Community banking

Community banking

-

Midland States Bancorp in Effingham, Ill., has ended loss-share agreements related to two failed banks it acquired.

October 3 -

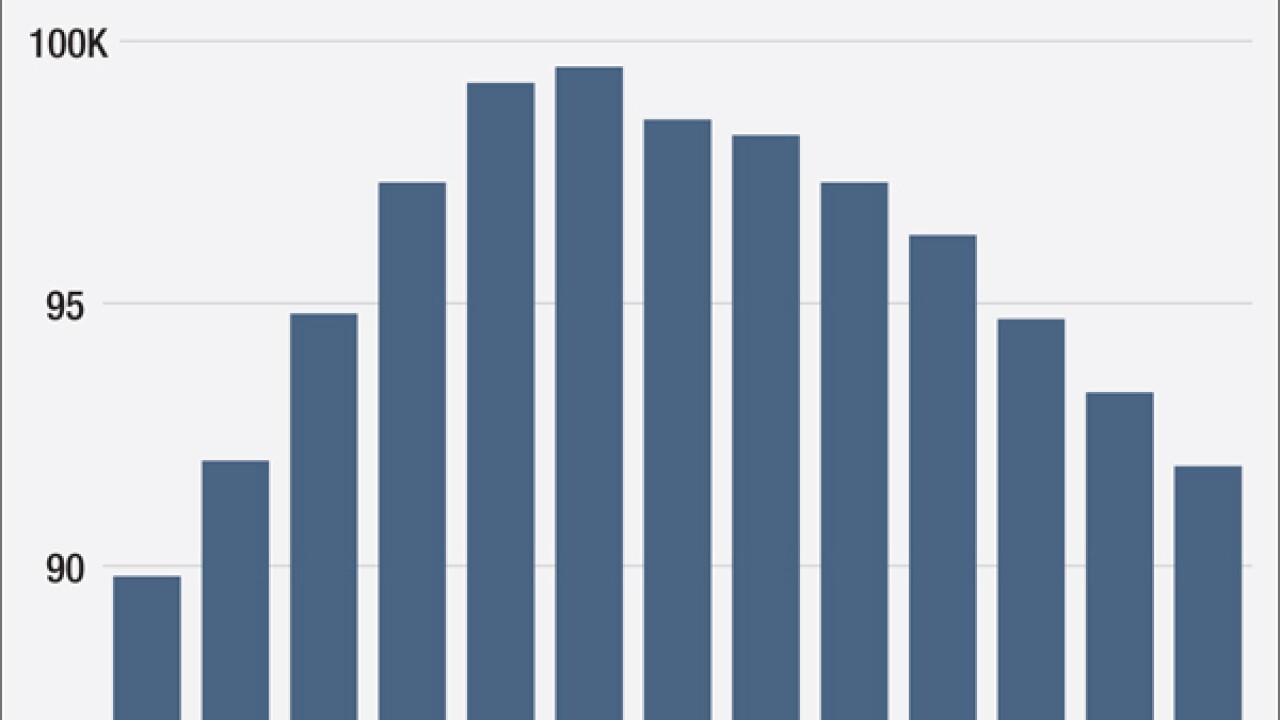

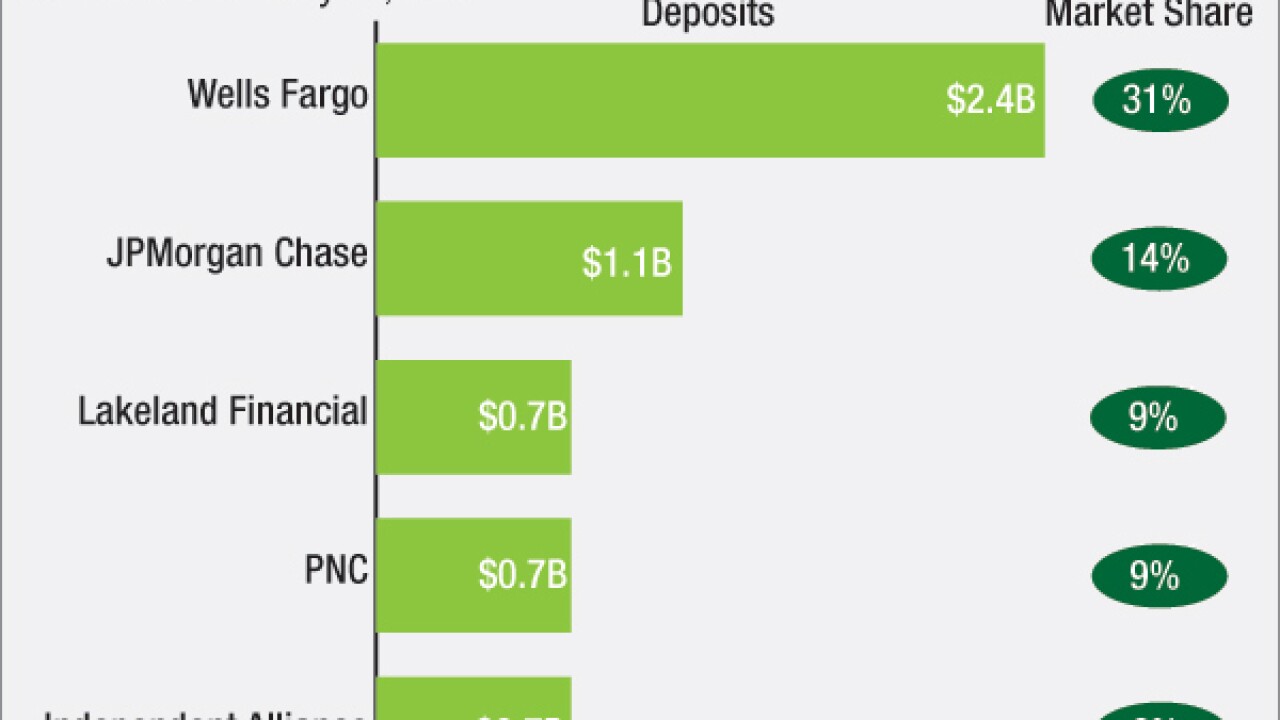

Total deposits at U.S. banks climbed nearly 6% year over year, to $11.3 trillion, even as the total number of banks and branches declined.

October 3 -

The $9.6 billion-asset company disclosed in a recent regulatory filing that it has a letter of intent to buy an unnamed banking company in Florida with about $400 million in assets.

October 3 -

First Merchants Corp. recently agreed to buy a minority stake in a bank in an attractive market. The move could allow the company to obtain intel while gaining an edge should the other bank decide to sell.

October 3 -

While the Wells Fargo scandal might offer marketing opportunities for community banks, there is concern about regulatory fallout that fails to distinguish between large and small banks.

October 3 -

A strategy to reinvigorate black-owned financial institutions would not only bring hope to the black community but would also be an inspiration for other minorities who seek to be more effectively served by financial institutions that understand their needs.

October 3 -

Meta Financial in Sioux Falls, S.D., has agreed to buy most of the assets and liabilities for a company that handles transactions for tax preparers.

October 3 -

First Commonwealth Financial in Indiana, Pa., has agreed to buy DCB Financial in Lewis Center, Ohio, for $106 million in cash and stock.

October 3 -

The private student loan market is dominated by large players, but some community banks are turning to a third-party tech company to help them get in the game.

September 30 -

Julie Stackhouse, head of supervision at the Federal Reserve Bank of St. Louis, discusses the insights that resonated at the regulator's recent community banking conference some encouraging for the future of small financial institutions, others less so.

September 30 -

Shiv Govindan at Pilgrims & Indians Capital has kept a relatively low profile as a bank investor. But two key board appointments at struggling community banks promise to make him a more visible player in the industry.

September 30 -

WASHIINGTON -- The Federal Deposit Insurance Corp. on Friday published its annual summary of insured deposits U.S. banks and thrifts.

September 30 - Maryland

MB Bancorp in Forest Hill, Md., has lined up a new chief executive.

September 30 -

Community bankers are showing renewed interest in consumer lending but admit they may be losing ground to more tech-savvy players, according to a survey released Thursday.

September 29 -

Orrstown Financial in Shippensburg, Pa., has agreed to pay a $1 million to settle charges that it misled investors as it raised capital in the wake of the financial crisis.

September 29 -

City National Bank in Los Angeles has launched a national business to focus on the food and beverage industries.

September 29 -

Scottrade Financial Services, an online brokerage services company whose holdings include the $16 billion-asset Scottrade Bank, is working with an adviser to explore a sale, according to people familiar with the matter.

September 29 - Maryland

Revere Bank in Laurel, Md., has raised $31 million in a subordinated debt offering that it plans to use for M&A and other purposes.

September 29 - Michigan

Mercantile Bank Corp. in Grand Rapids, Mich., announced several promotions that underscore a heightened focus on loan growth.

September 29 -

Granite Bank in Portsmouth, N.H., has acquired Cousins Home Lending.

September 29