-

Affirm, a three-year-old online lender that finances consumer purchases at the point of sale, has raised a $100 million in equity funding to help it boost distribution and develop new products and services.

April 13 -

The partnership with OnDeck will allow the megabank to approve and fund loans in as little as a day, according to CEO Jamie Dimon. Meanwhile, OnDeck is eyeing similar partnerships with other banks.

April 12 -

Citigroup is no longer buying loans off the Prosper Marketplace platform and repackaging them into securities, a person familiar with the matter said.

April 12 -

The New York company makes two- to three-year term loans of between $3,000 and $25,000. It is seeking to distinguish itself from other digital lenders by targeting young adults who have limited credit histories.

April 12 -

The latest version of a new accounting standard for calculating loan-loss reserves would ease the burden on small banks, ICBA officials say. However, the ABA says it still fails to eliminate the biggest problem asking lenders to predict the future.

April 11 -

Federal rules for technology-based firms providing the fast-moving sector certainty and consistency would be a benefit, even if rules are suboptimal.

April 8 Mercatus Center at George Mason University

Mercatus Center at George Mason University -

The findings from the California Department of Business Oversight, which also included data on interest rates and delinquencies, could be a precursor to new state regulations.

April 8 -

The bank says the partnership will improve the online experience for borrowers. It is just the latest example of banks and online lenders teaming up to speed up decision-making and win over new customers.

April 7 -

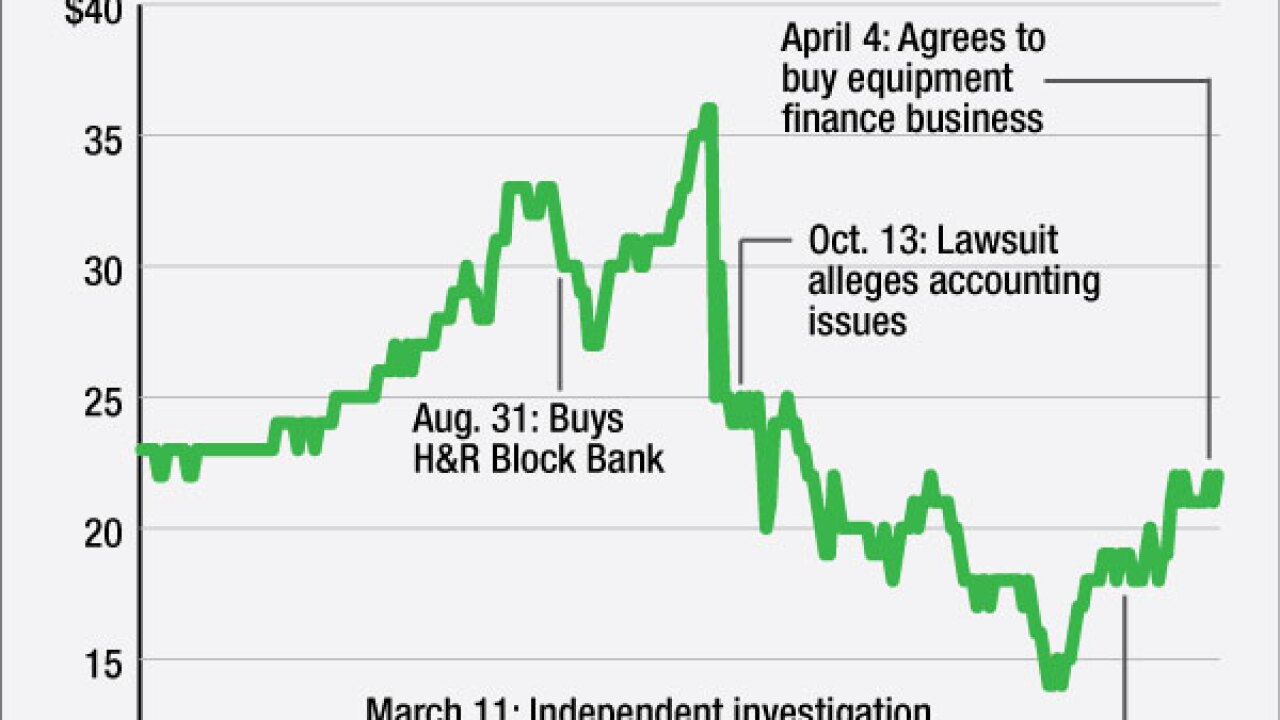

BofI Holding is looking to make more acquisitions and its leader says he doesnt think accusations from a former employee are unlikely to hold up a deal, even though theyve dragged down the stock price.

April 7 -

BlueVine, an online business lender based in Palo Alto, Calif., is branching into unsecured lending.

April 7