-

The $330 million transaction announced late Monday would give the Jasper-based company a foothold in fast-growing Columbus, as well as in Cincinnati.

July 30 -

The buyer said the all-stock deal to buy The First Bancshares would create a combined bank with $25 billion of assets.

July 29 -

The Wilmington, North Carolina-based institution is pursuing a model that cuts out the middleman and embeds its services directly into fintech partners' platforms.

July 29 -

In a new survey of bank executives from IntraFi, 90% of respondents said instances of check fraud have increased in recent years and half want law enforcement to make check fraud a bigger priority to stop criminals from stealing checks in the mail.

July 29 -

The store-branded credit card company revised its revenue guidance upward on the assumption that the CFPB's late-fee cap won't take effect before 2025. Still, Bread is moving ahead with plans to make up some of the revenue that it stands to lose from the contested rule.

July 26 -

Fulton Financial taps Valley National's Richard Kraemer as its new CFO; UBS' veteran private banker Jenny Su has left the firm; Bank of America names Kevin Brunner head of global technology, media and telecommunications investment banking; and more in this week's banking news roundup.

July 26 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

Fostering financial well-being among the country's fastest-growing demographic group is essential to the future of the American economy. And, not incidentally, it's also good for business.

July 26

-

Friday's deal for Premier Financial ends a five-year M&A hiatus for the Wheeling, West Virginia-based company while marking its expansion into Michigan.

July 26 -

ChoiceOne Financial Services would pay about $180 million to acquire Fentura Financial in a bid to expand in Detroit's suburbs. The deal would create a bank with more than $4 billion of assets.

July 25 -

The Raleigh, North Carolina-based bank grew loans and deposits in the second quarter as it won back business from former customers of the failed Silicon Valley Bank. First Citizens bought the remains of SVB last spring.

July 25 -

The siren song of greater regulatory uniformity will lead the industry to disaster, as the kind of innovation that benefits consumers is stifled.

July 25

-

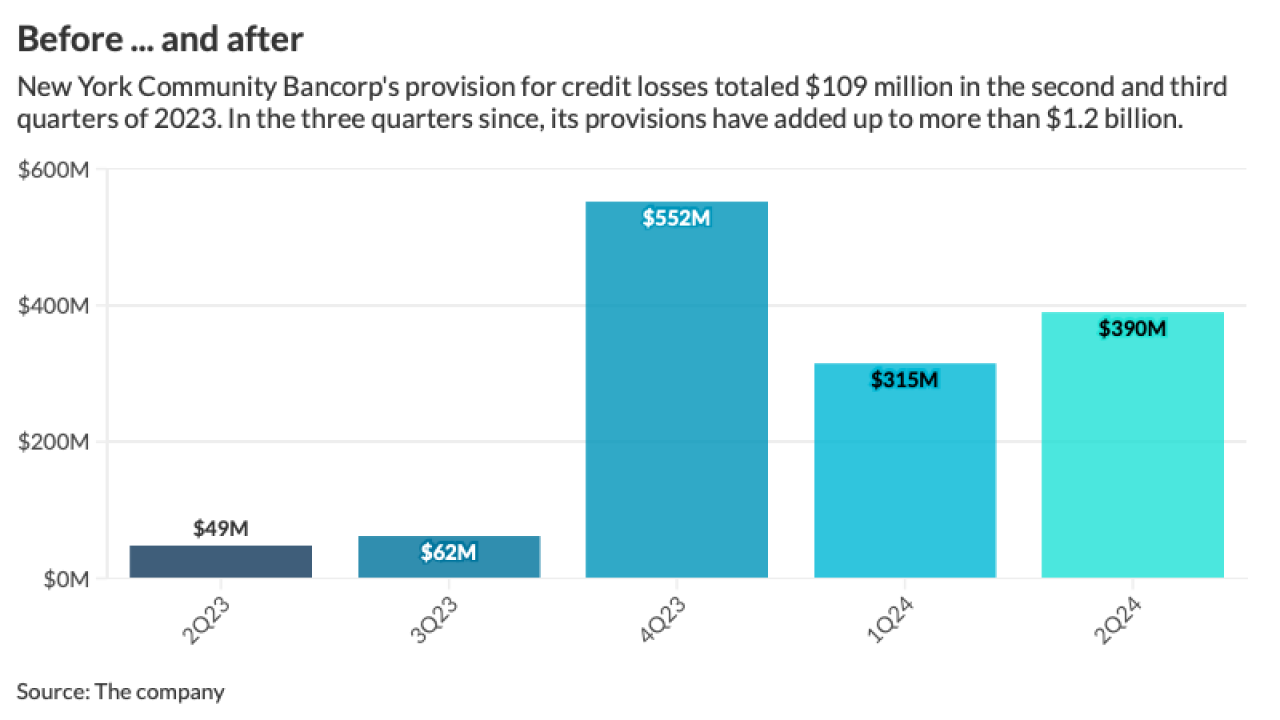

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The $72.8 billion-asset bank lowered its guidance for net interest income, explaining that while business prospects on the island are relatively rosy, its stateside opportunities for loan growth look weaker.

July 24 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

The $73.5 million all-stock deal, slated to close early in 2025, would create a bank with more than $3 billion of assets.

July 24 -

The Spanish bank recorded its best efficiency ratio in 15 years, Chairwoman Ana Botin said in its quarterly earnings statement.

July 24 -

A rising number of check fraud cases involving counterfeit checks is compounding the already-serious problem of fraud in one of the oldest payment methods widely available.

July 24 -

Old National Bancorp's earnings remained strong as it continued its expansion into the southeast with its recent $344 billion acquisition of CapStar. Executives said they foresee similar growth for the remainder of the year.

July 23 -

The Northeast regional bank missed expectations on net interest income and negatively revised much of its 2024 guidance.

July 23