-

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

Brick-and-mortar retail isn’t dead yet. Though the trend of retailers closing stores in the face of stiff competition from e-merchants is certainly troubling to commercial real estate lenders, it would be a mistake to conclude that all retail loans are risky. Here's a look at which ones are the safest and, potentially, the scariest.

March 5 -

The latest Credit Union Trends Report from CUNA Mutual Group shows strong performance in membership growth and delinquencies, but lending is beginning to slow and could slow further by next year.

March 1 -

Bank of Marin CEO Russ Colombo is tightening up pricing and terms, citing soaring real estate prices in markets like San Francisco.

February 28 -

Royal Bank of Canada reported a 5% increase in quarterly profits, but a sharp increase in its loan-loss provision is raising concerns about credit quality.

February 22 -

On Sep. 30, 2018. Dollars in thousands.

February 11 -

Bankers weigh their options in mortgage and CRE lending as implementation of a new accounting standard nears.

February 4 -

In addition to closing on its largest acquisition to date, the Tulsa, Okla., company reported double-digit growth in energy, health care and commercial real estate loans.

January 30 -

The Trump administration will offer a framework and get Congressional input on housing finance; some online banks offer more than 2% interest on deposits.

January 30 -

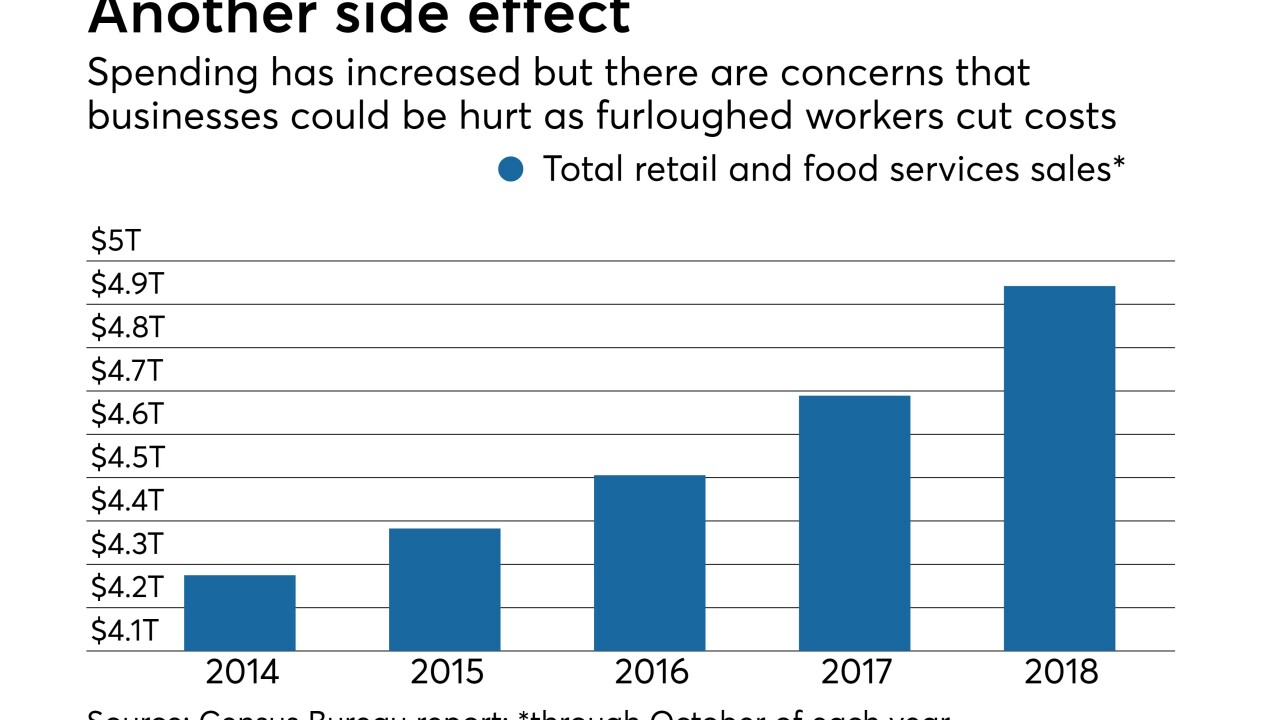

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18