-

Comerica, Regions and KeyCorp executives say their companies will proceed with caution despite the green light from the Federal Reserve to buy back stock in case they have to cover a surge in loan growth as the economy recovers.

March 9 -

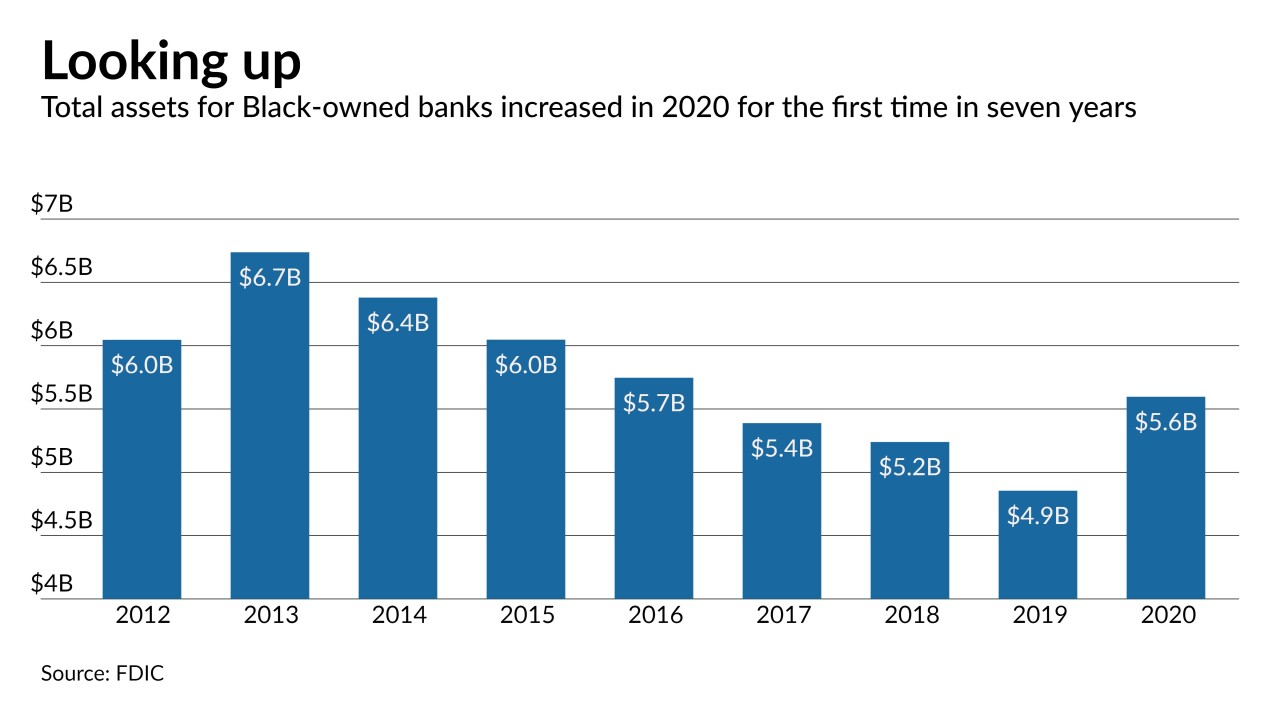

Six startups that seek to cater to Black and Hispanic consumers outside the financial mainstream are attracting heavy interest from investors. However, the new banks will vie with megabanks eyeing those same customers and with established minority-owned institutions suddenly brimming with new capital.

March 4 -

Ingenious Financial in Arlington, Va., is raising $200 million in hopes of buying an existing bank. Bank of Ingenious would focus on professionals such as doctors, dentists and veterinarians.

February 26 -

The bank, formed in 2019 when investors bought and recapitalized Sound Bank, will use the funds to hire lenders and improve its overall infrastructure.

February 26 -

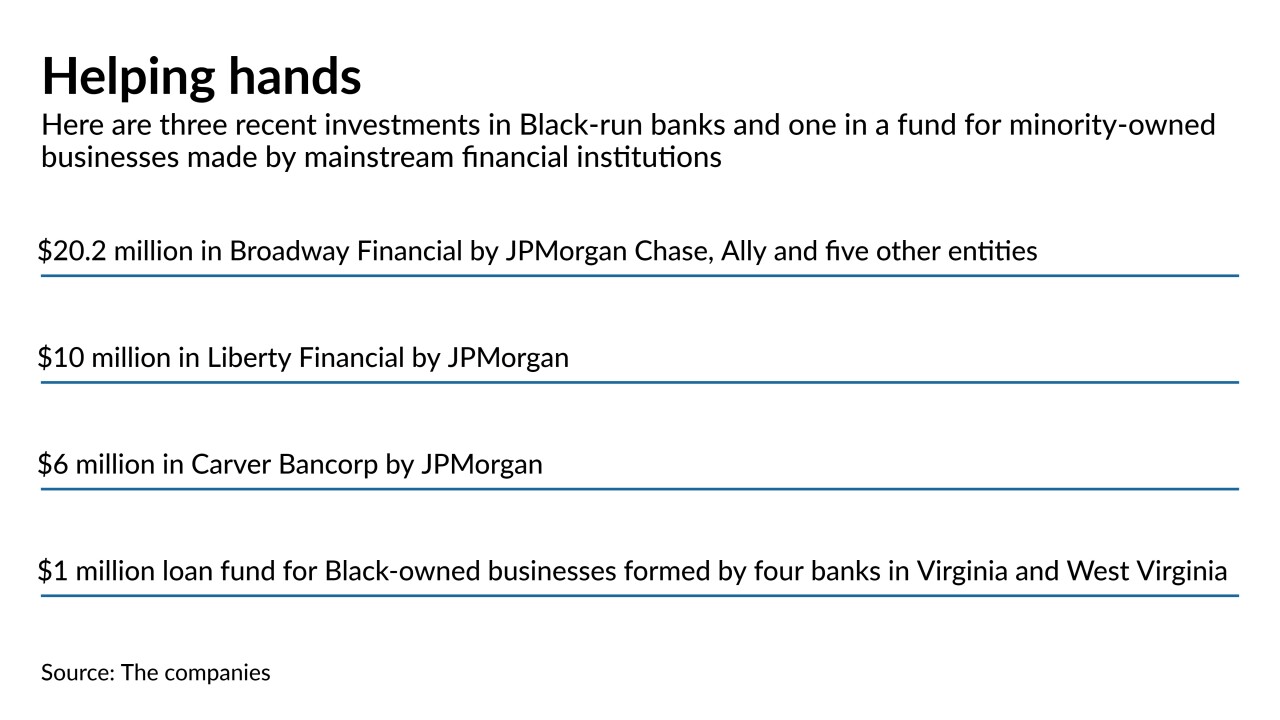

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

Hildene Capital, which is pressuring CIB Marine to issue subordinated debt to redeem preferred stock, has nominated two individuals to stand for election to the company's board.

February 24 -

The Fortune 500 conglomerate has had discussions about merging Thrivent Credit Union, which operates independently of the company, into the bank if the charter is approved.

February 24 -

A group led by Stephen Gordon has received conditional approval from the Federal Deposit Insurance Corp. to open Genesis Bank.

February 3 -

Organizers have been working raising capital and preparing an application for about four years.

January 28 -

The project will deploy $20 million as secondary capital to expand economic relief and financial inclusion, and follows a $1 million project last summer aimed at helping low-income consumers in Rust Belt cities.

January 14