Commercial banking

-

Investment banking fees shot up at the nation's largest bank, thanks to rebounds in M&A and the equity capital markets segment. And despite higher credit costs in the company's card business, a top bank executive expressed confidence in the health of U.S. consumers.

July 12 -

The top five community banks have combined first mortgage loans of more than $2.8 billion as of March 31, 2024.

July 11 -

After the megabank was hit with $136 million in regulatory fines over its alleged failure to comply with 4-year-old consent orders, analysts assessed the likely fallout. "There is clearly frustration on the part of regulators," one analyst wrote.

July 10 -

The ratings firm evaluated 4,100 loans to assess the state of 41 banks' commercial real estate risk. It found that the lenders should be holding, on average, about twice the amount of reserves they currently have for office loans.

July 9 -

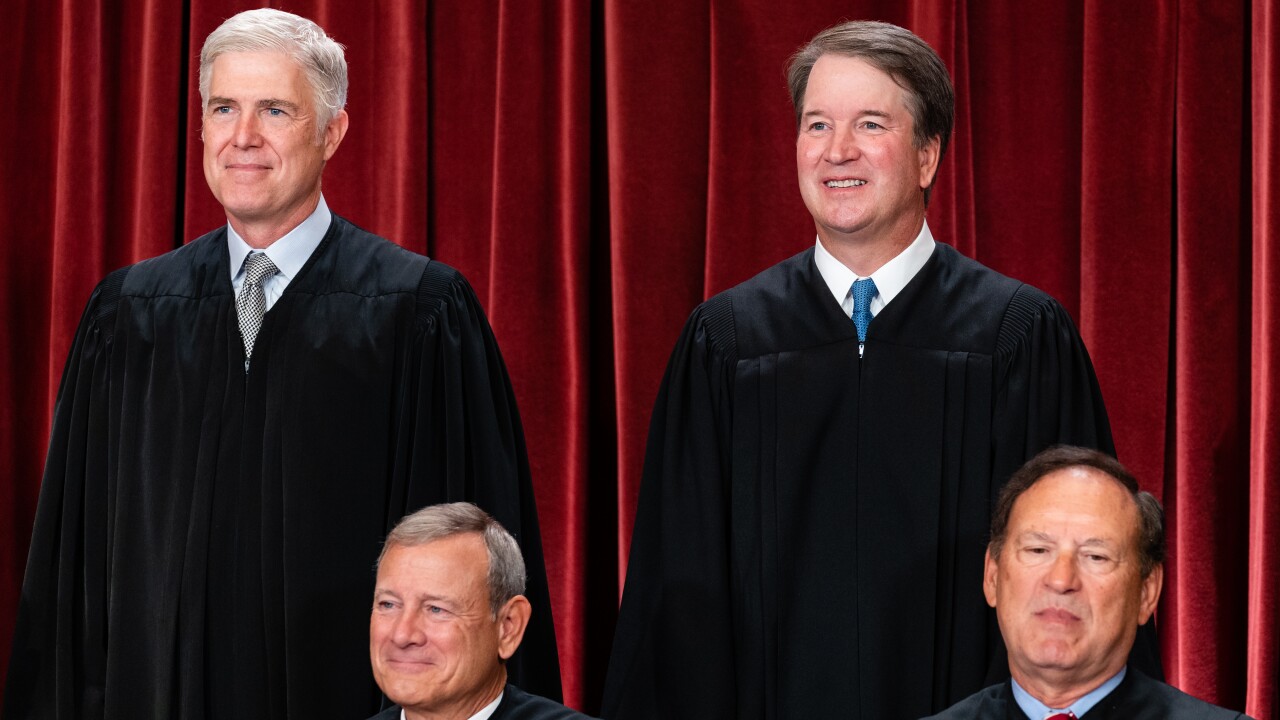

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

First Foundation will use the large investment to shrink its multifamily loan portfolio, which has weighed down its earnings since interest rates began rising.

July 2 -

Maryland-based Forbright Bank, which is led by a onetime Democratic presidential candidate, relied extensively on brokered deposits as it grew after a 2021 rebranding. The bank says it has made changes in response to regulators' concerns.

July 2 -

The top five community banks have more than $1.2 billion in combined farm loan portfolios as of March 31, 2024.

July 2 -

Bloom Credit Union and West Michigan Credit Union aim to join forces; Long Island-based New York Community Bancorp plans a reverse stock split; Providence, Rhode Island-based Citizens Financial hires longtime California banker to lead its middle-market team; and more in this week's banking news roundup.

June 28 -

Later this week, the Federal Reserve will release the results of its annual check-up on larger banks' balance sheets. Experts say there are always surprises, but that pending capital rules may have a bigger impact than the stress-test results on banks' dividend and buyback decisions.

June 24