-

Russell Golden, who just stepped down from the Financial Accounting Standards Board, says he wants to be remembered for encouraging open discourse over new rules and efforts to simplify financial accounting.

July 7 -

Borrower relief is necessary in a national emergency, but if the exclusion of the deferred loans from troubled-debt restructurings is extended past the end of the year, safety and soundness could be compromised.

June 25

-

In one of the first comprehensive analyses of how the banking industry was affected by the onset of the coronavirus pandemic, the agency said quarterly income fell by nearly 70% from a year earlier.

June 16 -

Lawmakers should go further than their recent criticism of the Financial Accounting Standards Board's loan-loss rule and just hand over its duties to the Securities and Exchange Commission.

June 12 -

The credit union regulator has implemented a host of measures to help the industry manage the pandemic, but there may be only so much it can do without congressional action.

May 21 -

Rodney Hood, chairman of the National Credit Union Administration, will testify before the Senate Banking Committee about how the regulator and the industry have responded to the coronavirus pandemic.

May 11 -

The millions of dollars earned from Paycheck Protection Program transactions will help cover rising provision costs tied to the new CECL accounting standard and coronavirus shocks to loan books.

April 30 -

Rodney Hood, chairman of the National Credit Union Administration, told the Financial Accounting Standards Board that complying with the Current Expected Credit Losses standard could adversely impact the industry's net worth.

April 30 -

Banks would have drowned if lawmakers hadn't delayed the new accounting standard during the coronavirus pandemic.

April 24 -

Banks had an opportunity to delay compliance with the new accounting standard, but many opted to move forward to get ahead of credit issues that could arise from the coronavirus outbreak.

April 22 -

The Los Angeles regional bank recorded the $1.5 billion noncash charge after its stock price ended March below its tangible book value.

April 21 -

Lawmakers delayed the new accounting standard as part of the stimulus package, but they shouldn't let bankers persuade them to eliminate it outright.

April 16

-

Measures that delay the Current Expected Credit Losses standard and reduce a community bank capital ratio are temporary, but the industry now sees an opening to argue that they should be permanent.

April 7 -

The regulator must speed up its capital reform efforts while taking immediate steps to reduce the examination burden.

April 7 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

Parties talking about a temporary lift of Wells' asset cap; GDP would have to drop an “unlikely” 35% in Q2 before JPMorgan would be forced to stop payouts.

April 7 -

Congress and financial regulators have implemented a number of measures to help the industry survive the financial impact of the pandemic, and a fourth phase of stimulus could be coming.

April 6 -

Emergency loan program plagued by chaos on eve of launch; why Moven, one of the first challenger banks, is calling it quits; Fed faces conundrum on whether to remove Wells Fargo's asset cap; and more from this week's most-read stories.

April 3 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

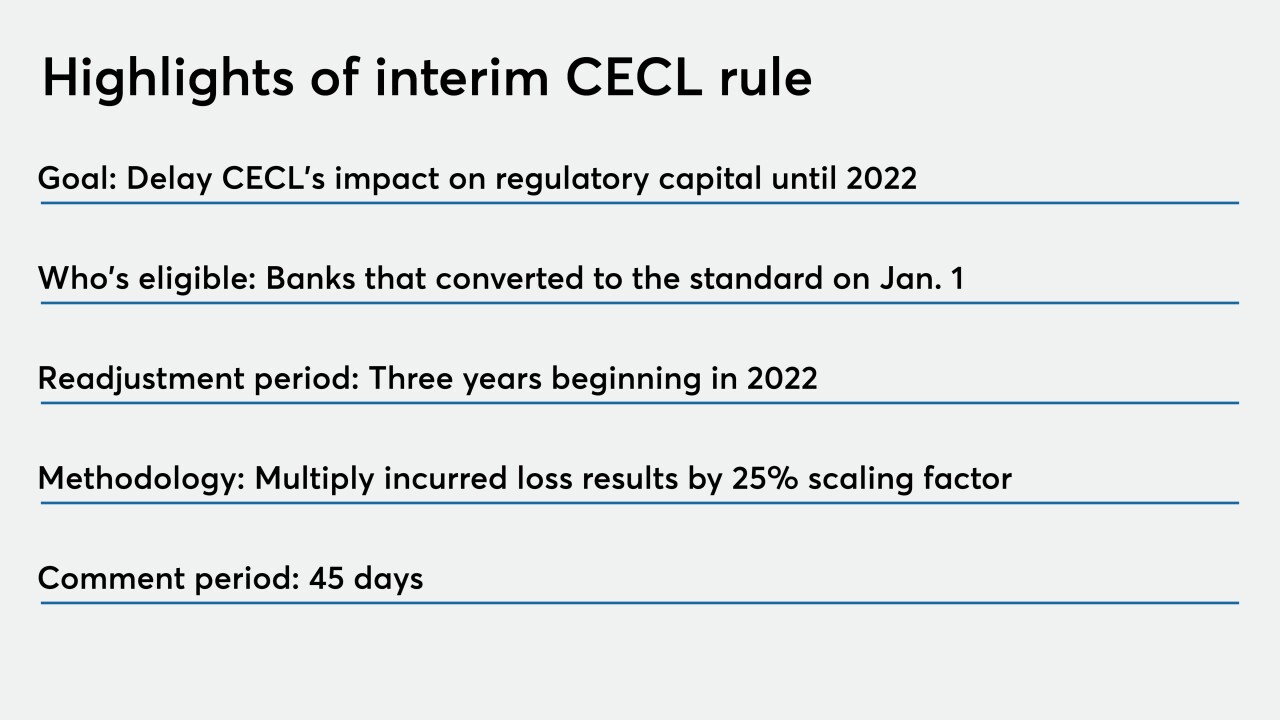

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27