-

Organizers of Bank of St. George still need to raise $18 million before opening.

December 30 -

The two agencies have delayed the deadline for the public to respond to a request for information on the rating system used to score banks' overall health.

December 20 -

Lower interest rates are allowing banks to use the cheaper capital to repay higher-cost debt and prepare for future expansion.

December 19 -

It's long past time for the National Credit Union Administration to implement a risk-based capital standard, and the recently approved delay could hurt more than it helps.

December 17

-

It's long past time for the National Credit Union Administration to implement a risk-based capital standard, and the recently approved delay could hurt more than it helps.

December 16

-

Organizers have applied to form Craft Bank. If successful, the bank would become the third to open in the Atlanta area in recent years.

December 13 -

The National Credit Union Administration board signed off on a controversial budget, and it delayed its risk-based capital rule to buy itself time amid complaints by bankers.

December 12 -

The supervisory letter had required the company to get Fed approval before issuing debt, paying dividends or making quarterly payments on its trust-preferred securities.

December 11 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

The company will gain branches in Northampton County as part of the $79 million deal.

December 10 -

The deal will create a bank with nearly $50 billion in assets.

December 9 -

The company will pay $122 million for six branches and nearly $1 billion in assets.

December 5 -

PiNG Bank, which would be based in Jersey City, is being proposed by former bankers at Cross River Bank, Citigroup and Bogota Savings Bank.

December 2 -

The company agreed to pay $41 million for Victory Community Bank.

December 2 -

The company will pay nearly $33 million for Tomah Bancshares to boost its operations in Wisconsin's Monroe County.

November 22 -

Hamp Johnston, a former market executive at JPMorgan Chase, would serve as RockPoint Bank's president and CEO. The bank would be based in Chattanooga.

November 22 -

The deal is Seacoast's third acquisition of a bank with operations in Palm Beach County.

November 20 -

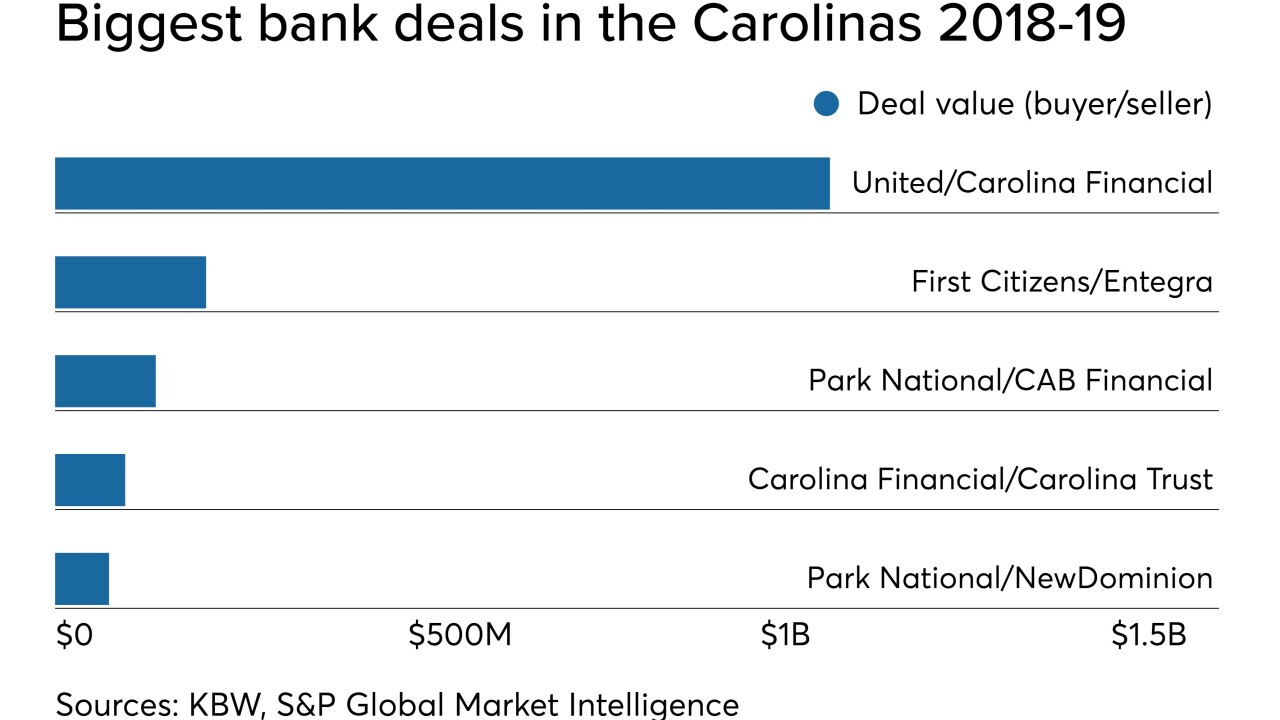

United Bankshares in West Virginia was willing to pay a healthy premium for Carolina Financial, one of a dwindling number of available banks with more than $4 billion in assets.

November 18 -

The company will pay $1.1 billion for Carolina Financial in Charleston, S.C., in a deal that will add nearly $5 billion in assets.

November 18