-

Republicans on the Senate Banking Committee objected to Biden administration picks for key jobs at the Department of Housing and Urban Development based on their past criticism of police practices. The nominees, including the prospective Federal Housing Administration chief, said their statements were taken out of context.

August 5 -

The White House's firing of Federal Housing Finance Agency Director Mark Calabria sparked immediate speculation about who will run the agency and help chart the future of the two mortgage giants. Potential nominees include ex-Obama administration officials, congressional staffers and members of the Biden transition team.

July 8 -

Consumer advocates and mortgage industry officials are urging Sandra Thompson, the new acting director of the Federal Housing Finance Agency, to undo many policies that her predecessor, Mark Calabria, put in place over the past year.

July 1 -

Gordon is currently president of the National Community Stabilization Trust, a nonprofit organization that promotes neighborhood revitalization and housing affordability.

June 24 -

Thompson, who was most recently the deputy director of the FHFA’s Division of Housing and Mission Goals, replaces Mark Calabria, who was fired Wednesday afternoon.

June 23 -

The Department of Housing and Urban Development reinstituted the “affirmatively furthering fair housing" measure, which the Trump administration had argued was overly prescriptive, and promised a later rulemaking to bolster the policy.

June 10 -

The funding requests break sharply with the Trump administration's calls to eliminate key housing funds and backing for community development financial institutions. The White House also wants to substantially increase the budgets of the Treasury Department and the Small Business Administration.

May 28 -

Bank of America is expanding a mortgage program for low- to moderate-income homebuyers in an effort to address racial wealth gaps.

May 18 -

Minority-led community development entities often lose out in getting NMTC support. They know best which investments will have the greatest impact on communities of color.

May 12 U.S. Bank

U.S. Bank -

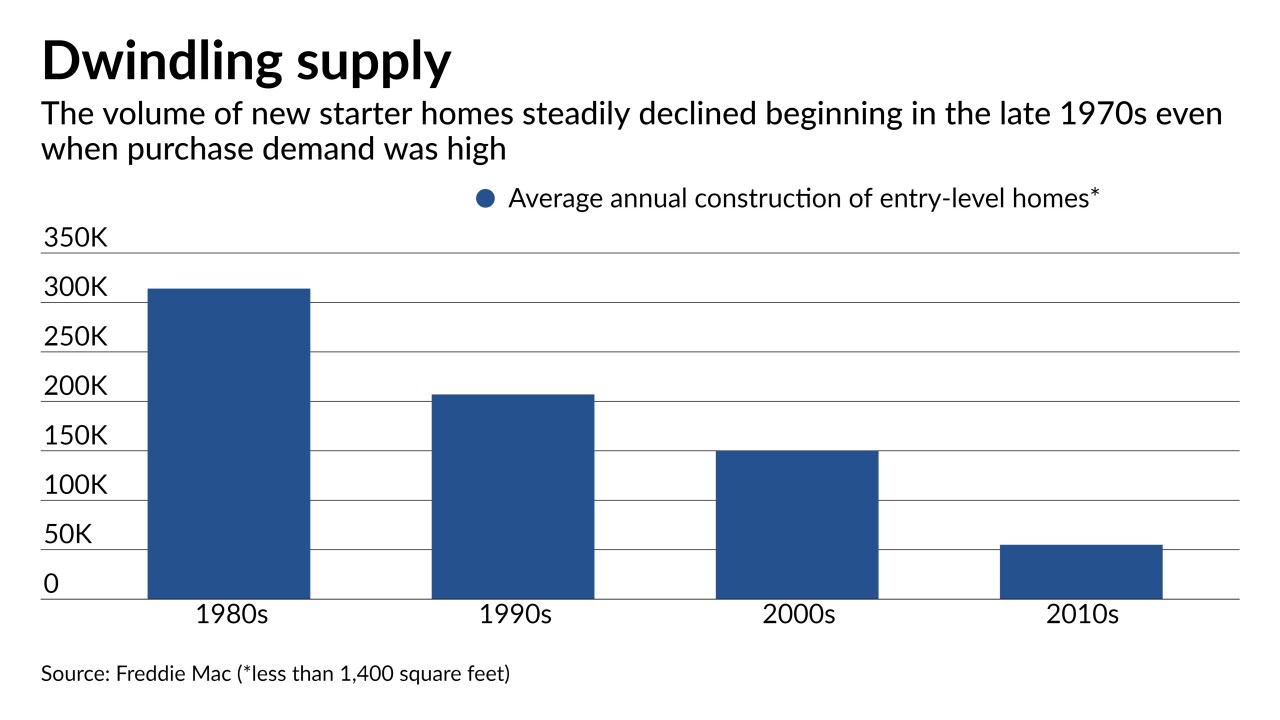

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27