Hancock Whitney in Gulfport, Miss., feels extremely comfortable with the risk profile of MidSouth Bancorp despite the Lafayette, La., company's ongoing struggles with credit quality.

The $1.7 billion-asset MidSouth has already set aside millions of dollars to cover bad loans, including a $6.6 million shared national credit that recently soured. And Hancock, which is assuming a gross credit mark of 5% tied to the deal, has competed against, and worked with, MidSouth for the better part of three decades.

At the end of the day, Hancock is

MidSouth is "a very familiar company to us, and we to them," John Hairston, Hancock's president and CEO, said in an interview. "We’ve partnered together in everything from sharing credit relationships with larger clients to [participating] in various community improvement endeavors. ... I think it feels more like the end of a very warm and long-term conversation.”

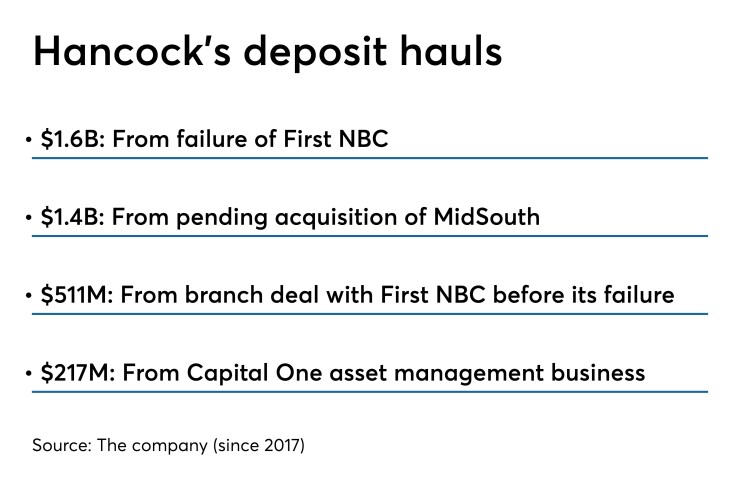

The $213 million acquisition seems to fit nicely within Hancock’s M&A parameters. It’s in-market and low risk, much like the $28.2 billion-asset company’s April 2017 purchase of the

MidSouth, despite losing more than $46 million since it fired founding CEO Rusty Cloutier in April 2017, was never in danger of failing, Hairston said.

“While they did struggle with some credit challenges, they were nowhere near the degree of First NBC," Hairston said. "That’s really a profound difference. What’s similar is both deals were in-market with a lot of overlap in clients and locations and markets, so we’re very familiar with both.”

First NBC and MidSouth also shared the same operating system, which gives Hancock another big leg up with integration.

“Our team members are familiar with the systems and how the processes work,” Hairston said. “It’s a little bit more like dusting off the work we just did a couple of years ago versus starting from scratch.”

Hancock expects to close the MidSouth deal in less than five months.

When the deal closes, Hancock will have $30.2 billion of assets, including $21 billion of loans.

MidSouth’s ratio of nonperforming loans to total loans was 1.6% on March 31, much higher than the 0.77% average for banks with assets of $1 billion to $10 billion, according to the FDIC. But its loan yield of 5.77% is higher than Hancock’s, and its reported a 3.89% net interest margin in the first quarter.

The deal should add 3 basis points to Hancock's margin.

“That’s a very important part of the deal to us,” said Michael Achary, Hancock's chief financial officer.

Given significant overlap, Hancock plans to cut up to 55% of MidSouth's annual expenses. The company said it is too early to discuss any plans for branch closings.

MidSouth also gives Hancock access to attractive markets including Dallas, which Hairston admitted that he’d been eyeing for some time. MidSouth has four branches and more than $78 million in deposits in the Dallas region, according to June 30 data from the Federal Deposit Insurance Corp.

“We hoped that eventually we would put together a transaction with someone who already had a presence [in Dallas] and have been waiting patiently for that opportunity,” Hairston said. “This is really perfectly in line with what we expected to happen.”

A chance to enter Dallas, along with gaining low-cost deposits in a low-risk deal, are all positives for Hancock, Will Curtiss, an analyst at Hovde Group, wrote in a note to clients.

"In general, we believe the deal makes a lot of strategic sense," Curtiss said.