-

Expenses soared in the rush to deploy emergency loans to small businesses, and now Bank of America may need to delay some investments if it hopes to meet cost targets, CEO Brian Moynihan said.

May 27 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

May 27 FS Vector

FS Vector -

The Dallas bank appears to be at a crossroads after its merger with Independent Bank Group was called off Tuesday.

May 26 -

The bank is trying to recover millions of dollars in returned deposits. It also has a $14 million loan to the company that allegedly conducted the scheme.

May 26 -

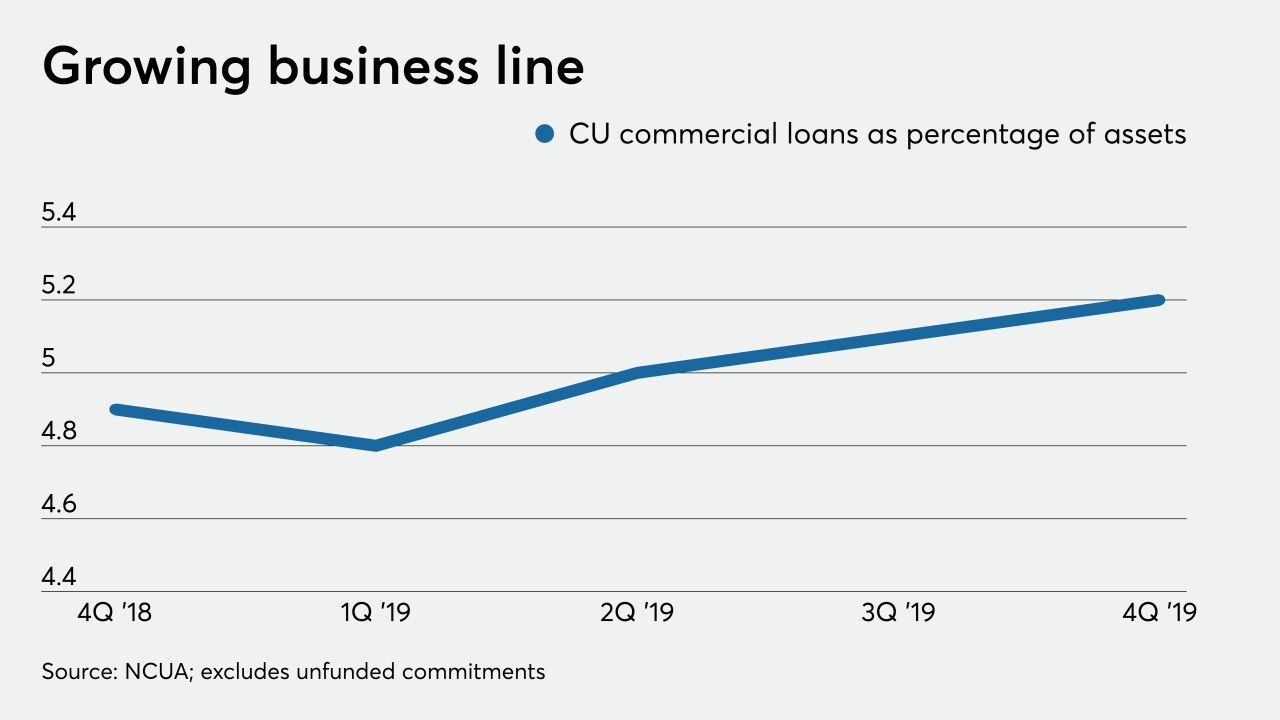

The industry is well positioned to gain market share, but institutions may not see the same levels of growth as after the last recession.

May 26 -

Federal Reserve Bank of Boston President Eric Rosengren said he expects companies to begin receiving money through the central bank's long-awaited Main Street Lending Program within two weeks.

May 24 -

The new Paycheck Protection Program rules, which created a review process and timeline for paying lenders, did not extend the time borrowers have to comply or increase how much money can be spent nonpayroll expenses.

May 24 -

The templates are meant to make it easier to obtain agency approval for small-dollar loan products and to accommodate mortgage servicers that want to provide online loss mitigation options.

May 22 -

Companies that received funding from the Paycheck Protection Program in early April can start to submit forgiveness applications at the end of May.

May 22 -

A Manhattan man was charged by federal prosecutors with fraudulently trying to obtain more than $20 million in government loans intended to aid small businesses affected by the coronavirus pandemic.

May 21