Commercial banking

-

The stock prices of banks that have large exposure to commercial real estate loans surged after comments from Federal Reserve Chair Jerome Powell. His remarks could be a sign that relief is coming on both sides of those banks' balance sheets.

August 23 -

The North Carolina-based bank doubled in size in 2022 and again last year, when it acquired the failed Silicon Valley Bank. It has used consistency to outperform peers.

August 21 -

The military-focused company, which operates an insurer and a $111.7 billion-asset bank, has tangled with regulators during Wayne Peacock's tenure. He will retire in the first half of 2025.

August 19 -

Royal Bank of Canada's onetime chief financial officer was allegedly in a relationship with an executive in the bank's corporate treasury group for more than a decade. A court filing offers a remarkably detailed look at how the bank alleges it played out.

August 19 -

The change will allow the Wall Street firm's material risk takers to now earn a bonus that's as much as six times their base salary.

August 14 -

KeyCorp wasn't seeking capital but saw the benefits of Scotiabank's minority stake. The deal would enable the Canadian lender to step into the U.S. consumer market.

August 12 -

The infrastructure fund dubbed BXINFRA targets individuals with at least $5 million of investments.

August 7 -

The parent company of Fulton Bank announced the creation of three new management roles and promoted existing employees into those jobs. The changes follow the recent hiring of an outsider to be CFO.

August 6 -

The Dallas-based bank is the latest bank to announce plans for a direct lending rollout using nonbank capital.

August 6 -

Shares in U.S. banks weren't immune to a global market sell-off, as worries mounted over whether the U.S. economy's recent resilience is faltering. The turmoil hit some tech stocks hard and led to the worst day for Japanese stocks since the 1980s.

August 5 -

After a bloodbath that wiped out several trucking companies, a new U.S. Bank report on the industry signals its fortunes may be turning. The rebound, if sustained, may end the bleeding in bank loans to the sector.

August 1 -

The five largest bank M&A deals had an average deal value of more than $1.2 billion.

August 1 -

The Kansas City, Missouri-based regional bank said it is making progress on its pending purchase of Heartland Financial USA in Denver. The deal is expected to close during the first quarter of 2025.

July 31 -

The top five banks and thrifts had combined assets of more than $13 trillion as of March 31, 2024.

July 31 -

Fulton Financial taps Valley National's Richard Kraemer as its new CFO; UBS' veteran private banker Jenny Su has left the firm; Bank of America names Kevin Brunner head of global technology, media and telecommunications investment banking; and more in this week's banking news roundup.

July 26 -

The Raleigh, North Carolina-based bank grew loans and deposits in the second quarter as it won back business from former customers of the failed Silicon Valley Bank. First Citizens bought the remains of SVB last spring.

July 25 -

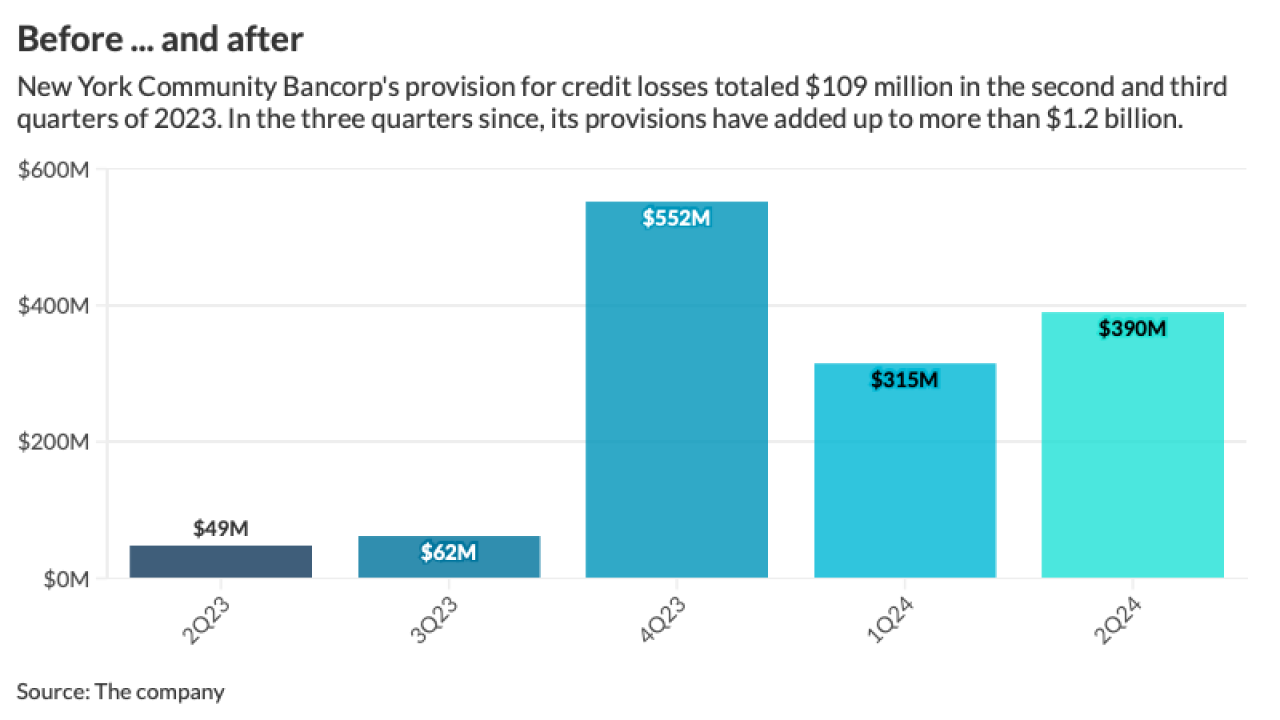

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The $72.8 billion-asset bank lowered its guidance for net interest income, explaining that while business prospects on the island are relatively rosy, its stateside opportunities for loan growth look weaker.

July 24 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

The Northeast regional bank missed expectations on net interest income and negatively revised much of its 2024 guidance.

July 23