesday, but lawmakers were closing in on a plan that would aim to put lenders and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25 -

Policymakers should abolish the new accounting standard because it could distract banks at exactly the moment they need to be focused on pulling their communities from the brink of recession.

March 25 Signature Bank of New York

Signature Bank of New York -

The $2 trillion deal passed by the Senate late Wednesday would aim to put banks and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25 -

If the new accounting standard poses too many risks during an economic crisis, then it's probably not a good idea at all.

March 24 -

Congressional proposals could expand Federal Reserve liquidity support, delay a new credit loss accounting standard, provide certain accounts with unlimited deposit insurance and more to help businesses and consumers reeling from the coronavirus outbreak.

March 23 -

The FDIC's call for FASB to postpone the loan-loss accounting standard's effective date could put pressure on other agencies to follow suit.

March 20