Commercial banking

-

After a bloodbath that wiped out several trucking companies, a new U.S. Bank report on the industry signals its fortunes may be turning. The rebound, if sustained, may end the bleeding in bank loans to the sector.

August 1 -

The five largest bank M&A deals had an average deal value of more than $1.2 billion.

August 1 -

The Kansas City, Missouri-based regional bank said it is making progress on its pending purchase of Heartland Financial USA in Denver. The deal is expected to close during the first quarter of 2025.

July 31 -

The top five banks and thrifts had combined assets of more than $13 trillion as of March 31, 2024.

July 31 -

Fulton Financial taps Valley National's Richard Kraemer as its new CFO; UBS' veteran private banker Jenny Su has left the firm; Bank of America names Kevin Brunner head of global technology, media and telecommunications investment banking; and more in this week's banking news roundup.

July 26 -

The Raleigh, North Carolina-based bank grew loans and deposits in the second quarter as it won back business from former customers of the failed Silicon Valley Bank. First Citizens bought the remains of SVB last spring.

July 25 -

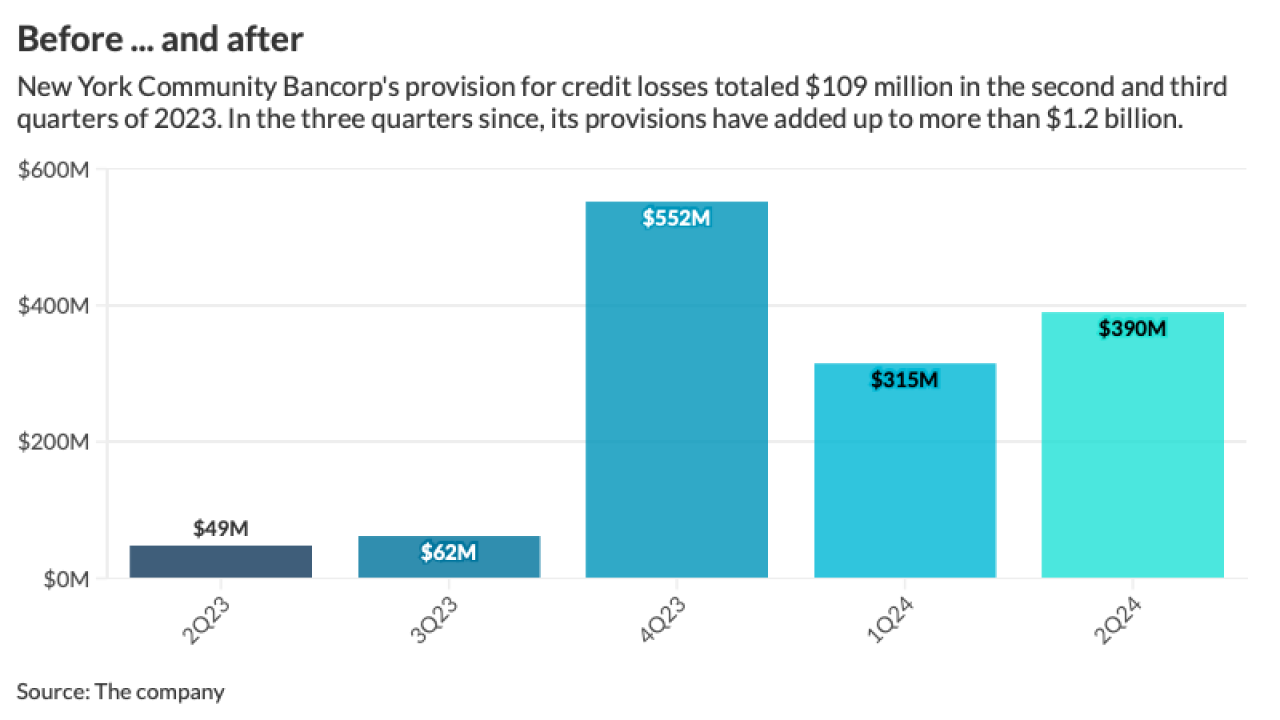

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The $72.8 billion-asset bank lowered its guidance for net interest income, explaining that while business prospects on the island are relatively rosy, its stateside opportunities for loan growth look weaker.

July 24 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

The Northeast regional bank missed expectations on net interest income and negatively revised much of its 2024 guidance.

July 23 -

The Oklahoma-based bank also struck an upbeat tone on economic conditions and credit quality after it reported a sharp quarter-over-quarter increase in net income.

July 23 -

Arrested four times for blocking the entrance to Citigroup, a veteran climate protester wonders why more rank-and-file bankers don't make common cause with activists trying to prevent the funding of fossil fuel development.

July 22 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

Bank OZK is the latest commercial real estate-heavy bank to announce plans to diversify its business. CEO George Gleason emphasized that he's confident in the bank's loan portfolio, but said he thinks misperceptions are dragging down the stock price.

July 22 -

The Alabama-based bank also said that its outlook for net interest income is brightening. Several other regional banks have offered similarly upbeat guidance in recent days.

July 19 -

Indirect auto loan originations at the Ohio-based bank rose by 31% from the first quarter. Huntington sees the business as an opportunity at a time when numerous other banks have been pulling back.

July 19 -

The Dallas-based company, whose earnings per share fell short of consensus by 6 cents, lowered its revenue forecast and raised its expense outlook. Its stock price fell more than 8% on Thursday.

July 18 -

The Minneapolis-based company reported an 18% increase in quarterly net income thanks largely to slimmed-down operating expenses. It also notched modest increases in loans and deposits, while asset quality issues remained manageable.

July 17 -

The Wall Street investment bank saw its profits rebound in the second quarter as last year's decline in mergers continued to thaw. "The game will have to go on because there's just been so much activity that has been suppressed," said CEO Ted Pick.

July 16 -

The Charlotte, North Carolina-based bank saw profits and net interest income dip in the second quarter, but made up lost revenue through investment banking fees.

July 16