-

Customers Bancorp in Wyomissing, Pa., is seeking to raise as much as $133.5 million through two avenues: a newly announced preferred stock offering and previously announced secondary sales of common stock.

September 12 -

Huntingdon Valley Bank in Pennsylvania has revived its plan for a mutual conversion.

September 9 -

Severn Bancorp in Annapolis, Md., has redeemed the last shares tied to the Troubled Asset Relief Program.

September 9 -

Colony Bankcorp in Fitzgerald, Ga., has redeemed $3.6 million in perpetual preferred stock associated with the Troubled Asset Relief Program.

September 8 -

Live Oak Bancshares in Wilmington, N.C., has formed a renewable energy lending division.

September 7 -

CapStar Financial Holdings in Nashville, Tenn., whose board includes a top Credit Suisse executive, has filed plans to raise up to $46 million in an initial public offering.

August 29 -

Metropolitan Bank Holding Corp. in New York has raised $34.4 million through a stock offering.

August 29 -

The holding company for Tennessee's FirstBank plans to hold an initial public offering, in order to make more than $65 million in distributions and debt repayments to its chairman.

August 22 -

The Bancorp in Wilmington, Del., disclosed the identities of directors nominated to its board by two investor groups.

August 22 -

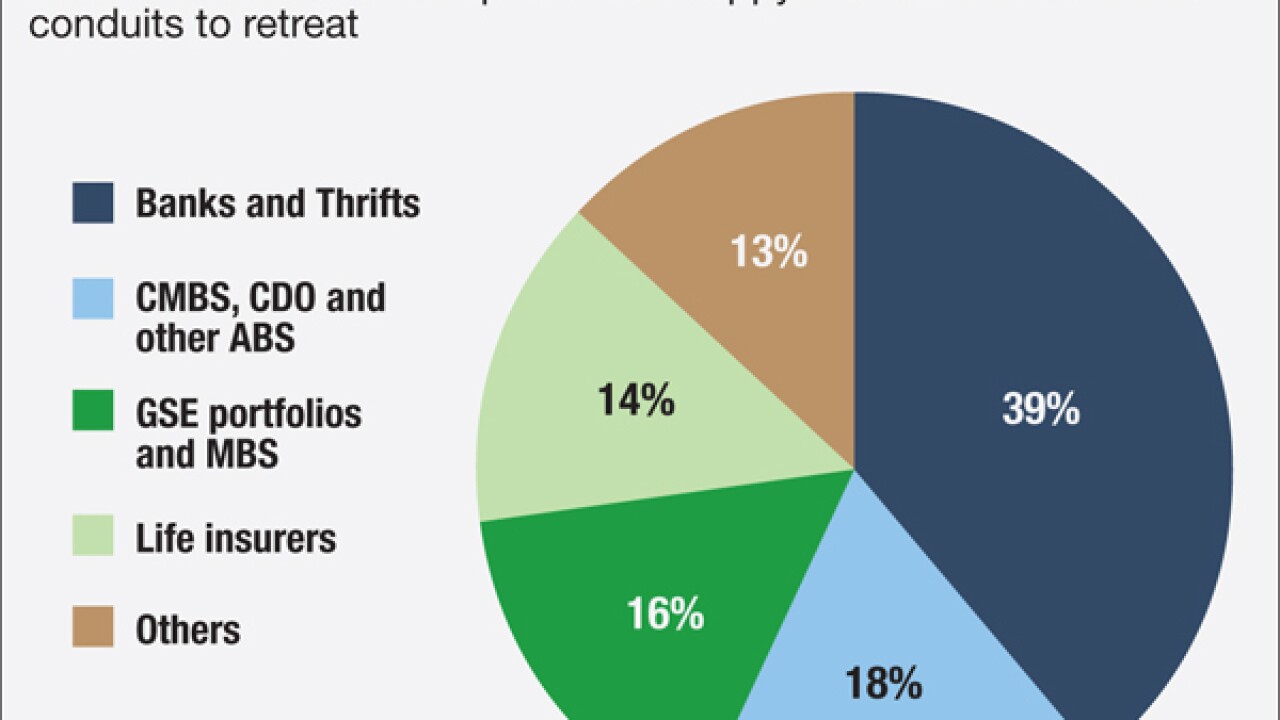

The first commercial mortgage-backed security to comply with "skin in the game" requirements was extremely well received. Market participants credit the way the large banks sponsoring the deal retained the risk a strategy unavailable to nonbank lenders.

August 19 -

The $185 million-asset bank said in a press release Tuesday that it is offering 800,000 shares of its common stock at a price of $7.50 each.

August 17 -

The $58 million-asset company said in a press release Monday that Stephen Taylor, chairman and chief executive of Taylor Asset Management in Chicago, is leading a $6 million investment in its Neighborhood National Bank, effectively doubling its capital.

August 15 -

Alamogordo Financial in New Mexico has kicked into gear its plans to convert from a mutual to a fully shareholder-owned company.

August 15 -

Meta Financial Group in Sioux Falls, S.D., has expansion in mind, citing M&A and other growth-related pursuits as the reasons behind a $75 million debt issuance.

August 11 -

Old Line Bancshares in Bowie, Md., has issued $35 million in subordinated debt to help pay for an acquisition and for growth moves down the road.

August 11 -

Regions Financial in Birmingham, Ala., has offered to repurchase up to $750 million of its outstanding senior debt.

August 11 -

First Financial Northwest in Renton, Wash., said Wednesday that it has repurchased about 10% of its stock under a tender offer.

August 10 -

The $4.3 billion-asset holding company said in a press release Monday that the fixed- to floating-rate subordinated notes are due in 2026.

August 8 -

Pacific City Financial in Los Angeles has raised $15.3 million in a secondary stock offering.

August 8 -

The Bancorp in Wilmington, Del., has raised $74 million by selling common stock and a new series of preferred stock.

August 8