A growing number of entrepreneurs are looking to address

At least six groups have been courting investors for banks that would largely focus on the Black and Hispanic communities. The executives behind the groups said investor appetite is helping drive their efforts.

“Change is in the air,” said Michael Jamesson, a principal at bank consulting firm Jamesson Associates in Scottsville, N.Y. “Social and economic winds are behind this in a way they were not before, and I think that’s why investment dollars are there and could continue to flow in.”

Those initiatives, on some level, will create more competition for the nation's 18 remaining Black-owned banks. The number of Black-owned banks has been cut in half since 2000, and the proposed merger of Broadway Financial in Los Angeles and CFBanc in Washington would remove another from the list.

But there is enough demand among minority groups to support more banks, industry observers said.

Nearly a fifth of Black citizens lack a bank account, said Donald Hawkins, co-founder and CEO of First Boulevard, a proposed digital bank that aims to connect with the unbanked in the Black community.

“It is vital for a bridge to be built,” Hawkins said.

“After viewing yet another tragedy engulf the Black community,” Hawkins said, referring to George Floyd’s death in Minneapolis at the hands of police last year and the ensuing outcries that have fueled the Black Lives Matter movement, “it was beyond clear to me that the solutions Black America need must be financially focused and developed within our community.”

First Boulevard said in February that it had secured $5 million in seed funding from a group of investors, including Barclays, to launch a digital platform by the third quarter. The Black Lives Matter movement highlighted America's wealth gap and the need for the financial services industry to address it, Hawkins said.

Importance of trust

Other efforts are focused on tackling the same issue.

Ingenious Financial, an Arlington, Va., company founded by Darnell Parker, announced plans in February to raise $200 million to form Bank of Ingenious. The group aims to raise the funds by June 30 so it can buy an existing minority-owned bank, upgrade the technology platform and instill a comprehensive financial education component for clients.

The goal is to buy a bank in a major market with $50 million to $600 million of assets. They would assume management, grow the customer base and, in time, look to buy other such banks with the intention of retaining

Parker, a former senior financial analyst at the Treasury Department and the Federal Deposit Insurance Corp., said his company is looking at a dozen potential acquisitions. Parker would like to secure the first acquisition by the third quarter, with plans to line up more deals over time.

“We’re taking a national view,” he said.

The average Black-owned bank has $280 million of assets, according to the FDIC. The biggest is the $765 million-asset Liberty Bank & Trust in New Orleans, though Broadway would

Maintaining minority ownership and management is important when it come to building trust with underserved groups, said Derek Taylor, Ingenious Financial’s chief operating officer.

“Minority institutions must stay relevant,” Taylor said. “This is about making sure the economy is finally going to be working for everybody.”

Ingenious would focus on retail and business customers, with an initial emphasis on physicians, dentists and other professional services providers. The belief is that those clients would drive economic expansion and job growth in predominantly Black communities.

Service-based model

BossUp Bank, co-founded by James Lindsay and music mogul Percy “Master P” Miller, has similar ambitions.

The bank plans to work with retail partners to launch a network of ATMs in the second quarter. It also intends to partner with existing banks to provide loans and other financial services to underserved populations.

There is an abundance of Americans to reach through BossUp and similar efforts, Lindsay said.

The Federal Reserve recently estimated that there are 55 million unbanked or underbanked people in the United States.

Those individuals are struggling with shopping, paying bills and managing other routine transactions, Lindsey said, adding that he wants to see more startups emerge.

“We have to connect more people to basic services that they need to really participate in this economy,” Lindsay said. “We just have far too many people not living up to the basic standard of America.”

Technological advances are making it easier for challenger banks to reach customers, while ongoing consolidation has opened paths for new types of banks to enter the fray, said Charles Wendel, president of Financial Institutions Consulting in New York.

“There’s certainly room for new competitors,” he said. “We’ll have to see over time how much investor support each can get.”

Rebound of established banks

Competition for banking the Black community is heating up.

Other startups include

The financial conditions of many existing Black-owned banks have improved in the last year.

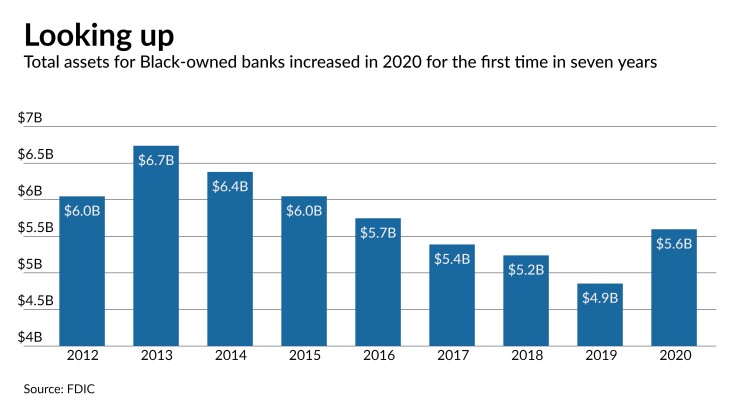

The Paycheck Protection Program reversed a trend of waning assets at Black-owned banks. After declining for eight straight years, total assets at those banks increased by 15% in 2020, to $5.6 billion.

Black-owned banks have also benefited from investments from other banks.

Bank of America last year vowed to

JPMorgan Chase recently

More capital and increased revenue should make those banks more competitive when it comes to serving members of their community.

Increased competition should help underserved communities, industry observers said.

“More players can mean more innovation and potentially more services,” Jamesson said.