Community banking

Community banking

-

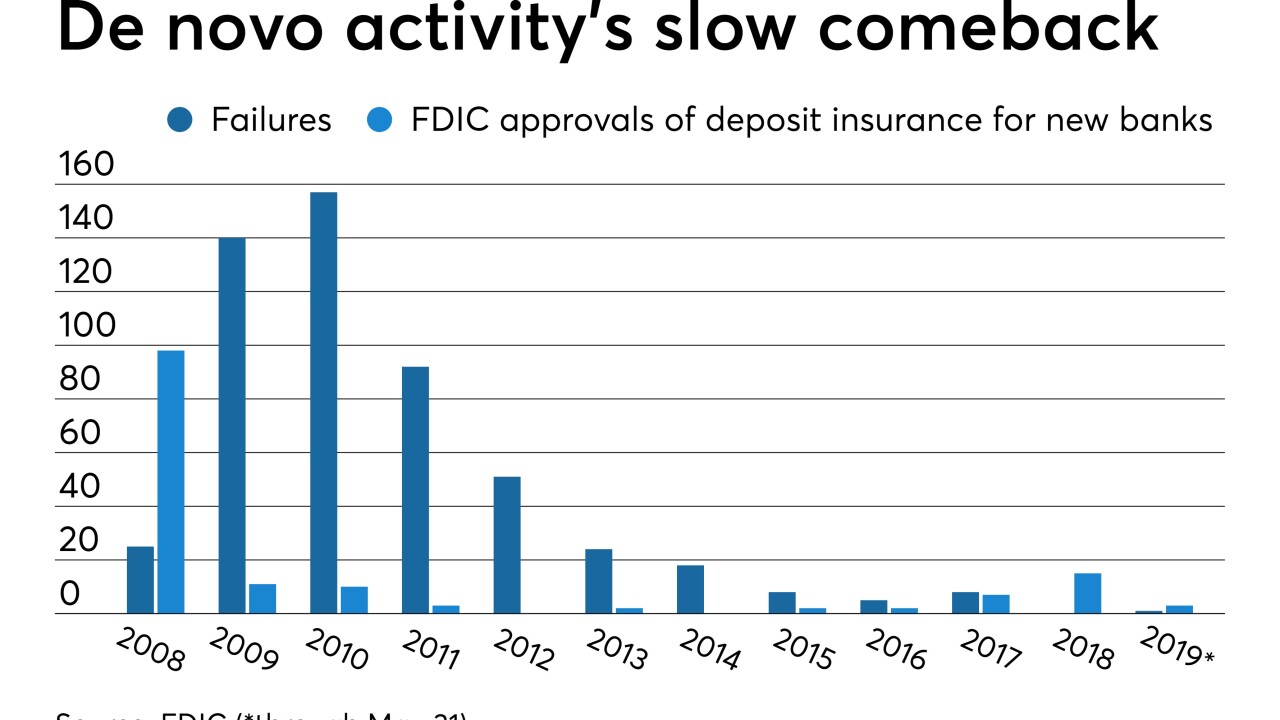

Founders Bank is the latest de novo effort that will target the nation's capital.

June 10 -

An unusual succession plan at Burke & Herbert Bank raised speculation that Virginia's oldest bank might be interested in buying another institution, for the first time in its history, or even selling to a larger rival. The bank's interim CEO, and the man who will replace him, have other plans.

June 10 -

On Mar. 31, 2019. Dollars in thousands.

June 10 -

On Mar. 31, 2019. Dollars in thousands.

June 10 -

The group behind Bank of St. George is looking to bring in up to $22 million in initial capital.

June 7 -

Freedom Northwest in Idaho hopes a proposal from the NCUA will help it bring in more deposits to fund a fast-growing mortgage business. Banks are crying foul.

June 7 -

Paramount Financial Technologies says its software can help banks answer key questions about their branch networks, including when it makes sense to expand them.

June 7 -

As credit unions buy up community banks, policymakers should take another look at ending the industry’s tax exemption and regulatory breaks.

June 7 -

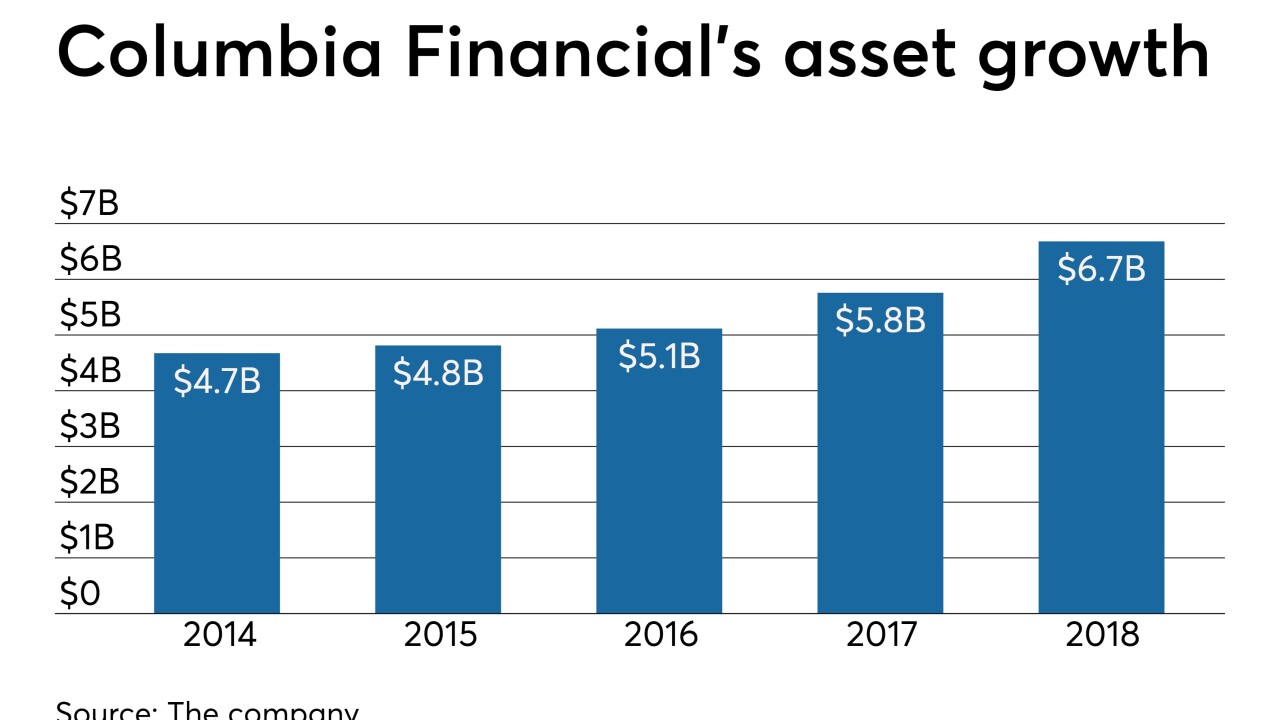

Columbia plans to incorporate certain aspects of Stewardship Financial's charitable giving into its own foundation.

June 7 -

The North Dakota company agreed to buy the $90 million-asset Prairie Mountain Bank.

June 6 -

Diverse economies and a limited number of sellers are making markets like Tampa, Fla., a hot spot for growth-minded banks.

June 6 -

Provident Bancorp, one of the nation's oldest active banks, is setting the stage to become a fully stock-owned company.

June 6 -

The North Carolina company will have two branches remaining in South Carolina after the sale closes.

June 6 -

Nominated for a full term at the central bank, Michelle Bowman told senators that bankers should not fear repercussions for servicing hemp growers after the crop was legalized.

June 6 -

DNB had been facing pressure from an activist investor to consider selling itself.

June 6 -

The company will pick up five branches as part of the $48 million deal.

June 5 -

The most profitable banks in American Banker’s annual rankings frequently produce year after year. That success requires rigorous budgeting and planning, timely analysis and more.

June 5 -

The company has agreed to buy Trinity Bancorp for $27 million in cash and stock.

June 5 -

Many community banks have given up on national mortgage platforms as not worth the effort, but organizers of NXG Bank in Maryland say they have a plan to make one work.

June 4 -

Regional and small banks are striking digital partnerships and launching new savings offerings as they attempt to steal away business from bigger institutions.

June 4