-

The huge buffers that banks built up over the pandemic are protecting the financial system from looming threats, regulators told President Biden during a meeting that also touched on climate change, extension of credit to the underserved and other topics.

June 22 -

Climate First Bank has raised $29 million in initial capital, surpassing the $17 million target set by the Federal Deposit Insurance Corp.

April 20 -

The Maryland company recently raised $345 million to form the subsidiary and fund growth opportunities for its bank.

April 19 -

Organizers of Integrity Bank for Business must raise around $19.9 million before they can open the bank.

April 16 -

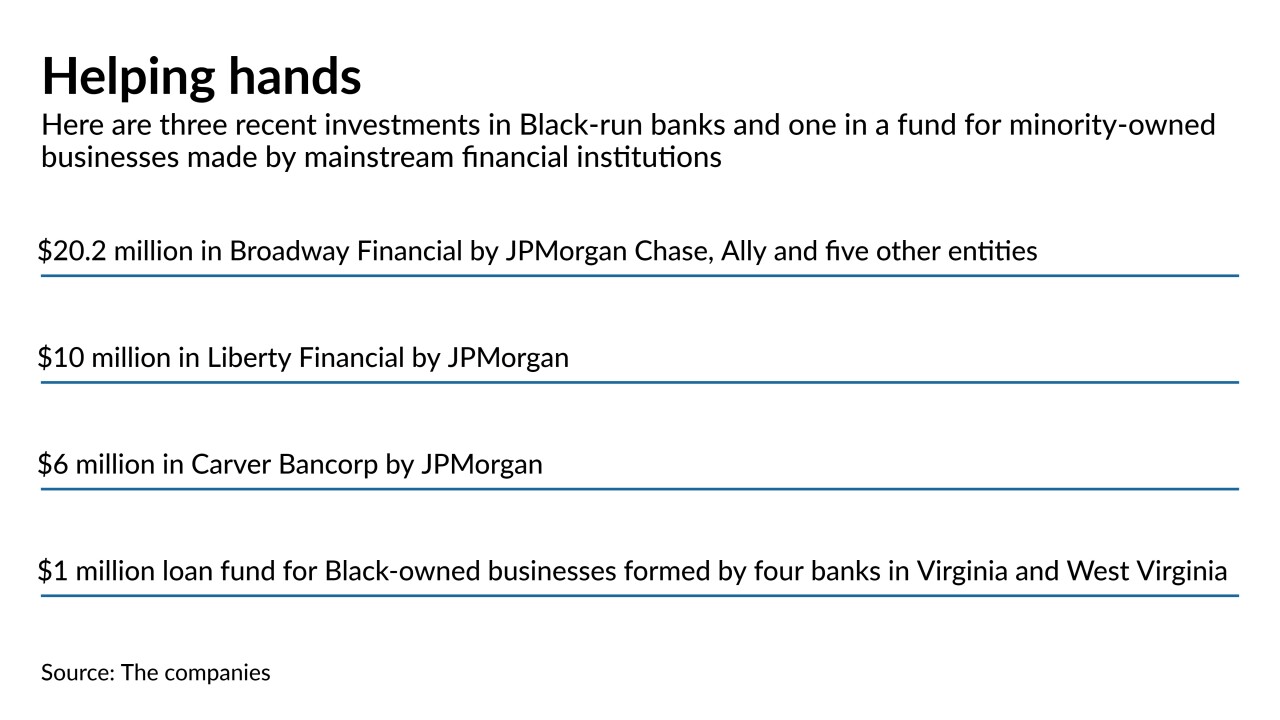

The San Francisco company has now backed 11 minority-owned banks as part of a $50 million pledge it announced last year.

April 13 -

The California company has not established a time or pricing for the IPO.

April 9 -

Organizers of the Florida de novo will need to raise $17 million in capital before opening.

April 1 -

The tennis legend will also serve as a strategic adviser on gender equality issues and First Women's Bank, which will be mostly owned and run by women.

March 24 -

The depositor-owned banks are discouraged from participating in the Emergency Capital Investment Program because they can't issue preferred stock to back loans for underserved communities. It's another reason to overhaul their capital rules, mutuals argue.

March 22 -

The de novo, which raised $33 million in initial capital, will become the state's third new bank since the 2008 financial crisis.

March 19 -

Keith Costello, who is looking to form Locality Bank, was president and CEO of First Green Bank when it was sold in 2018.

March 18 -

Organizers of the proposed Our Community Bank still need to raise $18 million before opening.

March 15 -

Payservices would use deposits largely to support its existing business. It has no plans to make loans.

March 15 -

Comerica, Regions and KeyCorp executives say their companies will proceed with caution despite the green light from the Federal Reserve to buy back stock in case they have to cover a surge in loan growth as the economy recovers.

March 9 -

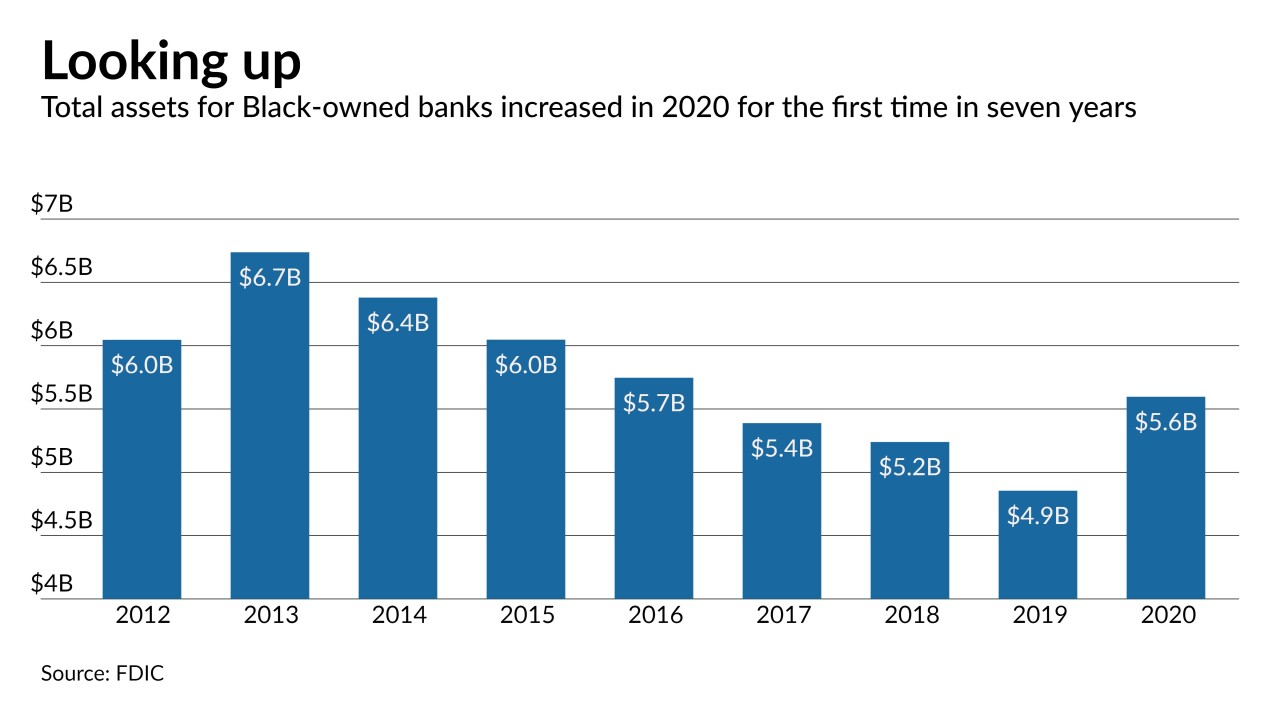

Six startups that seek to cater to Black and Hispanic consumers outside the financial mainstream are attracting heavy interest from investors. However, the new banks will vie with megabanks eyeing those same customers and with established minority-owned institutions suddenly brimming with new capital.

March 4 -

Ingenious Financial in Arlington, Va., is raising $200 million in hopes of buying an existing bank. Bank of Ingenious would focus on professionals such as doctors, dentists and veterinarians.

February 26 -

The bank, formed in 2019 when investors bought and recapitalized Sound Bank, will use the funds to hire lenders and improve its overall infrastructure.

February 26 -

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

Hildene Capital, which is pressuring CIB Marine to issue subordinated debt to redeem preferred stock, has nominated two individuals to stand for election to the company's board.

February 24 -

The Fortune 500 conglomerate has had discussions about merging Thrivent Credit Union, which operates independently of the company, into the bank if the charter is approved.

February 24