Community banking

Community banking

-

MiCommunity Bancorp, which will be Michigan's first new bank since the financial crisis, raised $30 million in initial capital.

April 15 -

The New York company formed the nationwide group after hiring a team of former Square 1 bankers.

April 15 -

The New Jersey company agreed to buy BoeFly, which connects franchisors, small businesses, lenders and loan brokers.

April 12 -

The company could use its share of proceeds from the IPO to repay debt and pursue bank acquisitions.

April 12 -

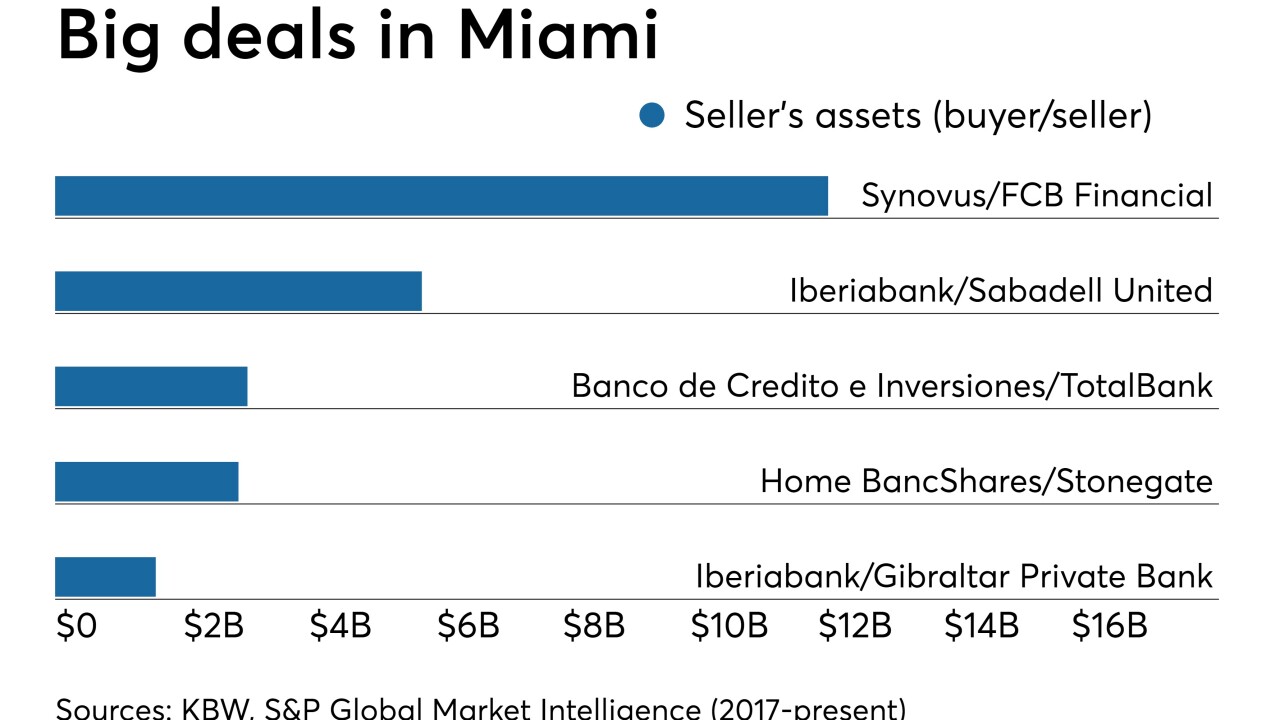

Lenders in South Florida are making tech upgrades and building scale to contend with bigger banks squeezing the market.

April 12 -

In a roundtable discussion, the heads of four banks called on Congress to move on CRA modernization and address the cannabis conundrum, while dismissing arguments that midsize banks need to merge to stay competitive.

April 11 -

Organizers of the Bank of St. George have filed an application with the FDIC and state regulators and plan a public stock offering.

April 11 -

The chairwoman of the House Small Business Committee promised to block action on the agency's budget unless it can justify its fee-hike request.

April 11 -

In 2016, a big-bank consortium said that it would charge the same prices to all institutions, regardless of their size. But now the group has added a large caveat to that pledge.

April 10 -

The decade-old rule, now under review, is outdated and another example of one-size-fits-all regulation, community bankers say.

April 10 -

The company warned that the move will likely reduce its first-quarter profit by $8 million.

April 9 -

With an implementation deadline less than a year away, bankers will be pressed to detail how a new accounting rule for loan losses will affect reserves, earnings and capital.

April 9 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

Sloane, who died on Saturday, refused to bulk up on commercial real estate loans, a move that helped him survive two severe economic downturns.

April 9 -

Jill Castilla, CEO of Citizens Bank of Edmond, has taken steps to help her bank stand out from the crowd.

April 9 -

The moves are part of an ongoing effort by the Seattle bank to largely exit mortgage lending.

April 8 -

The companies had planned to make Chemical CEO David Provost the new leader before October's market gyrations led them to break off talks. When they revisited the deal, several things changed — including Provost's role.

April 8 -

The Tennessee company has set up a $3.5 million reserve associated with the unnamed borrower.

April 8 -

Community banks are relying more on analytics, incentives and business partnerships in hopes of stemming an outflow of deposit relationships.

April 5 -

The North Carolina company was hit with a tax penalty tied to its purchase of Chattahoochee Bank of Georgia.

April 4