James McLemore still has a lengthy to-do list nearly two years after becoming CEO of MidSouth Bancorp in Lafayette, La.

McLemore had his work cut out for him from the moment his predecessor, Rusty Cloutier, was abruptly

Acknowledging soon after Cloutier’s dismissal that “

While some progress has been made, more work must be done on both fronts. MidSouth is also working to free itself from an October consent order tied to Bank Secrecy Act and anti-money-laundering compliance issues.

For these reasons, McLemore is one of American Banker’s community bankers to watch in 2019.

“The question is whether they can pull off a clean year, or at least a clean second half,” said Stephen Scouten, an analyst at Sandler O’Neill who covers the company.

“Can they get past the lion’s share of the credit costs and get past the regulatory order?” Scouten added. “Then they can explore the optionality of selling the bank, which seems to be a reasonable path for them.”

A call to McLemore wasn’t returned.

To be sure, McLemore has taken some serious steps. MidSouth has

Its had $128 million of energy loans at Sept. 30, down to 13.3% of total credits. Still, roughly 44% of those loans are criticized.

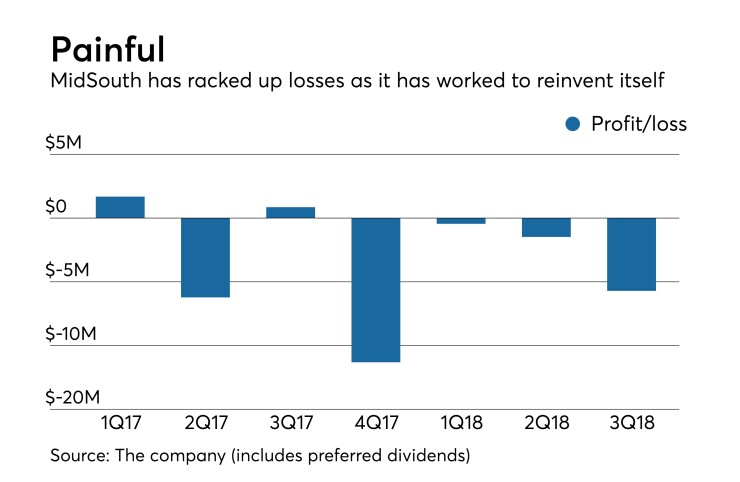

The moves have come at a huge cost.

Since firing Cloutier, MidSouth has lost more than $20 million, excluding losses tied to tax reform; it has been in the red in five of its last six quarters. The company still held about $32 million in SBLF capital on Sept. 30.

MidSouth in October reached agreements with Basswood Capital and Jacobs Asset Management to allow each firm to appoint a nonvoting observer to attend board meetings. In exchange, the companies agreed to a prohibition on making shareholder proposals and presenting board nominees, among other things.

But the company continues to hang in.

“Rumors of MidSouth’s demise are greatly exaggerated,” said Christopher Marinac, an analyst at FIG Partners. “Their issues are fixable. Still, we think it will be a long process to turn things around and get profit in line. The question is can they get back to a point where they’re growing the business and adding value.”

Pressure remains on McLemore to exit SBLF, improve on BSA compliance, put MidSouth's energy woes in the rearview mirror and eventually return MidSouth to profitability.

MidSouth will also need to hustle to protect its valuable base of low-cost core deposits. Competitors will only get more aggressive in trying to lure over depositors as interest rates continue to rise, industry observers said.

Progress on any of those fronts will be viewed favorably. In essence, McLemore still has a low bar to hurdle.

“It is not going from terrible to fabulous that makes investors dollars,” Marinac said. “It really is about going from crappy to mediocre and producing slight growth in book value.”