Community banking

Community banking

-

See American Banker's 17th annual ranking of the Most Powerful Women in Banking and Finance.

September 22 -

Increased adoption of The Clearing House’s faster payments system could put pressure on community banks and credit unions awaiting the launch of the Fed’s competing service, FedNow.

September 20 -

The company will gain 34 branches and $1.2 billion in assets when it buys State Capital in Mississippi.

September 20 -

The decision to bring in Michael Doyle follows a quarter where the South Dakota company reported a spike in net charge-offs.

September 20 -

The Michigan company sold collateral tied to Live Well, a mortgage company that has filed for bankruptcy protection.

September 20 -

The company will buy TB&T Bancshares, which operates branches near Texas A&M University.

September 20 -

The Pennsylvania company will pay $31 million for a bank with $269 million in assets.

September 19 -

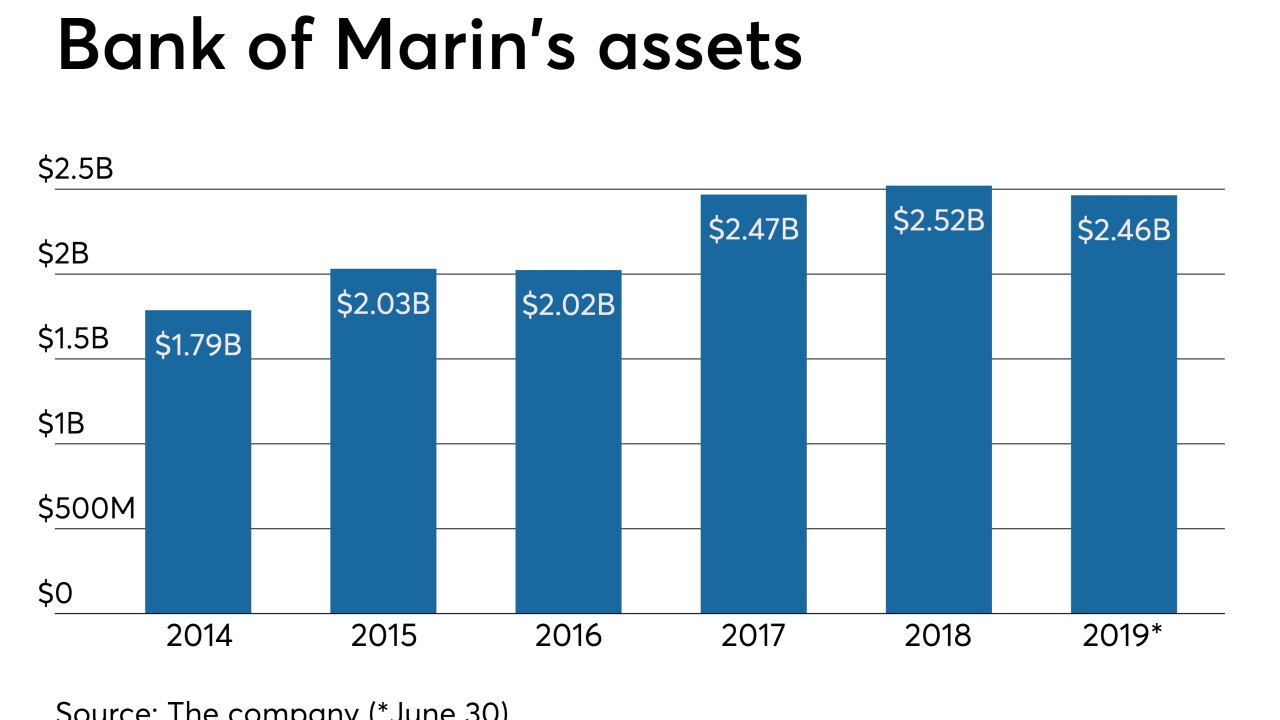

The California company said it has no timeline for Russell Colombo's expected retirement.

September 19 -

JWTT, created by former Wedbush Securities bankers, says it will use its connections to court business from other investment banks that were recently sold.

September 19 -

Nearly a tenth of the industry’s deals this year were connected to the state, which boasts a good number of sought-after small banks.

September 18 -

The company will pay $42 million in cash for the parent of Main Street Bank in southeastern Michigan.

September 18 -

The company will pay $29 million for Cornerstone Financial Services.

September 18 -

The Tennessee company will gain access to the Bowling Green, Ky., market as part of the $52 million deal.

September 18 -

Regulators have redefined a simplified capital measure for community banks following criticism that their 2018 proposal did not go far enough.

September 17 -

The popular program could go idle next month for the second time in less than a year if lawmakers are unable to approve a $99 million credit subsidy.

September 17 -

First Commerce Credit Union's agreement to buy Citizens Bank brings to 14 the number of deals this year in which a credit union is buying a bank.

September 17 -

The company will offer deposit-related services to firms with permits for hemp and CBD.

September 17 -

Private Bancorp of America is the latest bank to report a borrower issue in connection with a high-profile fraud case tied to liquor licenses.

September 17 -

The association filed a comment letter urging FASB to delay CECL implementation for all banks, while asking a key accounting group to support its effort.

September 17 -

The company agreed to buy Tennessee Community Bank Holdings, which has operations just west of Nashville.

September 16