-

-

A 90-day pause on reciprocal tariffs between the U.S. and China boosted the near-term economic outlook for banks, but tensions and uncertainty around trade barriers remain high.

May 12 -

A coalition of 105 organizations has analyzed the flow of financing to large, greenhouse-gas-emitting livestock operations and found these three banks do the bulk of loans.

September 12 -

-

-

-

-

Data as of Mar. 31, 2022. Dollars in thousands.

June 6 -

On Dec. 31, 2021. Dollars in thousands.

March 7 -

On Sep. 30, 2021. Dollars in thousands.

December 6 -

On Jun. 30, 2021. Dollars in thousands.

September 7 -

Community banks support legislation that would exempt them from paying tax on interest earned from farmland loans, arguing it would make them more competitive with government-backed lenders and expand access to credit in rural areas.

July 2 -

On Mar. 31, 2021. Dollars in thousands.

June 7 -

Under a plan signed into law in March, the agency will first target direct loans that it has made to socially disadvantaged farmers. Guidance that will affect small banks that have made government-backed agricultural loans is due in 120 days.

May 21 -

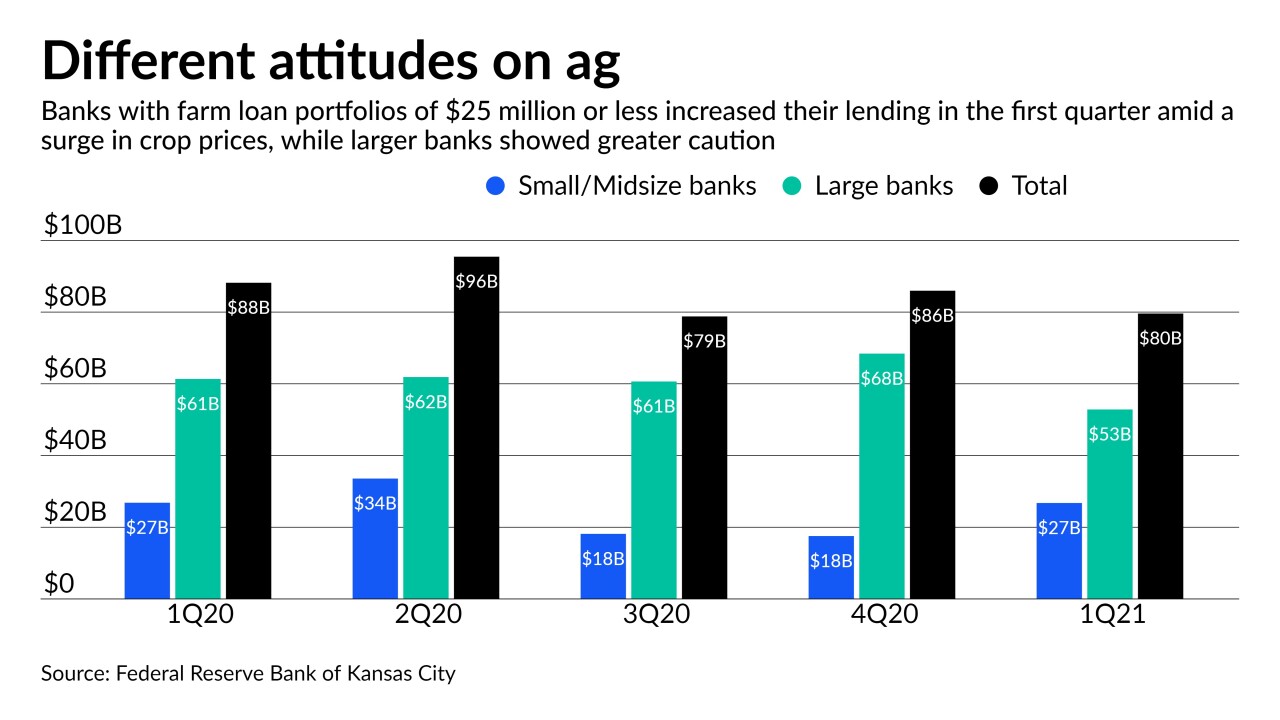

Smaller lenders have proved more aggressive than their larger rivals in making new loans during the farm country rebound. Market watchers warn that the price boom may not last.

May 5 -

On Dec. 31, 2020. Dollars in thousands.

March 8 -

A rule change that allows farms with just one employee tap the Paycheck Protection Program means more pandemic relief funds are flowing into such states as Nebraska, Oklahoma, Wyoming and North Dakota.

January 29 -

The Amarillo company is buying First National Bank of Tahoka, continuing the industry’s consolidation in the state.

December 14 -

On Sep. 30, 2020. Dollars in thousands.

December 7 -

On Jun. 30, 2020. Dollars in thousands.

September 14