-

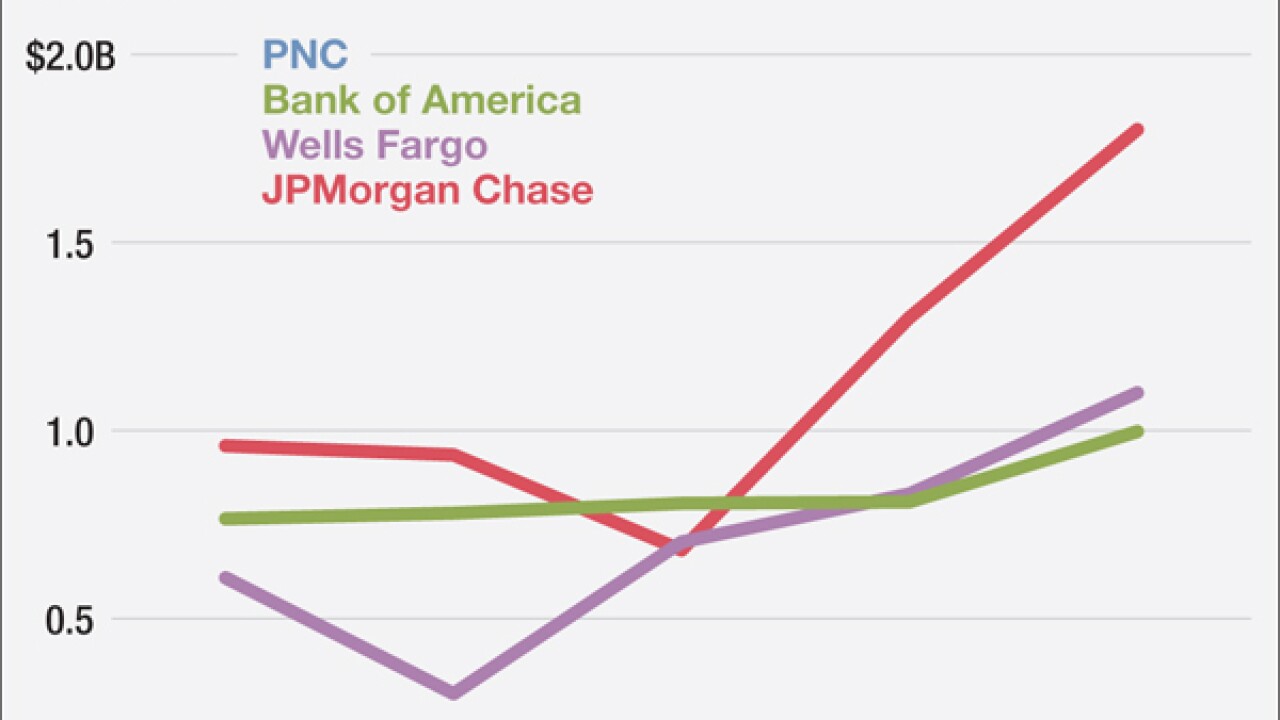

Bank earnings season is just getting underway, but a consistent theme around energy lending is already emerging credit quality is going to get worse and weigh on profits the rest of the year.

April 14 - North Carolina

B of A is normally thought of as a U.S. economic bellwether, but it has substantial operations overseas, and its international performance last quarter provided a painful reminder of that fact.

April 14 -

A month after introducing the Express Business Loan for its customers, Eastern Bank in Boston says it is in talks with several banks across the U.S. to license the product.

April 14 -

Suddenly, online lenders are struggling, or paying higher prices, to attract the institutional money that has fueled their rapid rise.

April 13 -

Affirm, a three-year-old online lender that finances consumer purchases at the point of sale, has raised a $100 million in equity funding to help it boost distribution and develop new products and services.

April 13 -

The partnership with OnDeck will allow the megabank to approve and fund loans in as little as a day, according to CEO Jamie Dimon. Meanwhile, OnDeck is eyeing similar partnerships with other banks.

April 12 -

Citigroup is no longer buying loans off the Prosper Marketplace platform and repackaging them into securities, a person familiar with the matter said.

April 12 -

The New York company makes two- to three-year term loans of between $3,000 and $25,000. It is seeking to distinguish itself from other digital lenders by targeting young adults who have limited credit histories.

April 12 -

The latest version of a new accounting standard for calculating loan-loss reserves would ease the burden on small banks, ICBA officials say. However, the ABA says it still fails to eliminate the biggest problem asking lenders to predict the future.

April 11 -

Federal rules for technology-based firms providing the fast-moving sector certainty and consistency would be a benefit, even if rules are suboptimal.

April 8 Mercatus Center at George Mason University

Mercatus Center at George Mason University