-

The company will top $1 billion in assets after it buys the parent of F&M Bank in Tomah, Wis.

January 22 -

The Montana company will more than double its assets in Utah when it buys FNB Bancorp.

January 17 -

The Tennessee company will have $4 billion in assets and 47 branches in six states when it buys Entegra Financial.

January 15 -

Though it would be based in the nation's capital, MOXY Bank would also have significant operations in Charlotte, N.C.

January 14 -

The North Carolina company agreed to pay $38 million in cash for First South Bancorp.

January 10 -

Silver River Community Bank is the fifth de novo in Florida to apply with the FDIC in the last three years.

January 10 -

The $128 million acquisition will provide First Financial with its first branches in Kentucky and Tennessee.

January 8 -

River Road Financial has agreed to buy Mississippi River Bank in a deal that will bring in a new CEO.

January 7 -

Organizers are planning to raise up to $25 million for Tandem Bank.

January 7 -

Bob Mahoney, CEO of Belmont Savings, called Jack Barnes after People's United agreed to buy a Connecticut bank. The banks announced their own merger agreement five months later.

January 3 -

Spirit Community Bank is the 15th bank to get the agency's approval this year. That list also includes Community Bank of the Carolinas, which was approved in early December.

December 31 -

James McLemore, one of our community bankers to watch in 2019, has more energy loans to purge and must exit the Small Business Lending fund and a BSA-related enforcement action.

December 30 -

The pressure is on CEO Christopher Myers, one of our community bankers to watch, to make the most of CVB Financial's biggest acquisition to date.

December 26 -

While these five bankers made headlines this year, not all of them did so for good reasons.

December 25 -

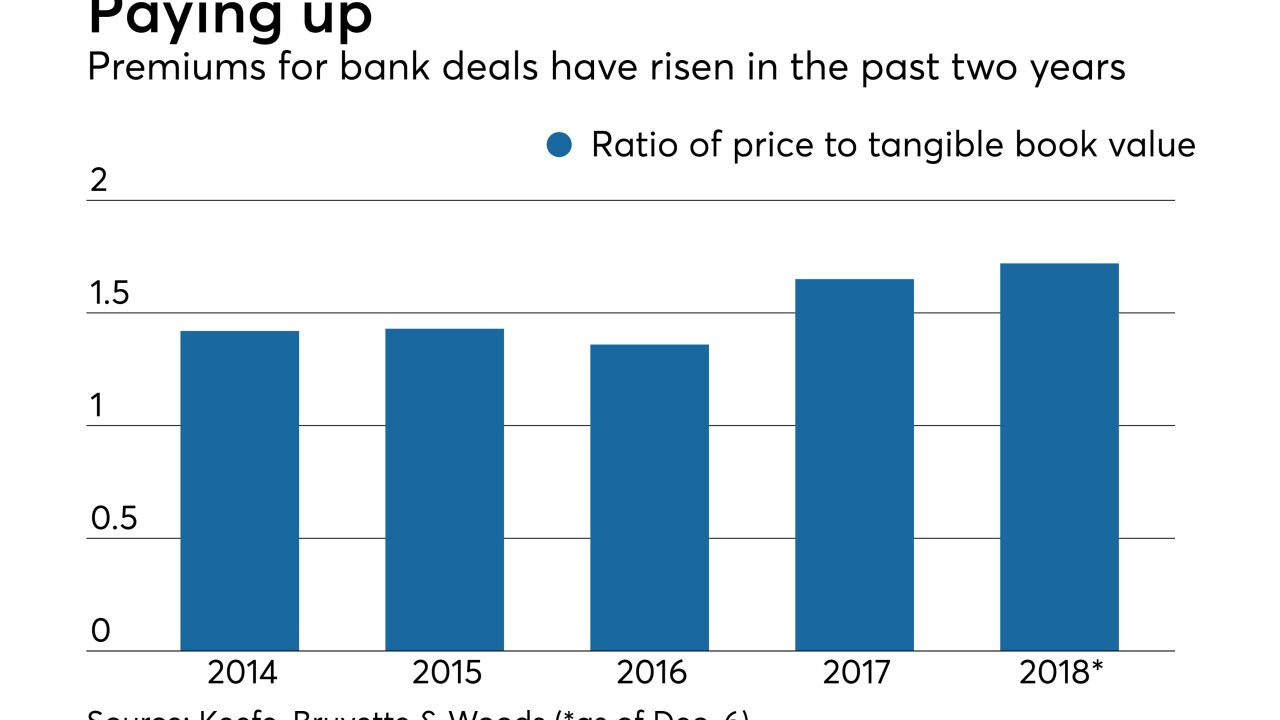

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

Stock Yards will remove a competitor in Louisville, Ky., and enter two markets outside of the city.

December 19 -

The agency’s rate cap for banks that are less than well capitalized contains several flaws and poses problems for community banks.

December 19 Independent Community Bankers of America

Independent Community Bankers of America -

The move is sure to draw criticism from bankers because it would allow credit unions to compete for backing from private investors.

December 19 -

The move is sure to draw criticism from bankers because it would allow credit unions to compete for backing from private investors.

December 18 -

The sale should increase Shore's capital levels and allow it to expand its banking activities.

December 18