-

The Consumer Financial Protection Bureau should have direct oversight of auto dealers instead of being forced to go through indirect auto lenders to make changes to the market, Sen. Elizabeth Warren, D-Mass., suggested Wednesday.

February 3 -

The CFPB notched another victory in its effort to limit dealer discretion after Toyota Motor Credit Corp. agreed to cut in half how much partnering dealerships can mark up the interest rate on a loan as compensation.

February 2 -

CEO Jeffrey Brown spent much of the firm's quarterly earnings call Tuesday responding to the demands of shareholders who are unhappy with Ally's weak stock price.

February 2 -

The public focus on whether Ally should pursue a sale has obscured other issues being raised by the firm's unhappy shareholders.

January 31 -

The Minnesota company's management team expressed confidence in its ability to monitor risk, even as companies such as BB&T and Fifth Third issue warnings over pricing and returns.

January 28 -

TCF Financial in Wayzata, Minn., reported higher profits on lower provision costs and a pickup in lending in the fourth quarter.

January 28 -

Chargeoffs jumped 13% at the Dallas lender, and its warning that they could increase further because of deterioration in subprime auto lending set off alarm bells about the broader consumer finance market.

January 27 -

Santander Consumer USA Holdings on Wednesday reported a sharp drop in profits, due to losses tied to its exit from personal lending.

January 27 -

The way the Consumer Financial Protection Bureau is regulating the auto finance industry's relationships with dealers is simply wrong both legally and ethically according to Blair Evans of Baker Donelson. It's also directly counterproductive to its goal of protecting consumers, she says.

January 25

-

At least five regional banks on Thursday discarded concerns about the global economy, stocks, interest rates and credit quality, forecasting loan growth for the rest of this year.

January 21 -

The House Financial Services Committee argues that the CFPB ignored a Justice Department request to narrow the list of potential consumers harmed in the Ally case, purposely casting a wider net for political purposes.

January 20 -

Overlapping missions and jurisdictions are fueling competition between the Consumer Financial Protection Bureau and the Federal Trade Commission, according to former officials at both agencies.

January 15 -

Bank chiefs should brace for a barrage of questions about economic uncertainty, if JPMorgan Chase's experience after releasing fourth-quarter results is any indication. Double-digit increases in loans and profits were not enough to stave off questions about the odds of recession, energy risks and adequacy of reserves.

January 14 -

Ford Motor Credit is rolling out a pilot program that allows small groups of people to lease a vehicle together.

January 12 -

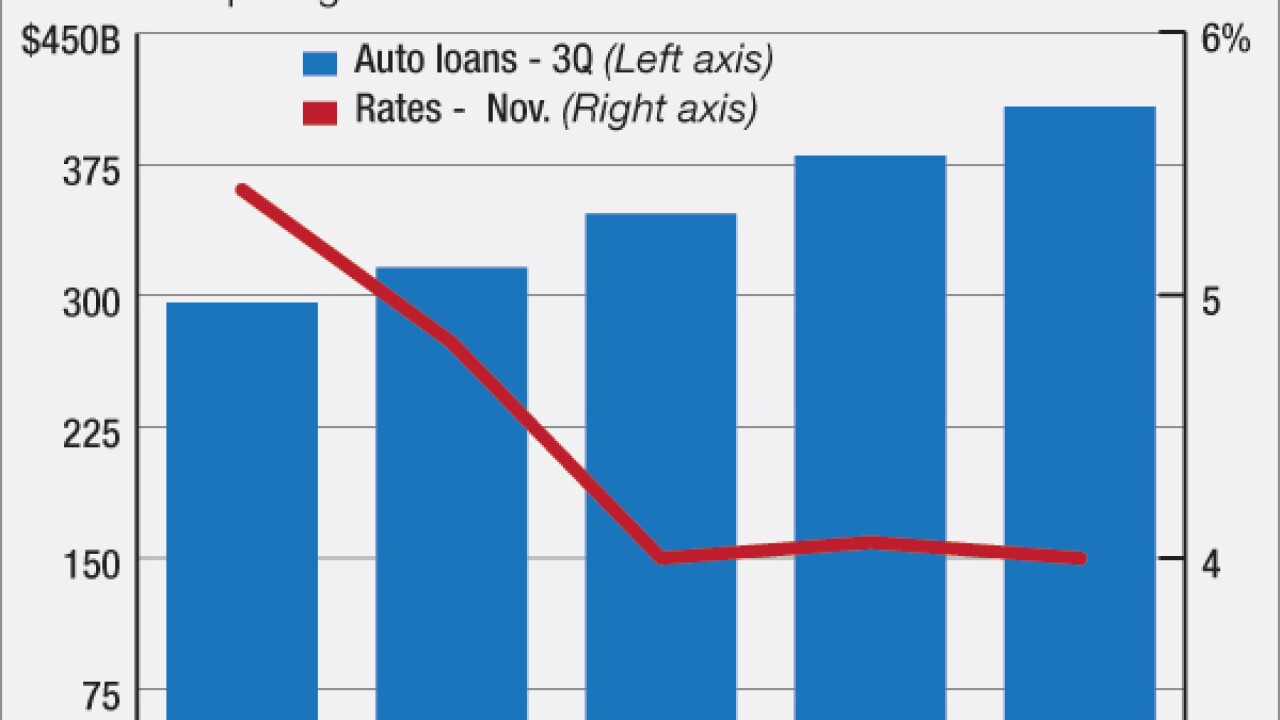

Consumers increasingly fell behind on their payments in several loan categories in the third quarter as economic growth cooled.

January 12 -

Consumer credit is better than ever before, even as Americans households have started levering up. But the big question for banks looking to re-commit to consumer lending is how.

January 5 -

Some lost their jobs while others made major missteps or faced serious challenges to their business plans. Here are the folks who had a rough 2015 and are looking forward to better times in 2016.

December 29 -

California Republic Bancorp in Irvine has securitized $380 million of its prime auto loans.

December 21 -

Ally Financial, seeking new sources of customers, will finance used cars sold through Beepi, an 18- month-old website that lets people buy vehicles with a few clicks and no test drive.

December 17 -

Bank officials say they are ready for rising rates; disagree on how much the initial increase would help or hurt lending and the economy; and predict more rate increases next year.

December 16