-

Readers weigh potential risks in the leveraged loans market, debate Herb Sandler's legacy, consider the role the Fed should play in real-time payments and more.

June 6 -

The merging banks, whose new headquarters would be Charlotte, N.C., will each double their charitable giving over the next three years in Atlanta and Winston-Salem, N.C.

June 5 -

The bank has hired Brandee McHale away from Citigroup to head its charitable foundation and implement a new strategy that will place a greater emphasis on rental housing and combating homelessness.

June 5 -

The head of Fannie Mae and Freddie Mac’s regulator blamed “burdensome” local regulations for a lack of housing supply, and also provided an update on the administration’s plan for GSE reform.

June 3 -

Wells Fargo is in negotiations to settle a U.S. probe into procurement of low-income housing tax credits as its top lawyer tries to clean up issues before handing off the chief executive officer role.

May 31 -

At a time when costs continue to soar and regulators weigh reforms for Fannie Mae and Freddie Mac, more than half of the Democratic presidential candidates have talked about housing on the campaign trail.

May 22 -

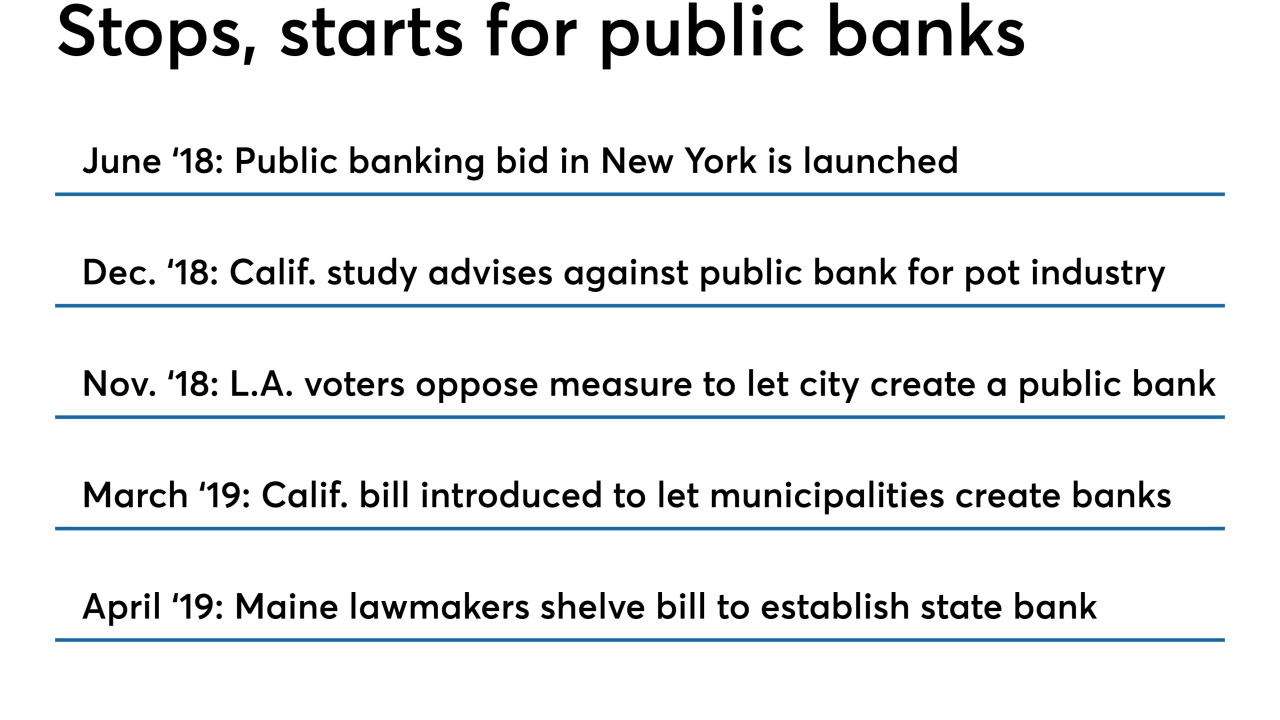

Undeterred by setbacks in other cities, a broad coalition of community groups is seizing on popular mistrust of traditional banks to press the case for a city-owned bank.

May 17 -

Housing advocates and Democratic lawmakers want to create more protections for tenants of rent-controlled apartments, but they are facing stiff opposition from property owners and the banks that lend to them.

May 10 -

Two nonprofits threatened by the effort say the Department of Housing and Urban Development tried to avoid scrutiny last month when it announced the new policy outside the formal rulemaking process.

May 6 -

The two banks’ CEOs used a public hearing to argue their merger will be a boon for underserved markets. But other speakers warned that bank consolidation hurts communities.

April 25