-

The Pennsylvania company will pay $346 million for MutualFirst Financial.

October 29 -

The New York company will enter Suffolk County after it buys Empire Bancorp.

October 25 -

The application for Riverside Bank of Dublin comes just six months after another group opened a bank in a nearby market.

October 16 -

Federal regulators should amend a capital buffer requirements for certain derivatives to avoid economic damage.

October 11 American Bankers Association

American Bankers Association -

OUR Community Bank would focus on small-business loans with an emphasis on underserved Hispanic and Latino communities in South Florida.

October 10 -

MetroCity Bankshares has said it could use the proceeds to open branches or pursue acquisitions.

October 10 -

A strong economy, low-cost deposits and disruption from M&A are presenting opportunities.

October 8 -

The company could raise as much as $158 million by selling shares to the public.

October 1 -

Gulf Capital Bank has received conditional approval from state and federal officials and could be up and running late this year or early next year, its organizers say.

September 30 -

An initial review determined that lax oversight at Enloe State Bank allowed for the origination of more than 100 allegedly fraudulent or fictitious loans.

September 26 -

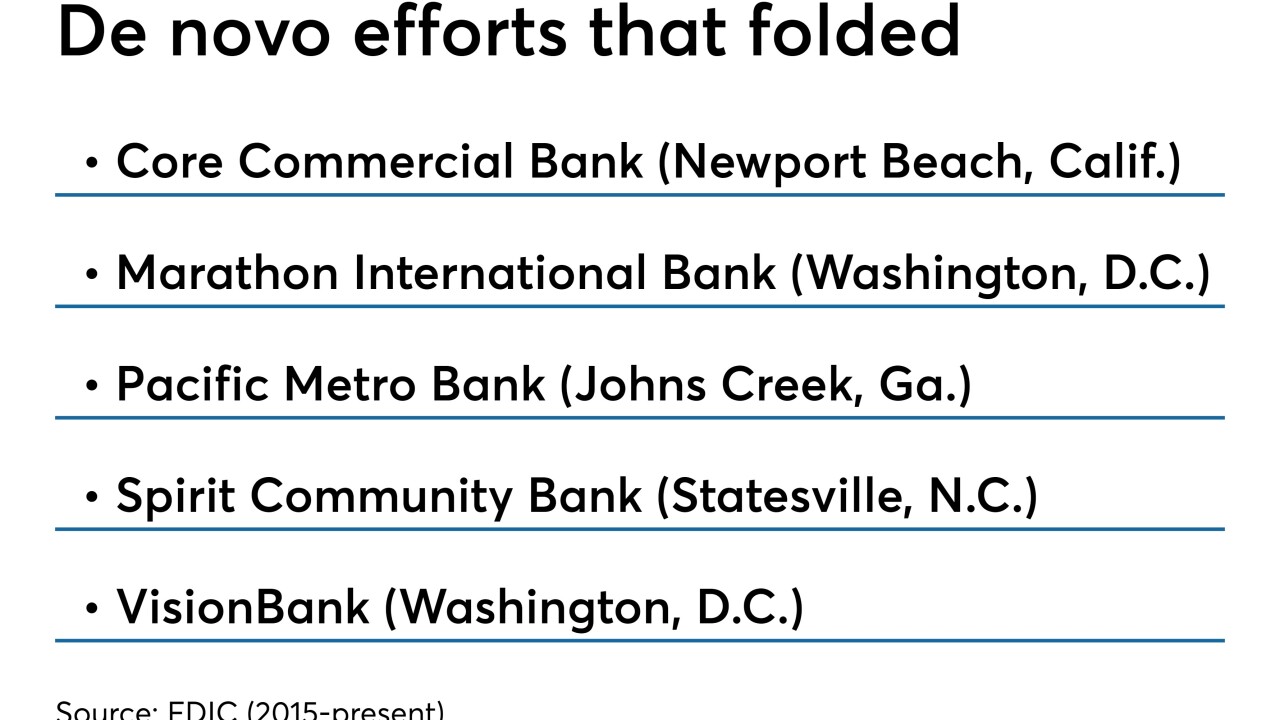

Regulators may be willing to grant new charters, but economic uncertainties, capital hurdles and inexperience have led the organizers of numerous bank startups to give up in the last few years.

September 25 -

FWBank would be led by Marianne Markowitz, former acting SBA director. Amy Fahey, a former JPMorgan Chase executive, would serve as chairman.

September 24 -

The chairman of the National Credit Union Administration gave CU Journal more details on the agency’s forthcoming rule providing guidance for credit unions purchasing banks.

September 10 -

As credit union leaders converge on Washington, here's a look at some of the biggest legislative and regulatory issues facing the industry – and what it might take to move the needle.

September 9 -

Farmers will pay $40 million for the bank, which is in an affluent area in northeast Ohio.

August 30 -

Loyal Trust Bank is the seventh proposed bank in 2019 to secure the agency's approval for deposit insurance.

August 29 -

The Plano bank, which is being sold to Prosperity Bancshares in one of the industry's biggest M&A deals this year, was also worried about credit quality, a regulatory filing shows.

August 27 -

Organizers of Silver River Community Bank must raise $17 million before opening.

August 26 -

The Michigan company will pay $68 million to expand in a high-priority market.

August 13 -

The companies said the merger will provide scale and help them update technology more efficiently.

August 12