-

The North Dakota governor's real estate background and affordable housing policies fit with the president-elect's plan to open up federal lands for new home construction.

November 15 -

The state lost almost 48,000 people by mid-2022 from two years before, according to Census Bureau estimates, spurring concern about outmigration that will curb long-term economic growth.

May 12

-

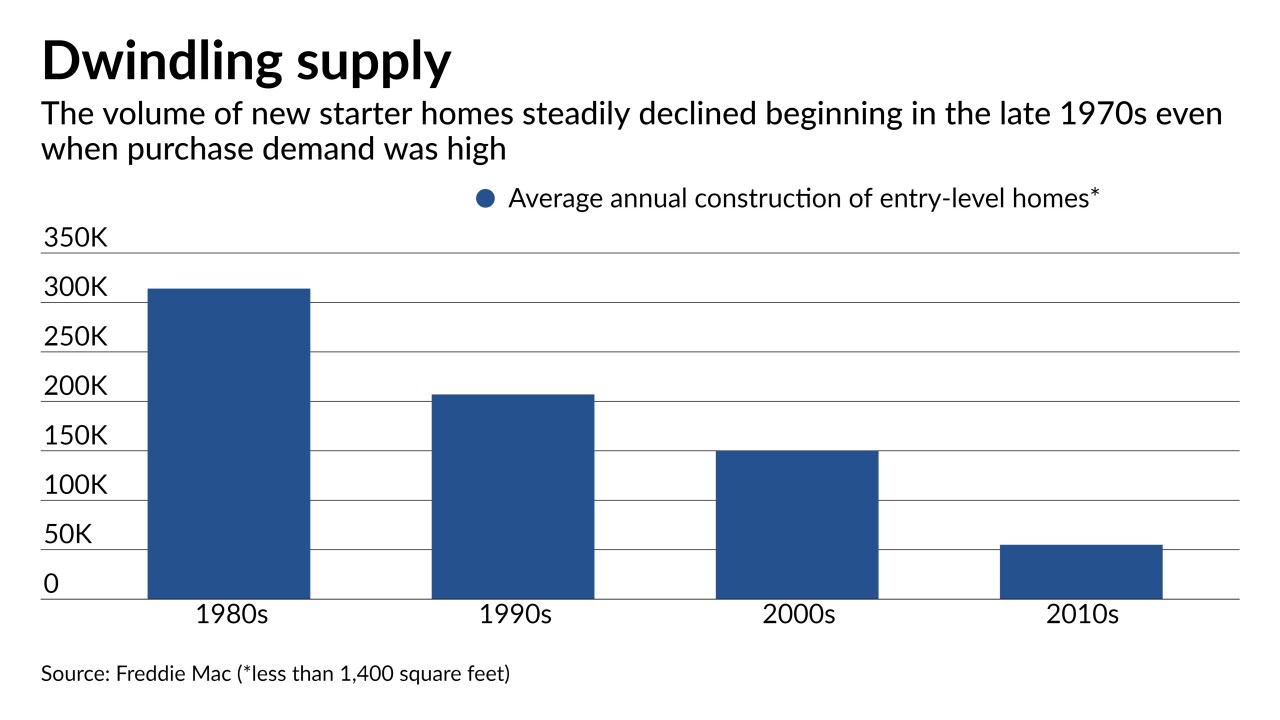

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

Default risks soar in minority neighborhoods during challenging economic times because, data shows, homes there are overpriced relative to incomes. Zoning and other changes could make loans more affordable by boosting housing stock and driving down prices.

November 25 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

One could change how commercial property is taxed, the other could change rent control policies. Both might affect financing.

October 14 -

One segment of the market, at least, has proved more resilient than many feared early on in the crisis.

June 8 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4 -

Popular TV shows about house fixers and flippers have sparked consumer interest in remodeling, creating an opportunity for lenders to build a specialty in renovation loans while traditional mortgage lending is weak.

February 4 -

Home prices are rising and first-time buyers now account for an increasing share of sales, factors that could lead to a surge in defaults during the next economic downturn.

December 5 American Enterprise Institute

American Enterprise Institute -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

Real estate and mortgage industry groups outspent proponents 3-to-1 to defeat Proposition 10, a measure to allow California municipalities to set local rent control laws.

November 7 -

City National Bank said the foundation will buy houses and hold onto them until the buyer lines up financing.

October 25 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

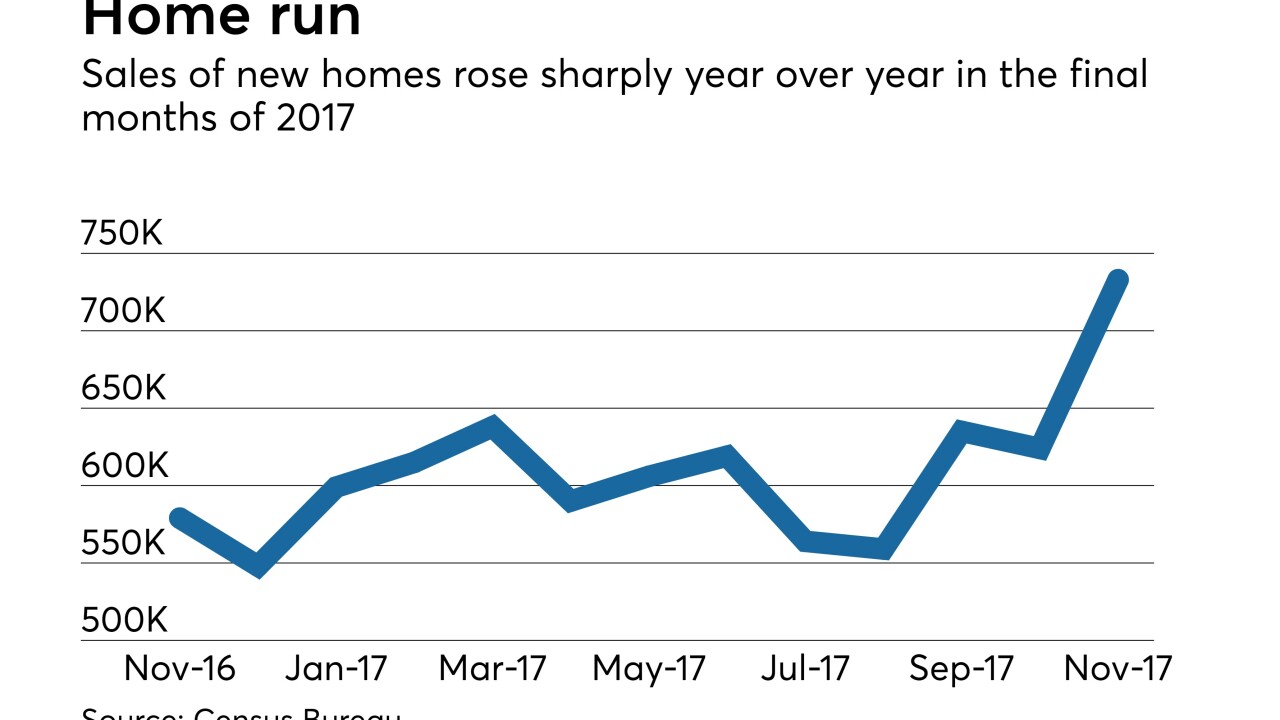

Housing confidence hit an all-time high as more consumers report it's a good time to sell, while also anticipating a rise in home prices but a drop in mortgage rates, according to Fannie Mae.

May 7 -

Despite soaring home prices, other factors needed to inflate a housing bubble are absent from the real estate market. But experts warn falling home values and rising mortgage defaults are inevitable, even if conditions naturally cool off.

March 28 -

Here's a look at the 10 housing markets with the biggest gap between growth in home prices and wages that could indicate a housing bubble is forming.

February 13 -

The recently enacted tax reform bill is likely to encourage more consumers to rent instead of buy and tamp down the rapid rise in home prices.

January 4 -

The tax law is expected to eliminate 300,000 affordable housing units over 10 years in part because it will reduce the value of banks’ low-income tax credits, which finance half of all affordable housing units.

January 3