Community banking

Community banking

-

Banco Bradesco said it will use the acquired bank to expand its investment offerings in the United States.

May 6 -

Profitability improved significantly last year for banks with less than $2 billion of assets, but not because of anything they did. Some troubling trends lurk beneath those big gains too.

May 5 -

Tandem Bank has approval from the Georgia Department of Banking and Finance as its aims to become the state's first new bank since the financial crisis.

May 4 -

Aging tech systems have become a "pain point" in financial services, and VC firms have backed newcomers trying to push aside traditional vendors and win over banks and credit unions.

May 3 -

Community banks in the state have struggled to attract the funds to meet surging loan demand, but that could change now that a new law has made it easier for them to accept government deposits.

May 3 -

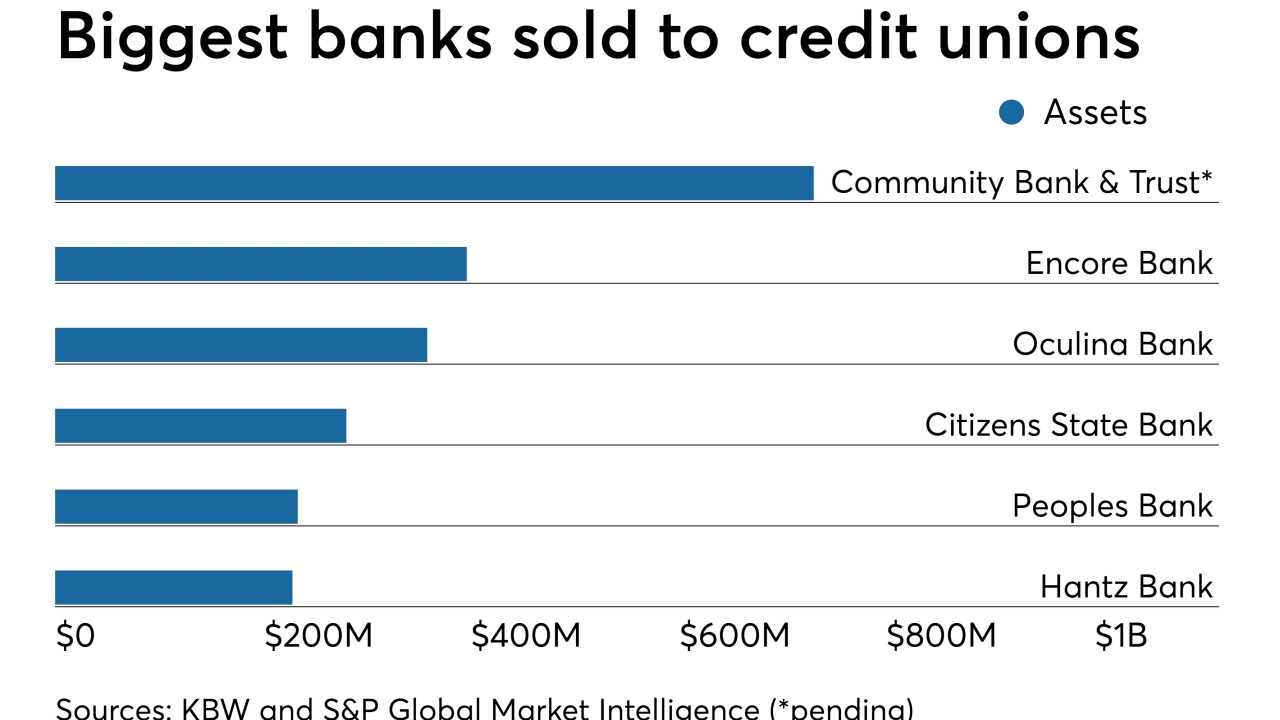

MidFlorida Credit Union has agreed to buy the $730 million-asset Community Bank & Trust of Florida in Ocala.

May 3 -

The National Credit Union Administration and the Small Business Administration have established a program to boost SBA lending by credit unions, which was very light last year. It is sure to irk bankers, who have raised competitive concerns.

May 3 -

The Consumer Financial Protection Bureau proposed steps to ease Home Mortgage Disclosure Act requirements, just days after announcing it was retiring a platform to let users analyze raw mortgage data.

May 2 -

Give Lindsay Lawrence a big job to do and she just might find a way to make it even bigger.

May 1 -

Paul Taylor previously served as CEO of Guaranty Bancorp in Denver, which was sold in January to Independent Bank.

May 1 -

Shelley Seifert had been the bank's chief operating officer.

May 1 -

It is comfortable with the deal for MidSouth despite the seller's lingering credit issues, given a shared history and the opportunity to add low-cost deposits.

May 1 -

It just got harder for banks in Georgia to enforce noncompete agreements in employee contracts. For employees of two merging banks, BB&T and SunTrust, the timing couldn’t be better.

May 1 -

Innovation is part of Emily Girsch's daily routine. That's why the chief financial officer at Lincoln Savings Bank in Cedar Falls, Iowa, spends a lot of time thinking about the need to modernize bank regulations for the digital age.

April 30 -

MidSouth had spent the last two years improving credit quality by reducing its exposure to energy credits.

April 30 -

Rising premiums and lengthy earn-back periods have made investors more skeptical than ever about M&A. So the sooner banks are able to convert systems and rebrand, the sooner they'll be able to meet the promised cost-cutting and revenue targets.

April 30 -

The company, which has invested $3 million in fintech in recent years, said the value of the portfolio is nearing $14 million.

April 30 -

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

Even as consumer and CRE lending slowed in the first quarter, business lending — particularly to middle-market companies — surged. But some banks are already warning that the growth could taper off as competition from nonbanks heats up.

April 29 -

The NCUA is letting Union Yes in California raise capital by turning to temporary funding sources, which banks have complained is an example of the regulator's overreach.

April 29