-

-

The New York megabank unveiled the most complete accounting to date of its carbon footprint, and pledged to further reduce emissions from various high-emitting industries. Climate activists offered a mix of praise and concern.

March 5 -

The small businesses said in a lawsuit that the bank used "misleading marketing and business practices" to rake in processing fees from oversized Paycheck Protection Program loans. A bank spokesperson placed responsibility on PPP borrowers for the representations they made in loan applications.

March 1 -

The rise of e-commerce during the pandemic has fueled demand for warehouse space as companies look to move their products closer to their customers. While a slight slowdown is now under way, bankers still see plenty of business ahead.

February 24 -

Octaura, an electronic portal backed by seven global banks, completed its first syndicated loan trades earlier this month.

February 21 -

The North Carolina bank's new financing program will allow electric car buyers to include the cost of an at-home charging station in their auto loan.

February 8 -

In a reversal from five years ago, six of the eight biggest U.S. banks by branch count now offer the loans, which observers see as safer alternatives to payday loans.

February 1 -

Rising inventories and the specter of regulation may make it seem like the pandemic auto boom is over, but broader trends could make it a profitable business if banks do it right.

January 31 American Banker

American Banker -

North Carolina-based First Citizens blamed a rise in problem credit on certain office loans that it acquired in the CIT Group merger. Connecticut-based Webster also expressed caution about the segment, which has been impacted by remote work policies.

January 26 -

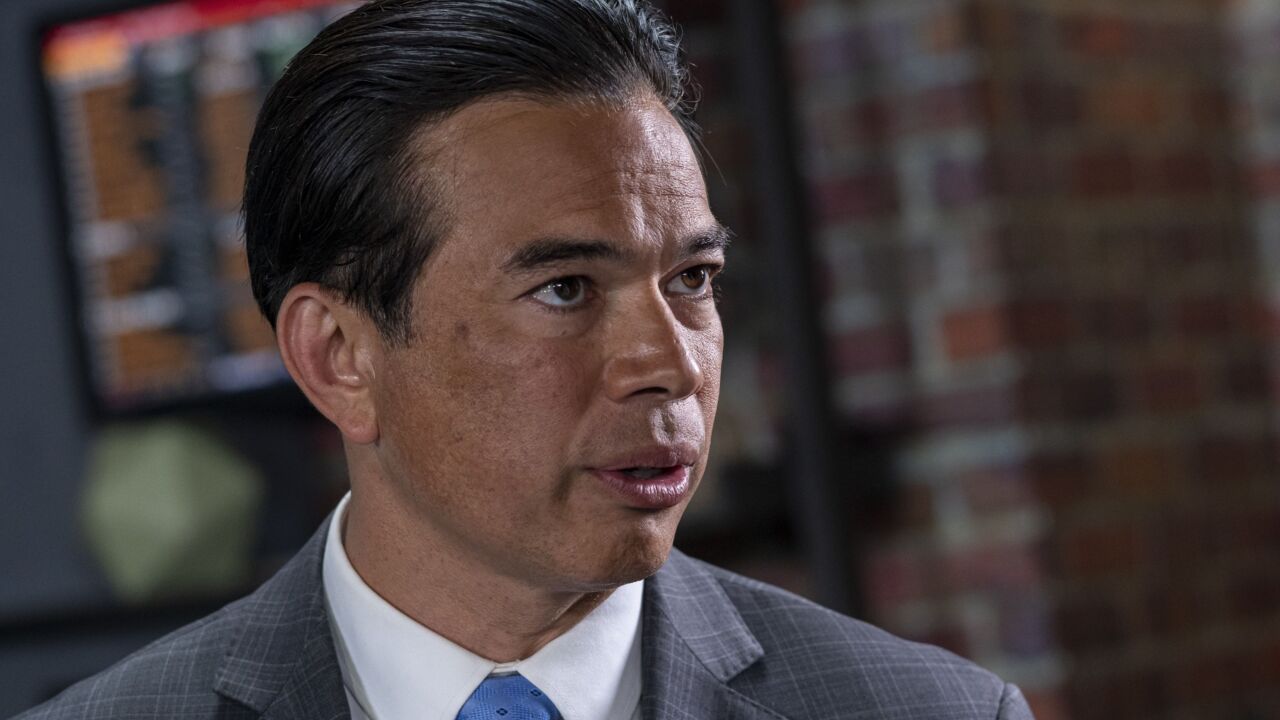

California Attorney General Rob Bonta is standing by the state's commercial financing disclosure law, urging more protections for small-business financings and arguing that federal consumer law does not not apply to commercial lending.

January 24