Community banking

Community banking

-

The banking industry, in the face of prolonged challenges, is relying on professional help to improve in areas such as productivity, hiring and M&A. The hope is that being introspective now will limit the amount of costly mistakes in the future.

April 12 -

The number of seriously delinquent mortgages reached its lowest level in over eight years, helped by new job creation and higher wages, according to CoreLogic.

April 12 -

Midland States Bancorp in Effingham, Ill., is planning to raise $120 million through an initial public offering. The $company said in a regulatory filing Monday that it has applied to list shares on the Nasdaq Global Select Market.

April 12 -

Commerce Union Bancshares in Brentwood, Tenn., plans to close mortgage offices in Ohio, Illinois and Kentucky and to transfer the employees to Bridgeview Bank Group in Bridgeview, Ill.

April 11 -

Louisiana Community Bancorp in Houma has agreed to buy Tri-Parish Bancshares in Eunice, La.

April 11 -

The latest version of a new accounting standard for calculating loan-loss reserves would ease the burden on small banks, ICBA officials say. However, the ABA says it still fails to eliminate the biggest problem asking lenders to predict the future.

April 11 - Massachusetts

Boston Private Financial Holdings appointed its bank president, George Schwartz, to the newly created position of chief executive of its private banking group.

April 11 - Wisconsin

First Business Financial Services in Madison, Wis., has appointed David Seiler as chief operating officer. The $1.8 billion-asset holding company said Seiler will start in the newly created role on April 18.

April 8 -

Kearny Financial completed its IPO less than a year ago and already it has found itself in the crosshairs of Lawrence Seidman. The well-known activist is pushing for the resignation of several board members he says are overcompensated and is urging shareholders to vote against a proposal on director pay this fall.

April 8 -

First Midwest Bank in Itasca, Ill., announced Friday that it has hired Jo Ann Boylan, formerly of MB Financial Bank in Chicago, as chief information and operations officer.

April 8 -

Citizens National Bank in Henderson, Texas, has agreed to buy Kilgore National Bank in Kilgore, Texas.

April 8 -

Hampton Roads Bankshares in Virginia Beach juggled a search for a new chief executive while also arranging for its eventual merger with Xenith Bankshares in Richmond, Va.

April 8 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

April 8 -

Edward Duffy, who was chairman of the holding company for the former Marine Midland Bank in Buffalo, N.Y., has died. He was 89.

April 7 -

LAS VEGAS Office of the Comptroller of the Currency chief Thomas Curry said Thursday that banks have reached a do-or-die moment and it is up to them to keep up and outinnovate nonbank rivals.

April 7 -

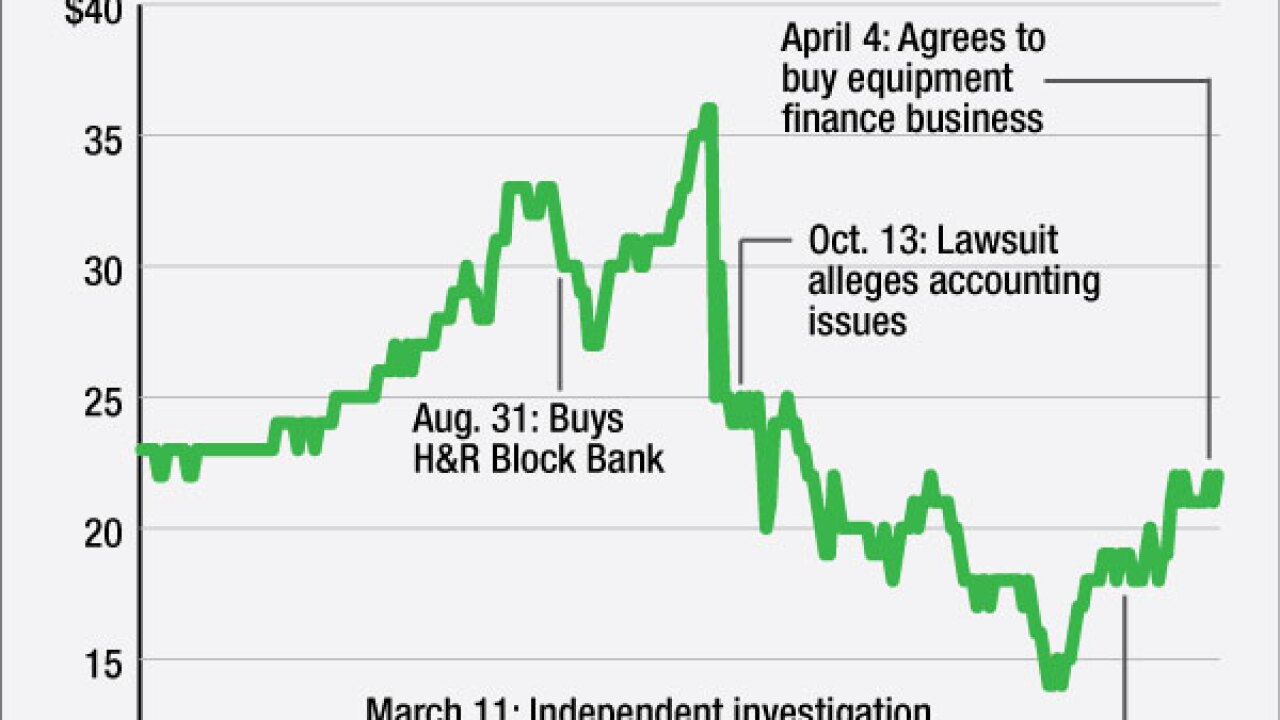

BofI Holding is looking to make more acquisitions and its leader says he doesnt think accusations from a former employee are unlikely to hold up a deal, even though theyve dragged down the stock price.

April 7 - California

Banc of California in Irvine has agreed to sell its wholly owned investment adviser subsidiary, The Palisades Group.

April 7 -

The month of March produced a broad-based seasonal boost that propelled the Index of Banking Activity to its highest level since June, 2015. The IBA's 59.1 reading in March was buoyed by strong improvements in metrics that track loan applications and approvals and for the first time in many months a noticeable rise in the component that monitors banks' staffing levels. In all, 12 of the 16 components of the IBA improved on levels reported in the February survey, with most of the remainder steady to slightly lower. (Commercial loan rejections were the one exception: the decline in this component was driven mainly by an increase in rejections in the Midwest, where application growth was strongest.) In addition, only one component score a 49.3 reading in the deposit-pricing indicator failed to surpass the 50-point level indicative of expansionary activity in the industry. Improvements in overall business activity were evident across all geographic regions. Respondents in the Midwest reported the most dramatic gains in lending-related activities, while bankers in the South region were the most bullish on the question of hiring. In addition, survey participants in both the Midwest and South regions reported significant improvements in their markets' respective real estate and local business conditions.

April 7 -

Banks have long struggled with how to better serve the underbanked and unbanked. Here's a roundup of some strategies that are working and some fresh ideas that are in the offing.

April 6 -

First Interstate BancSystem in Billings, Mont., announced its third deal in two years as it inched closer to $10 billion of assets.

April 6