-

The proposed Agility Bank would rely heavily on digital offerings. It is pursing a national charter with the Office of the Comptroller of the Currency.

April 3 -

Requiring banks to test themselves is likely to be a waste of time in the current crisis, says a former Senate Banking counsel.

April 3 Corporations and society initiative at Stanford Graduate School of Business

Corporations and society initiative at Stanford Graduate School of Business -

The change — effective immediately — will reduce capital demands by about 2% overall, the Fed estimated, and will be open for a 45-day comment period.

April 2 -

The acquirer had pursued a de novo strategy in its home state but was unable to raise enough capital.

March 30 -

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

NAFCU and CUNA wrote to the regulator asking for a variety of measures to help credit unions weather the pandemic, including not implementing the CECL standard until at least 2024.

March 26 -

A former market president for State Bank Financial would serve as CEO of the proposed Classic City Bank.

March 26 -

The central bank will prioritize monitoring and outreach while reducing examination activity due to the coronavirus pandemic until at least the end of April.

March 24 -

Organizers of Coastal Community Bank must raise $19.5 million before opening.

March 20 -

Triad Business Bank, which will immediately have offices in three cities, will debut next week.

March 13 -

Organizers of Riverside Bank of Dublin will need to raise $18 million before opening.

March 13 -

The move come a day after the Bank of England cut rates and introduced a series of emergency measures, including capital requirements and a lending program for smaller companies.

March 12 -

Banks with the most exposure to oil and gas companies say they’ve added capital and changed their borrower mixes since the 2015 market fall. But skeptics question whether they can stave off losses if low prices endure.

March 10 -

E-Trade could add about 30 basis points to a key capital ratio once the deal closes, Jonathan Pruzan says.

February 27 -

Though the agency plans to give more credit unions authority to issue subordinated debt, limited investor appetite and other factors could hamper activity.

February 27 -

The banking group issued lawmakers a guide on questions to ask as credit union executives visit Capitol Hill for two days.

February 26 -

Want to satisfy regulators and better compete with the big banks? Here's where to start.

February 14 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

Organizers of Triad Business Bank have raised enough capital and have received approval from the FDIC.

February 5 -

The Mississippi company will pay $49 million for Traders & Farmers Bancshares.

February 5 -

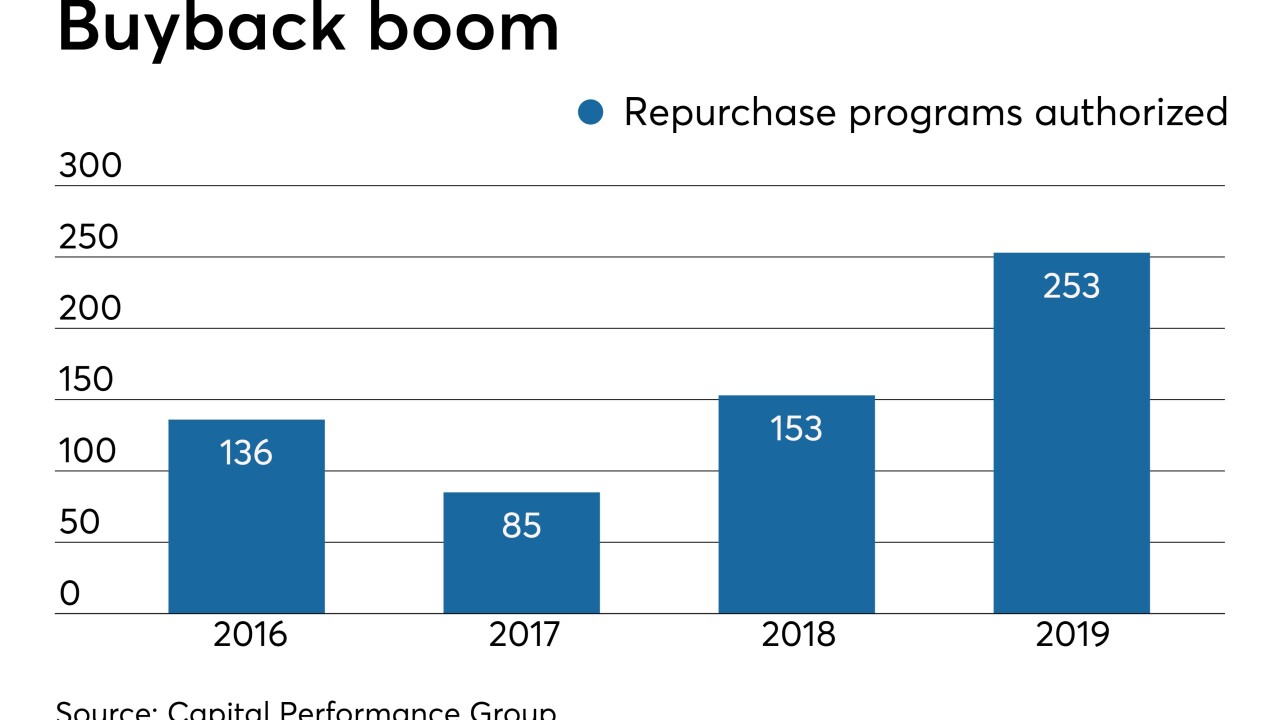

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5