-

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10 -

Nominated for a full term at the central bank, Michelle Bowman told senators that bankers should not fear repercussions for servicing hemp growers after the crop was legalized.

June 6 -

Farmers were already taking on more debt to cover losses from falling crop prices. New tariffs and other retaliatory moves could hurt ag borrowers further and lead to loan losses and tighter underwriting.

May 16 -

Banks that serve U.S. farmers are increasingly restructuring existing loans and boosting the collateral needed for new ones as the numbers of late and missed payments have risen.

May 3 -

The latest World Council of Credit Unions project in the Caribbean will see the island nation working alongside Indiana CUs to share best practices, strategic initiatives and more.

April 23 -

On Dec. 31, 2018. Dollars in thousands.

March 25 -

Rising waters in the Cornhusker State have already caused in excess of $1 billion in damages.

March 22 -

The shutdown is keeping the agency from approving about 300 loans per day, according to CBA President Richard Hunt.

January 22 -

Farm Service Agency staff will have three days to work on existing loan applications and provide tax documents for existing loans.

January 17 -

A recent proposal to allow the government-sponsored enterprise to offer more credit in agricultural regions is deeply flawed.

January 15United Bank & Trust -

The impasse has halted grant and loan applications and frozen many farm subsidies just weeks ahead of planting season.

January 14 -

Financial institutions of all sizes are offering low- or zero-rate loans, waiving fees and making other arrangements to aid federal workers — a practice that regulators officially blessed on Friday, the 21st day of the closing of many U.S. agencies.

January 11 -

The banking industry has long been critical of the government-sponsored enterprise, but the system could provide valuable banking services to large swaths of the country currently lacking access to them.

January 2 Duke Financial Economics Center

Duke Financial Economics Center -

Banks were reluctant to offer services to an industry that had a hazy legal status. That’s about to change.

December 19 -

On Sept. 30, 2018. Dollars in thousands.

December 17 -

Dozens of House members and four senators agree with arguments by farmers and lenders that a proposed change to the 7(a) program would disqualify worthy borrowers.

December 5 -

Can farmers — and the banks that lend to them — survive Trump's trade war?

November 5 -

Organizers of the credit union believe there is a funding gap in the state for agriculture and want to fill the void.

November 1 -

Harvest is when farmers need funding the most. ProducePay has financed over $850 million of produce in under four years, disrupting traditional finance rules in the farm-to-table process.

October 31 -

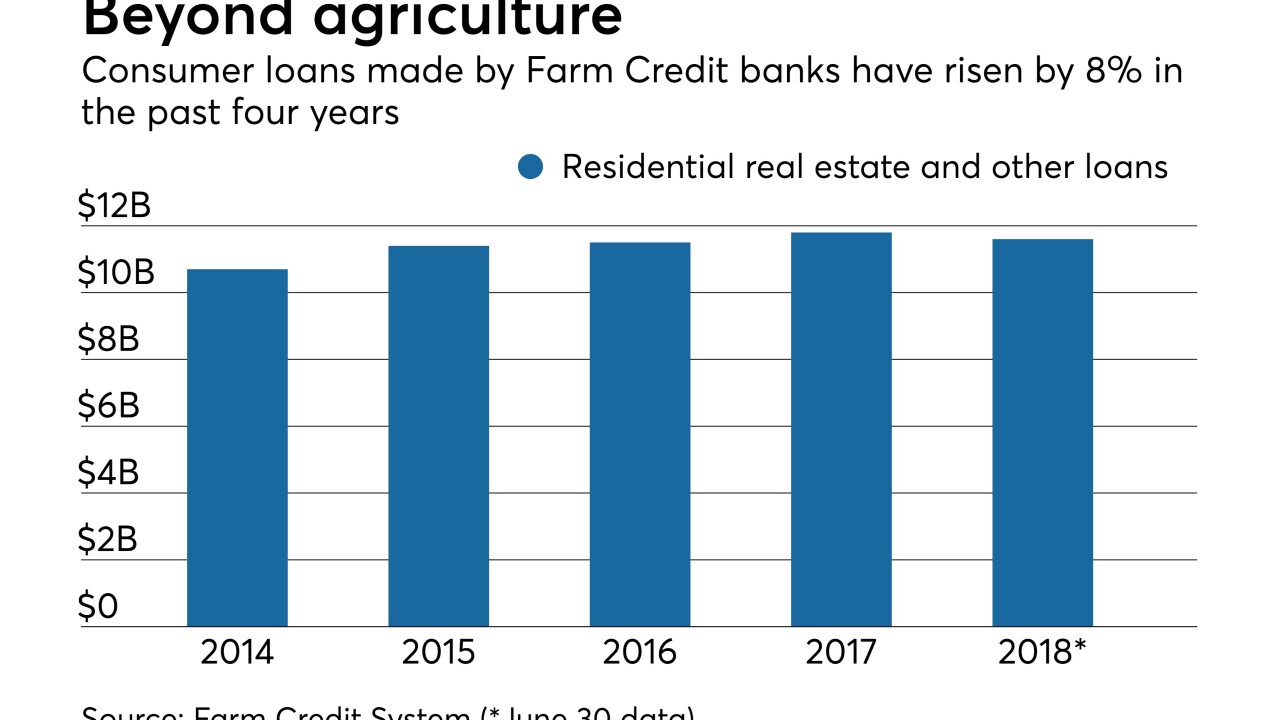

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31